XRP Challenges Key Ascending Triangle Barrier – Will Bullish Momentum Push Price Toward $2.40?

XRP is currently testing a critical resistance level within an ascending triangle formation, sparking speculation among traders about a potential bullish breakout. Market participants are closely watching whether buying pressure can sustain momentum to propel the asset toward the $2.40 target. The ascending triangle, a classic technical pattern, suggests accumulation, but confirmation requires a decisive close above resistance with substantial volume. Analysts highlight that macroeconomic factors and broader crypto market sentiment may influence XRP’s ability to capitalize on this technical setup. A failure to break resistance, however, could lead to consolidation or retracement, making this a pivotal moment for XRP’s near-term trajectory.

XRP is currently testing a critical resistance level within an ascending triangle formation, sparking speculation among traders about a potential bullish breakout. Market participants are closely watching whether buying pressure can sustain momentum to propel the asset toward the $2.40 target. The ascending triangle, a classic technical pattern, suggests accumulation, but confirmation requires a decisive close above resistance with substantial volume. Analysts highlight that macroeconomic factors and broader crypto market sentiment may influence XRP’s ability to capitalize on this technical setup. A failure to break resistance, however, could lead to consolidation or retracement, making this a pivotal moment for XRP’s near-term trajectory.XRP Bulls Eye Breakout As Market Looks for Direction

XRP bulls are gaining confidence as the market shows signs of stabilization following weeks of volatility. With global tensions still unresolved, the broader crypto environment remains uncertain—but XRP has managed to hold its ground, consistently trading above the $1.80 level. This steady performance has analysts optimistic that the token could be preparing for a strong move higher, especially if macroeconomic pressure starts to ease in the coming weeks.

The anticipation surrounding potential monetary policy shifts and cooling inflation expectations could create a more favorable environment for risk-on assets like XRP. Some market participants are betting that as clarity returns to the global economy, high-conviction assets will lead the charge—and XRP is firmly on that list.

However, not all analysts agree that the rally will be smooth. A more cautious view suggests that the market might need one more correction to establish a solid foundation. This scenario would involve a dip below current levels to set a new demand zone before the next leg up begins.

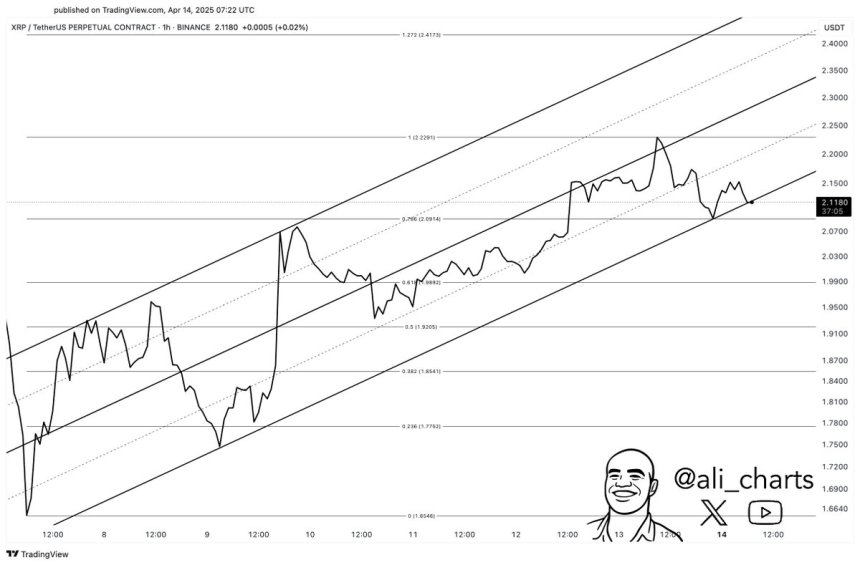

In the meantime, Martinez identified a key pattern unfolding: XRP is trading within an ascending triangle—a bullish continuation setup. According to Martinez, the $2.22 resistance level is the crucial threshold. A confirmed breakout above this level could trigger a surge toward $2.40, potentially marking the start of a broader upward trend.

As traders watch price action closely, XRP’s ability to hold key support and test the top of its triangle could determine its next big move. The coming days may prove pivotal in shaping the short-term future of this high-profile altcoin.

Daily Price Action Leans Bullish After Reclaiming Key Averages

XRP is currently trading at $2.14 after a strong move that saw the token reclaim both the 200-day moving average (MA) at $1.89 and the 200-day exponential moving average (EMA) at $1.95. This bullish development signals a potential shift in trend, as XRP bulls now hold a short-term momentum advantage. Holding above these key indicators is essential for sustaining upward pressure and building confidence in a broader recovery.

The next major hurdle lies at the $2.60 daily supply zone. A clean break above that level could open the door for a continuation rally targeting higher resistance zones. For now, bulls will need to maintain strong buying interest and volume to test and eventually breach that level.

However, downside risks remain. If XRP fails to hold the $2.00 psychological support, a deeper correction could unfold. This would invalidate the recent breakout and potentially send the token back toward the $1.80 zone or lower, depending on broader market conditions.

For now, all eyes are on whether XRP can consolidate gains above $2.00 and sustain enough momentum to challenge the next supply region. Traders should monitor volume and broader market cues for confirmation.

Featured image from Dall-E, chart from TradingView