Dogecoin at a Crossroads: Boom or Bust? Analyst Reveals Make-or-Break Signal

Dogecoin traders are holding their breath as a critical technical signal looms—will the meme coin defy gravity or faceplant back to reality?

The analyst community is split: some see a bullish breakout brewing, while others warn of a 'buy the rumor, sell the news' trap. One thing's certain—when DOGE moves, it moves fast.

Meanwhile, Wall Street hedge funds still can't decide whether to dismiss it as a joke or quietly allocate 1% of their portfolio 'for research purposes.'

Dogecoin Teeters On The Edge

In a video published yesterday under the headline “Is Doge About to CRASH or SOAR? Price Analysis & Scenarios,” the Elliott-wave commentator argues that the advance from the June 22 bottom remains incomplete.

“The DOGE chart is currently still, yeah, trying to reverse here to the upside from the swing low that formed on the 22nd of June,” he says at the outset, stressing that the rise so far is “only a three-wave move.” Because the structure has not yet printed the full five-wave sequence that typically inaugurates a new bullish trend, he cautions traders against assuming the worst is over.

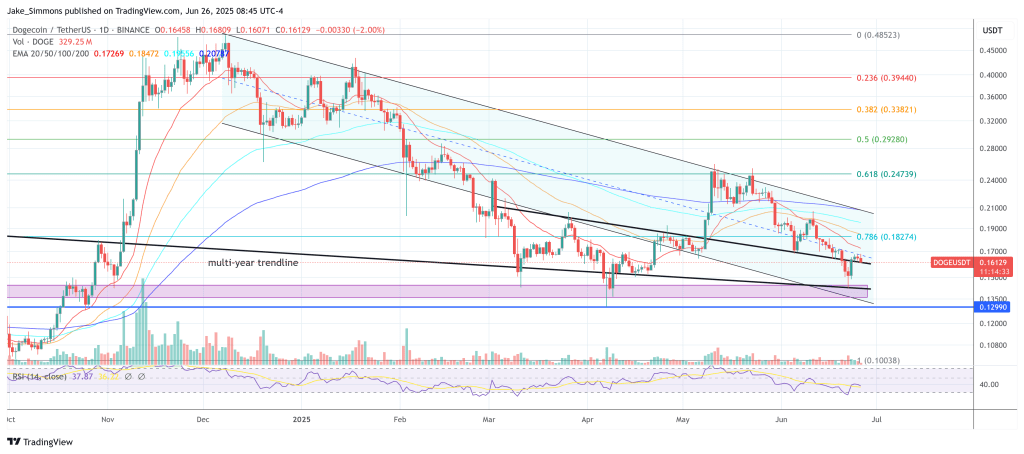

The technician locates that June 22 low inside a demand band between $0.15 and $0.14, a zone that also includes the 78.6 percent Fibonacci retracement of the May–June rally and sits just above April’s cycle through—his hard “invalidation point.” From there, Dogecoin bounced in what he labels an a-b-c recovery, with the third wave peaking at $0.169, exactly the 1.618 Fibonacci extension he looks for in a “healthy third wave.” If price can now carve a fourth-wave higher low and extend to a fifth-wave high near $0.174–$0.177, the analyst says, “we actually get five waves up and then we can add support … and we have a setup.”

Until that confirmation, the move remains a “chameleon-like” B-wave—prone to deeper pullbacks than the more bullish wave-two alternative. The line in the sand is $0.158. “Any break now below $0.158 cents WOULD indicate the upside-reversal attempt is failed and we fall back into the support region, maybe we’ll even test the $0.14 level,” he warns. Conversely, holding that micro-support and punching through the $0.17 handle would provide the first “evidence” that a durable bottom has formed.

The stakes are high because, as the analyst points out, confirmation of a five-wave impulse would force subsequent corrections to respect a higher-low framework, allowing traders to reposition with clearer risk parameters. Failure would likely drag dogecoin back into the wide consolidation range that has dominated June and risk flipping sentiment toward a protracted downside grind.

For now, the memecoin’s near-term fate rests on whether buyers can engineer that final fifth-wave pop without first violating $0.158. “At the moment,” he concludes, “we’re in a wait-and-see situation to see if we actually get five waves up.” Until the chart resolves, Dogecoin remains suspended between a technical breakout and another leg down—boom or bust hinging on a single intraday signal.

At press time, DOGE traded at $0.161.