Bitcoin Poised for Explosive Moves as Fed Rate Cut Probability Hits 91%

Markets brace for seismic shift as Bitcoin positions for major volatility ahead of anticipated Federal Reserve policy pivot.

The Tipping Point

With a 91% probability of rate cuts baked into market expectations, digital gold stands at the precipice of its next major trend-defining moment. Institutional money already positioning for the liquidity surge that typically follows monetary easing.

Technical Setup Screams Breakout

Compressed volatility patterns across major timeframes suggest the calm before the storm. Trading ranges have tightened to levels not seen since previous cycle breakouts—historically reliable indicators of impending major price movements.

The Institutional Floodgates

Traditional finance finally catching up to what crypto natives knew years ago: digital assets represent the ultimate liquidity play in a reflating economy. Wall Street's belated embrace feels less like innovation and more like desperation to avoid missing the next big thing.

When central bankers start playing with the money printer again, smart money doesn't wait for permission to front-run the inevitable. The only question remaining: how violent will the move be when 91% probability becomes 100% reality?

What to Watch

For a more comprehensive list of events this week, see CoinDesk's "Crypto Week Ahead".

- Crypto

- Nothing scheduled.

- Macro

- Oct. 10, 8 a.m.: Brazil Aug. PPI YoY (Prev. 1.36%), MoM (Prev. -0.3%).

- Oct. 10, 8:30 a.m.: Canada Sept. Unemployment Rate Est. 7.2%.

- Oct. 10, 10 a.m.: Michigan Consumer Sentiment Oct. (Preliminary) Est. 54.2.

- Earnings (Estimates based on FactSet data)

- Nothing scheduled.

Token Events

For a more comprehensive list of events this week, see CoinDesk's "Crypto Week Ahead".

- Governance votes & calls

- Decentraland DAO is voting to replace the DAO Committee with a 3-of-5 multisig of ecosystem representatives, shifting execution-only duties while the council retains oversight. Voting ends Oct. 10.

- Unlocks

- Oct. 10: Linea (LINEA) to unlock 6.57% of its circulating supply worth $26.73 million.

- Oct. 11: Aptos (APT) to unlock 2.15% of its circulating supply worth $59.98 million.

- Oct. 12: Aethir (ATH) to unlock 16.08% of its circulating supply worth $67.7 million.

- Token Launches

- No major launches.

Conferences

For a more comprehensive list of events this week, see CoinDesk's "Crypto Week Ahead".

- Day 2 of 2: North American Blockchain Summit (Dallas)

Token Talk

By Oliver Knight

- The recent Chinese memecoin frenzy which sent tokens like GIGGLE, 四, and 哈基米 on PancakeSwap V2 soaring, has abruptly fizzled out.

- Within 24 hours, many of these assets lost more than 95% of their value, wiping out speculative gains built on hype and social momentum.

- The crash coincided with a broader memecoin market downturn that Binance founder Changpeng “CZ” Zhao described as a “blood bath,” fueled by FUD and false rumors about token listings.

- The plunge comes after Binance rolled out its "Meme Rush" platform that was supposed to provide a structured path for tokens before being tradable on various decentralized and centralized exchanges.

- However, much like how Solana memecoins faded in February following the launch of TRUMP and MELANIA, BNB Chain memes appear to be following the same route to demise.

- Pancake Swap trading volume has remained inflated at $18 bilion over the past 24 hours, with a handful of newly-launched tokens catching a bid, although it's worth noting that liquidity remains relatively low; with w

Derivatives Positioning

- Data from Coinglass shows that many BTC perpetual short positions face the risk of liquidation above $121,600. So, a sustained move above the said level could trigger a short squeeze, leading to a quick rally toward record highs.

- The market is undergoing a leverage reset, with volatility flushing out excess positioning on both sides, Glassnode said. Still, the overall positioning in the global BTC futures market remains elevated, with open interest just shy of the record 755K BTC.

- BNB, XRP, ADA, and TRX have seen a drop in futures open interest (OI) in the past 24 hours, indicating capital outflows. BTC's OI has risen by 1%, with ETH up just 0.4%.

