5 Reasons Why Morpho (MORPHO) Could Be the Most Underrated DeFi Token of 2025

Why Trust BTCC

Introduction

In the crowded DeFi token landscape, few names generate as much quiet optimism as Morpho (MORPHO). While many eyes remain fixated on large-cap DeFi oracles, layer-2s, or yield aggregators, Morpho has been methodically building a foundation that deserves serious attention.

In this article, you’ll get to know 5 reasons why Morpho (MORPHO) might be the most underrated DeFi token of 2025. We’ll combine protocol insights, data trends, and price forecasts. You’ll also get practical guidance on how to buy MORPHO, what MORPHO is. When to invest in the MORPHO token, and whether it’s a good investment in 2025.

Let’s start by grounding ourselves in Morpho’s fundamentals.

- 1. What Is Morpho (MORPHO)? The Underlying Protocol Advantage

- 2. Reason #1: Efficiency & Yield Edge via Peer-to-Peer Matching

- 3. Reason #2: Strong Traction, TVL Momentum & Institutional Signals

- 4. Reason #3: Expansion, Upgrades & Multi-Chain Strategy

- 5. Reason #4: Token Alignment, Governance & Fee Strategy

- 6. Reason #5: Undervalued Relative to Risk / Reward & Market Mispricing

- 7. Price Forecasts & Scenario Modeling

- 8. How to Buy MORPHO, When to Invest & Risk Measures

- 9. Risks and Headwinds to Watch

- 10. FAQs: Morpho (MORPHO) and DeFi Token Outlook

- 11. Final Takeaways and Strategic Insights

- How to Trade Crypto on BTCC?

- BTCC FAQs

1. What Is Morpho (MORPHO)? The Underlying Protocol Advantage

To understand why Morpho might be undervalued, we must first appreciate its architecture, model, and positioning.

1.1 Protocol Overview & Innovation

- Morpho is a permissionless, non-custodial lending protocol operating on Ethereum and Base.

- It layers a peer-to-peer (P2P) matching engine on top of existing lending pools (e.g., Aave, Compound). That means lenders and borrowers can be matched directly when possible; when not, the protocol falls back to pool liquidity.

- This hybrid design aims to reduce interest spreads, improve yield for lenders, and reduce borrowing costs.

- Morpho’s markets are isolated & customizable — users or developers can create markets with specific collateral, oracle, or interest rate models.

1.2 Tokenomics, Governance & Single-Asset Approach

- The native token MORPHO is used for governance, incentives, and network alignment.

- Morpho recently adopted a single-asset token model, making MORPHO the sole asset, aligning incentives between token holders and contributors.

- The Morpho Association and Morpho DAO are structured such that protocol fees may be reinvested to compound growth, rather than distributed outright.

- The total supply is capped (1 billion MORPHO), and the circulating supply is smaller.

1.3 Recent Growth, TVL, and Market Momentum

- As of mid-2025, Morpho had surpassed $6 billion in Total Value Locked (TVL).

- It has also reportedly crossed $10 billion in deposits, according to some media sources.

- The MORPHO token recently traded near an all-time high of $4.17, with a market capitalization of around $900 million.

- According to crypto media, Morpho’s core architecture, institutional adoption, cross-chain buildout, and liquidity partnerships are being viewed as driving 60% upside potential.

Together, these structural and growth underpinnings set up several bullish narratives. Next, we explore 5 reasons why MORPHO may be underrated going into 2025.

BTCC, one of the longest-running crypto exchanges in the world, supports crypto demo trading, crypto copy trading, crypto spot trading for 240+ crypto pairs, as well as crypto futures trading for 360+ crypto pairs with a leverage of up to 500Χ. If you want to start trading cryptocurrencies, you can start by signing up for BTCC.

/ You can claim a welcome reward of up to 10,055 USDT\

2. Reason #1: Efficiency & Yield Edge via Peer-to-Peer Matching

One of Morpho’s standout advantages is its P2P matching overlay — this gives it a structural yield edge over pure pool-based models.

Efficiency Gains & Spread Reduction

- By matching lenders with borrowers directly when possible, Morpho reduces the interest rate spread. Reports suggest spreads can shrink by up to 30% over typical pool spreads.

- In practice, this means lenders get more net yield, and borrowers pay less. That dual incentive can attract both sides of the market.

