BNB Shatters ATH Records - AlphaPepe Emerges as Top Crypto Pick Among Traders

BNB rockets past previous ceilings as traders scramble for the next big opportunity.

The Breakout Phenomenon

Binance's native token defies gravity with unprecedented momentum, leaving traditional resistance levels in the dust. Market veterans point to fundamental shifts in utility and adoption driving this parabolic move.

AlphaPepe's Ascent

While established coins dominate headlines, savvy investors are quietly accumulating what they call the 'meme coin with brains.' The project's unique tokenomics and community-driven approach create perfect conditions for explosive growth.

Timing the Market

Post-ATH breakouts often trigger profit-taking waves, but this time feels different. Institutional money flows combined with retail FOMO create a potent cocktail for sustained upward pressure.

Because nothing says 'sound investment strategy' like chasing green candles while ignoring fundamentals - welcome to modern portfolio management.

Bitcoin Miner Correlation Turns Negative

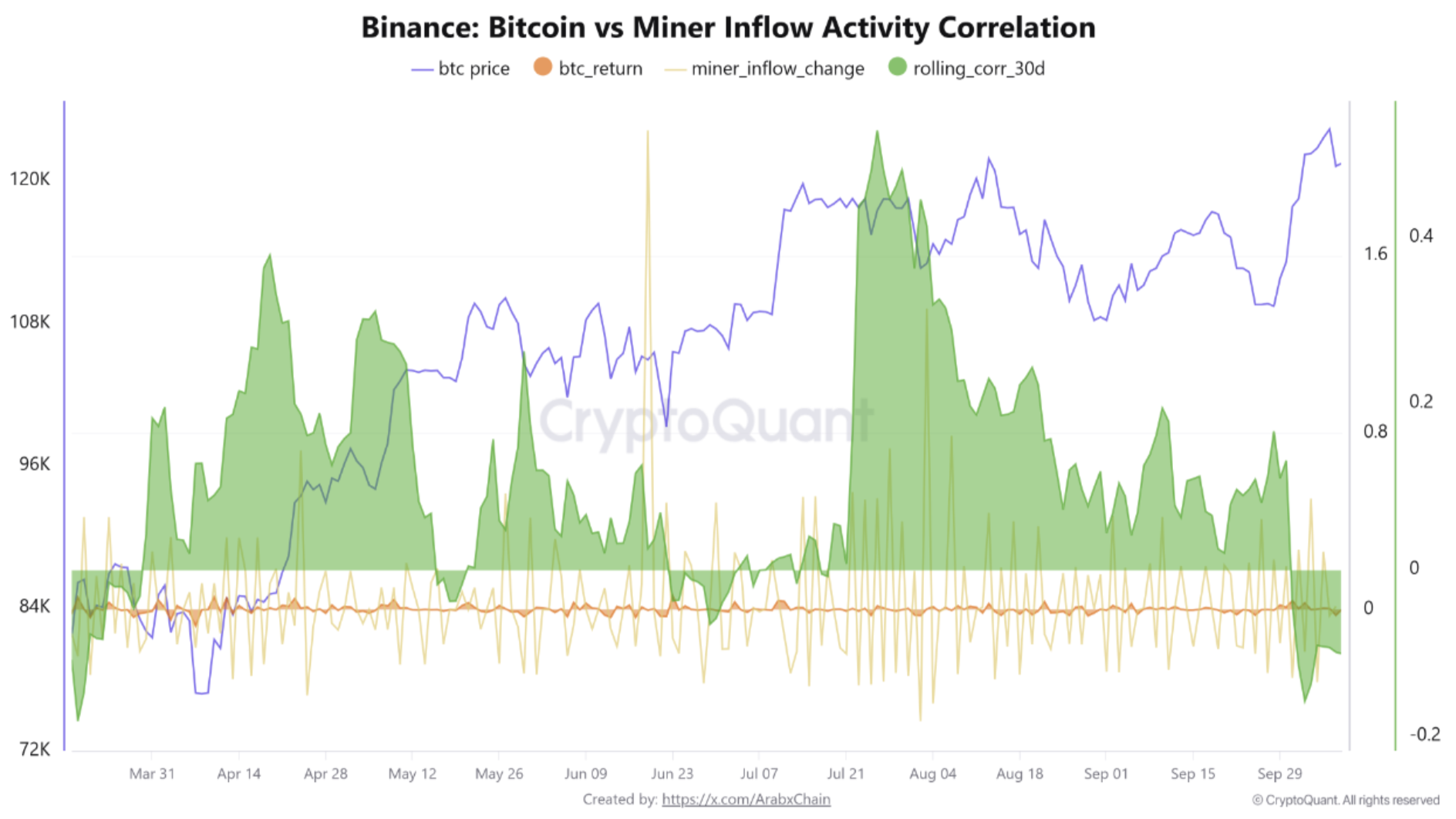

According to a CryptoQuant Quicktake post by contributor Arab Chain, fresh data from Binance shows that Bitcoin price and miner flows to the crypto exchange have undergone a significant shift in recent months.

Specifically, the 30-Day Rolling Correlation indicator has tumbled to its lowest level since March 2025. On October 3, this indicator fell to -0.157, its lowest reading in more than five months. Since then, it has remained close to the -0.10 range.

For the uninitiated, the 30-day rolling correlation indicator measures how closely two variables, such as Bitcoin’s price and miner flows, MOVE together over the past 30 days. A positive value means they typically rise or fall in tandem, while a negative value means they move in opposite directions.

It is worth noting that the indicator had previously been moving within a positive range of 0.1 to 0.5 during Q2 2025. The shift from positive rage to negative suggests that the recent surge in BTC price has not been driven by miner flows to exchanges.

This is in stark contrast to previous cycles, where miner flows to exchanges played a key role in BTC’s price movement. However, the current cycle’s positive price action can be attributed to increased demand from investors and institutions. Arab Chain added:

In past cycles, when the price rose, miners often transferred larger amounts of bitcoin to exchanges to sell and take profits, creating a positive correlation between price and miner flows – meaning that as prices increased, flows also increased.

Arab Chain added that the decline in correlation indicates a phase of “price independence” where miners opt to hold their BTC rather than sell it during times of price appreciation. A fall in miner signal is usually considered a bullish signal, as it reduces BTC’s circulating supply.

That said, if the correlation turns strongly positive again, it could signal the return of selling pressure and a medium-term price correction could be expected. At present, the BTC market is showing a healthy balance between demand and supply.

BTC Needs To Defend This Level

Following BTC’s fall to the low $120,000 range, some crypto analysts say that the top cryptocurrency must defend the $120,600 level to avoid further crash. However, not all analysts are bearish on BTC just yet.

For instance, crypto entrepreneur Arthur Hayes predicts that US President Donald Trump could send BTC to $250,000 by the end of 2025. At press time, BTC trades at $121,375, down 0.8% in the past 24 hours.