- The XMR market is looking a bit overheated, with annualized funding rates nearing 60%, a sign of frenzied demand for bullish bets. Funding rates for other major tokens, including BTC and ETH, paint a bullish picture, but nothing out of the ordinary.

- On decentralized exchange Derive, open interest in the Oct. 31 expiry options is concentrated in calls at strikes $128K and $145K, reflecting a bullish bias. ETH options activity is equally bullish, with OI concentrated in $5K and $6K calls.

- On Deribit, however, the call-put skew for BTC and ETH remains mildly negative across timeframes, reflecting a bias for protective puts. Block flows on Paradigm featured ETH puts and straddles.

Market Movements

- BTC is up 0.17% from 4 p.m. ET Thursday at $121,389.27 (24hrs: -0.59%)

- ETH is down 0.37% at $4,323.41 (24hrs: -0.54%)

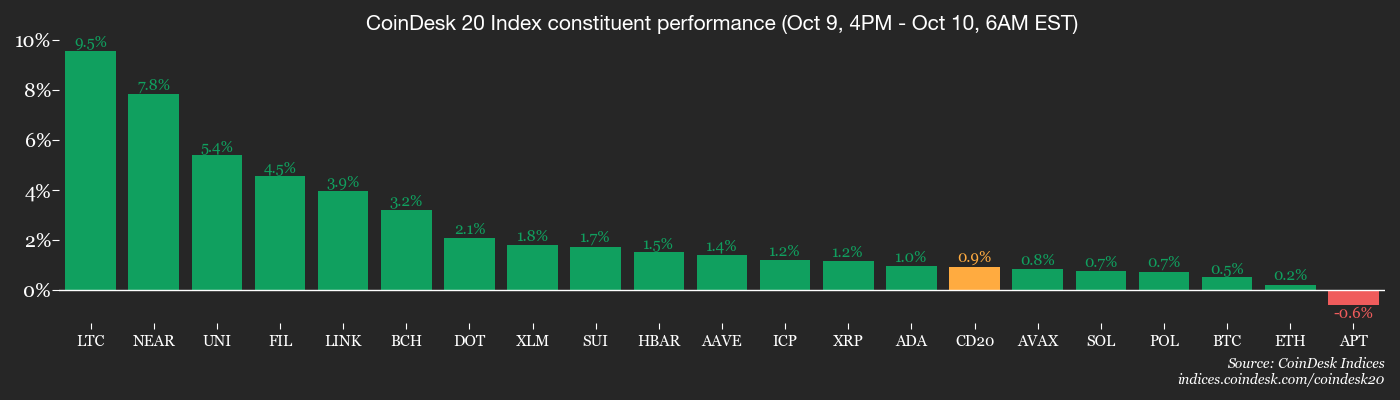

- CoinDesk 20 is up 0.4% at 4,162.46 (24hrs: +0.02%)

- Ether CESR Composite Staking Rate is up 1 bp at 2.86%

- BTC funding rate is at 0.0045% (4.8968% annualized) on Binance

- DXY is down 0.24% at 99.29

- Gold futures are up 1.00% at $4,012.20

- Silver futures are up 2.45% at $48.31

- Nikkei 225 closed down 1.01% at 48,088.80

- Hang Seng closed down 1.73% at 26,290.32

- FTSE is down 0.14% at 9,495.88

- Euro Stoxx 50 is unchanged at 5,627.22

- DJIA closed on Thursday down 0.52% at 46,358.42

- S&P 500 closed down 0.28% at 6,735.11

- Nasdaq Composite closed unchanged at 23,024.62

- S&P/TSX Composite closed down 0.76% at 30,269.98

- S&P 40 Latin America closed down 0.51% at 2,858.54

- U.S. 10-Year Treasury rate is down 3.5 bps at 4.113%

- E-mini S&P 500 futures are unchanged at 6,785.00

- E-mini Nasdaq-100 futures are up 0.1% at 25,313.50

- E-mini Dow Jones Industrial Average Index are up 0.11% at 46,643.00

Bitcoin Stats

- BTC Dominance: 59.36% (unchanged)