Capital Utilization & Dynamic Fallback

- Morpho’s fallback to underlying pools ensures liquidity when P2P matches aren’t found, preventing illiquidity.

- This combination gives it nearly 100% capital utilization potential in many markets.

- Because the protocol doesn’t rely solely on pool aggregates, it can behave more adaptively and avoid some inefficiencies of traditional lending platforms.

Competitive Advantage Over Legacy DeFi Lenders

- Compared to pure pool lenders (Aave, Compound), Morpho adds an optimization layer without having to compete in liquidity sourcing.

- As DeFi matures and yield margins compress, protocols with structural efficiency will gain a comparative advantage.

In short: this yield optimization is not just marketing — it’s a defensible protocol edge.

3. Reason #2: Strong Traction, TVL Momentum & Institutional Signals

Underrated tokens often hide behind numbers that haven’t yet been fully priced in. Morpho shows multiple signs of real traction.

TVL Growth & Deposit Volume

- The protocol’s TVL grew rapidly in 2025 to exceed $6B.

- Media reports suggest deposits passing $10B, indicating that institutional or large capital flows are entering the system.

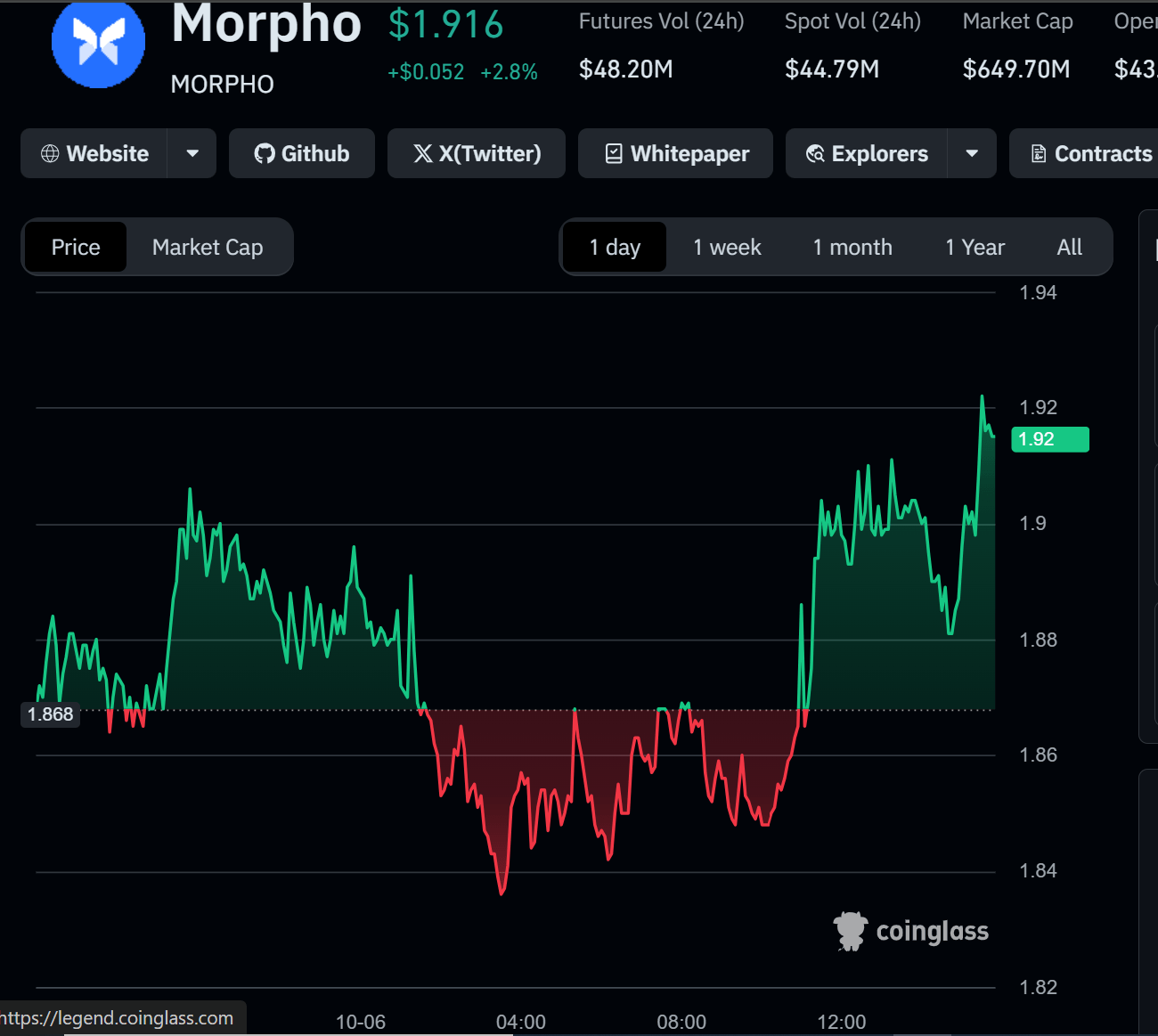

Token Price & Market Sentiment

- MORPHO recently hit $2.76, a six-month high, amid a broader market rally.

- On CoinCodex, Morpho’s historical range shows it peaked at $4.17 in January 2025.

- The current coding metrics show ~338 million circulating out of 1 billion max supply, leaving room for upside as more tokens move into circulation.

Institutional & Liquidity Signals

- Reports mention integration with Coinbase liquidity flows and possible listing visibility.

- As Morpho expands cross-chain and pursues more trust-minimized integrations, it may attract funds that prefer transparent, audited protocols.

- In narrative terms, Morpho is beginning to position itself in the cross-section of DeFi + institutional infrastructure.

These metrics suggest Morpho may be undervalued relative to its on-chain performance and investor attention.

4. Reason #3: Expansion, Upgrades & Multi-Chain Strategy

Tokens often remain underrated when market participants ignore growth in protocol expansion or technical improvements. Morpho is doing just that.

V2 Launch & Feature Roadmap

- Morpho is developing V2, which aims to bring fixed-rate lending, modular risk architecture, improved capital efficiency, and cross-chain expansion.

- The shift to a modular, token-only governance model also reinforces alignment and clarity in future upgrades.

Multichain / Cross-Chain Infrastructure

