Solana Eyes $360 Rally—But Only If This Critical Support Level Holds

Solana’s price surge has traders buzzing—the $360 target is in play, but the party stops if support cracks. Here’s what’s fueling the rally and the make-or-break zone.

The Bull Case:

SOL’s recent breakout mirrors its 2021 bull run pattern. Network upgrades and meme coin mania are juicing volume.

The Trap Door:

A drop below $280 would invalidate the setup. ’Support’ is just a fancy word for ’last line of defense before panic selling’—ask any overleveraged degen.

Watch the charts, not the hype. Crypto moves fast, but gravity always wins (eventually).

Solana Could Surge To $360

Zooming in, the channel’s Elliott-wave count now shows five clean waves even on what MCO calls “the nano level,” a configuration that, in classical wave theory, typically finishes either an impulsive first wave or the terminating leg of a diagonal.

“If it’s a five-wave move, it can be a so-called A-wave,” the analyst explains, which WOULD “result in a B-wave, ideally a higher low, and then a C-wave up.” The alternative—and MCO’s preferred scenario—treats the structure as wave 1 of a much larger impulse that could ultimately “easily get to $360 or higher.”

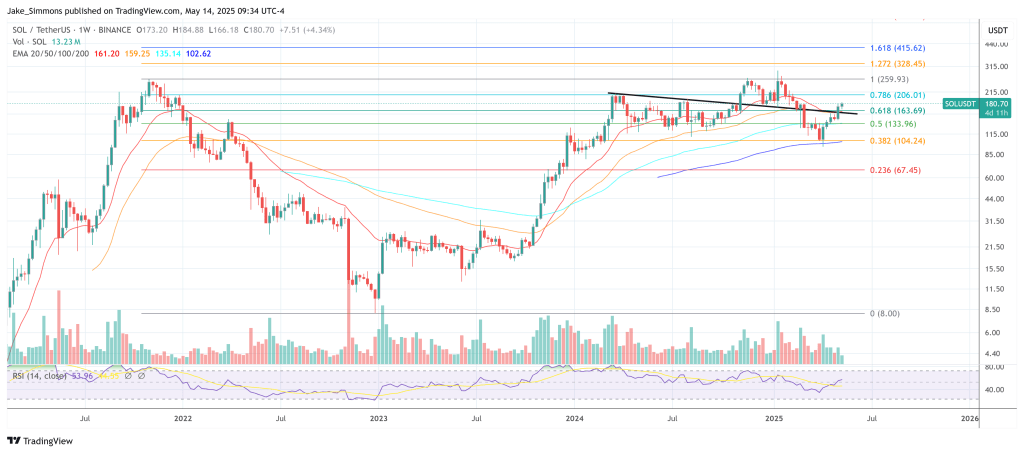

For traders trying to calibrate risk in the NEAR term, MCO isolates two numbers that matter most. On the upside he names $191.25 as “the next upside level to watch,” describing it as the 61.8 percent extension of waves 1 and 3—a textbook Fibonacci target for a fifth wave.

On the downside he warns that “it takes a break below $172, which is the last swing low, to indicate that a price top has formed in wave 1.” In a follow-up post on X he put it even more succinctly: “5th wave to the upside is confirmed. $191.25 is the next upside level to watch … it takes a break below $172 … to indicate that a price top has formed.”

A clean, high-volume break of $191.25 would confirm that the immediate corrective risk has been deferred; a decisive daily close beneath $172 would instead signal that the first leg of the new advance has exhausted itself and that a retracement toward the upper-$160s or even the mid-$150s is underway.

As ever, traders should remember that Elliott-wave projections are probabilistic rather than predictive. With volatility historically elevated in Solana, position sizing—alongside a clear plan for the two technical levels singled out in today’s analysis—remains the first line of defence.

At press time, SOL traded at $180.