- Ether to bitcoin ratio: 0.03563 (-0.75%)

- Hashrate (seven-day moving average): 997 EH/s

- Hashprice (spot): $51.21

- Total Fees: 3.79 BTC / $462,241

- CME Futures Open Interest: 147,025 BTC

- BTC priced in gold: 30.4 oz

- BTC vs gold market cap: 8.59%

Technical Analysis

- BTC's dominance rate, or its share in the total market cap, is looking to establish a new uptrend, having risen from 57% to over 59% in two weeks.

- The increase indicates that capital is again flowing into the market leader.

- In other words, the altcoin season is still not here.

Crypto Equities

- Coinbase Global (COIN): closed on Thursday at $387 (-0.07%), -0.22% at $386.15

- Circle Internet (CRCL): closed at $150.48 (+0.01%), -0.19% at $150.19

- Galaxy Digital (GLXY): closed at $42.22 (+2.01%), +2.08% at $43.10

- Bullish (BLSH): closed at $66.71 (-1.04%), +0.13% at $66.80

- MARA Holdings (MARA): closed at $20.2 (0%), +1.53% at $20.51

- Riot Platforms (RIOT): closed at $22.28 (+1.32%), +0.4% at $22.37

- Core Scientific (CORZ): closed at $18.04 (+2.91%), +1.16% at $18.25

- CleanSpark (CLSK): closed at $20.09 (+5.85%), +4.03% at $20.90

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $57.57 (+3.95%), +3.42% at $59.54

- Exodus Movement (EXOD): closed at $29.67 (-1.33%), +1.08% at $29.99

- Strategy (MSTR): closed at $320.29 (-3.18%), +0.53% at $322.00

- Semler Scientific (SMLR): closed at $28.32 (+0.43%)

- SharpLink Gaming (SBET): closed at $16.95 (-3.53%), -1.47% at $16.70

- Upexi (UPXI): closed at $6.85 (-4.46%), -0.44% at $6.82

- Lite Strategy (LITS): closed at $2.54 (+1.6%), +11.42% at $2.83

ETF Flows

Spot BTC ETFs

- Daily net flow: $197.8 million

- Cumulative net flows: $62.73 billion

- Total BTC holdings ~ 1.36 million

Spot ETH ETFs

- Daily net flow: -$8.7 million

- Cumulative net flows: $15.1 billion

- Total ETH holdings ~ 6.89 million

Source: Farside Investors

While You Were Sleeping

- ‘Bitcoin Is Not an Asset Class’: UK’s Biggest Investment Platform Has a Stark Warning for Investors (CNBC): Hargreaves Lansdown warned bitcoin’s volatility, lack of intrinsic value and unpredictable performance make it unsuitable for portfolios, even as the U.K.'s financial regulator gives retail investors access to crypto ETNs.

- Bitcoin Implied Volatility Reaches 2.5-Month High as Seasonal Strength Kicks In (CoinDesk): Bitcoin implied volatility index, which represents the annualized expected price turbulence over four weeks, surged above 42, mirroring similar seasonal spikes seen in October 2023 and 2024.

- Monero Releases Privacy Boost Against Sneaky Network Nodes (CoinDesk): The "Fluorine Fermi" upgrade changes how nodes choose peers, preventing multiple connections within the same IP subnet and making it harder for malicious clusters to trace transaction activity.

- Hyperliquid Introduces 'Based Streams,' a DEX-Powered Live Streaming Platform (CoinDesk): The livestreaming feature lets creators broadcast trades, accept token donations and reward viewers via the decentralized perpetual swaps exchange's Hypercore protocol.

- Ray Dalio Warns of Soaring Debt and 'Civil War' Brewing in US (Bloomberg): The Bridgewater Associates founder urged Congress to pair tax hikes with spending cuts to curb ballooning national debt, while also citing wealth inequality and geopolitical tensions as major concerns.