- Initially operating on Ethereum and Base, Morpho is positioning to expand into other chains and rollups.

- Cross-chain reach is essential in a fragmented DeFi world; more rails = more users, more yield flows.

Real-World Asset (RWA) & Institutional Interfaces

- Morpho contemplates bridging real-world assets and institutional-grade APIs. The ability to onboard compliant capital or regulated assets may open new channels of growth.

- The protocol’s alignment and governance structures indicate a willingness to incorporate more formal financial integrations under DAO oversight.

Because many market participants focus only on current yields or token price, future growth vectors are often underpriced — giving MORPHO upside if progress is executed.

5. Reason #4: Token Alignment, Governance & Fee Strategy

A token’s alignment structure is a core factor in sustainable, undervalued potential. Morpho’s governance and fee strategy are underappreciated levers.

Single-Asset Governance Model

- As previously noted, Morpho moved to a single-asset approach, where MORPHO is the only protocol token, ensuring alignment between contributors and holders.

- The elimination of dual token models reduces complexity and conflict between governance tokens and equity interests.

Fee Reinvestment & Protocol Growth

- Instead of distributing protocol fees, Morpho’s governance may reinvest them into growth (e.g., treasury, expansions, liquidity) to amplify compounding value.

- This model can supercharge long-term growth if executed well, rather than short-term payout but long-term stagnation.

Decentralized Decision-Making & Community Trust

- MORPHO token holders have direct governance capabilities — voting on interest models, collateral parameters, risk settings, and upgrades.

- Because contributors and token holders are structurally aligned, the incentive for protocol integrity is stronger.

- This contrasts with projects where token holders and protocol developers have misaligned incentives.

Underappreciated tokenomics and governance structures often create asymmetric upside when adoption scales — MORPHO is well-positioned in this regard.

/ You can claim a welcome reward of up to 10,055 USDT\

6. Reason #5: Undervalued Relative to Risk / Reward & Market Mispricing

Finally, we argue that MORPHO currently may be undervalued relative to its risk/reward profile — a classic sign of an “underrated” token.

Market Mispricing & Sentiment Lag

- Many DeFi investors still focus more on names like Aave, Compound, or Lido, ignoring newer arch-optimizing protocols.

- Because Morpho is relatively newer (token launched late 2024) and less widely known, adoption lags may create a discount to true potential.

Forecasts Suggest Upside

- Several price prediction platforms show bullish estimates. For example, CoinLore expects MORPHO to reach $3.36 in 2025 and $8.14 in 2030.

- DigitalCoinPrice forecasts MORPHO could peak at $3.97, and even move toward $5.62 by 2027.

- Traders Union projects Morpho could reach $4.29 by the end of 2025 and potentially $5.24 by 2030.

- BeInCrypto’s MORPHO forecasts show average targets of $1.84 to $3.93 in the coming years.

These forecasts cluster in the multi-dollar range, suggesting that the current price may not fully reflect potential upside.

Risk vs Reward Comparisons

- MORPHO’s downside is somewhat capped by its liquidity, governance safeguards, and hybrid model, unlike hyper-speculative meme coins.

- The upside comes from yield edge, adoption levers, cross-chain scaling, and institutional flow capture.

- If Morpho successfully executes upgrades and growth, upside multiples may outpace many peers.

Because many market actors discount future optionality, MORPHO may currently trade at a risk premium to its baseline — creating a window for informed investors.

7. Price Forecasts & Scenario Modeling

To ground these qualitative reasons, here’s a scenario-based forecast for MORPHO from 2025 to 2030.

7.1 Conservative / Base / Bull Scenario Bands

| Year | Conservative ($) | Base / Moderate ($) | Bull / Stretch ($) |

| 2025 | $1.50 – $2.50 | $2.50 – $4.00 | $4.00 – $6.00 |

| 2026 | $1.80 – $3.00 | $3.00 – $5.50 | $5.50 – $8.00 |

| 2027 | $2.20 – $3.80 | $4.50 – $7.50 | $7.50 – $12.00 |

| 2028 | $2.70 – $4.50 | $6.00 – $9.50 | $9.50 – $15.00 |

| 2029 | $3.10 – $5.20 | $7.50 – $11.50 | $11.50 – $18.00 |

| 2030 | $3.50 – $6.00 | $9.50 – $14.00 | $14.00 – $22.00+ |

These ranges incorporate yield, adoption growth, upgrades, and macro environment assumptions.

7.2 Model Anchoring & Sensitivity

- If Morpho can push TVL to $20–30B, cross-chain penetration deepens, and institutional capital flows in, bull scenarios become credible.

- Conversely, if upgrades stall, regulatory friction emerges, or yield margins compress, the conservative band is likelier.

- Price prediction platforms generally reflect similar ranges: e.g., MORPHO forecast from Traders Union for $4.29 end of 2025.

- KRaken’s simple 5% annual growth model yields modest projections (e.g. $2.11 by 2030).

8. How to Buy MORPHO, When to Invest & Risk Measures

Having built a thesis, here’s a practical guide to entering, timing, and managing MORPHO exposure.

8.1 Where & How to Buy MORPHO

- MORPHO is traded on centralized exchanges and decentralized exchanges (DEXes).

- You can swap via DEXes using liquidity pools, or on listed exchanges via pairs like MORPHO/USDT or MORPHO/ETH.

- Ensure you use exchanges with sufficient liquidity to minimize slippage.

- Use limit orders when possible to avoid price impact in volatile moves.

8.2 Entry Timing & Strategy

- Breakout entry: watch key resistance zones (e.g. $2.28, $3.00, or upper bands) for signals of trend shift.

- Pullback entry: after a breakout, wait for the price to retrace to support for a safer entry.

- Dollar-cost averaging (DCA): Given uncertainty, spreading your purchase over weeks or quarters helps reduce timing risk.

- Seed exposure: consider a small initial allocation, then scale exposure as signals confirm.

8.3 Exit Strategy & Risk Controls

- Use stop losses below key structural support (e.g., below $1.50 or earlier pivots)

- Partial profit-taking: at milestone levels (e.g. $4, $6, $10)

- Trailing stops: protect gains during momentum runs

- Reassess if key signals reverse (e.g,. TVL stagnation, sentiment collapse, technical breakdown).

8.4 Position Sizing & Portfolio Allocation

- Because MORPHO is still at a relatively early stage, keep allocations moderate (e.g., 2–5% of crypto holdings).

- Diversify: pair MORPHO with core blue chips (BTC, ETH) and thematic alts.

- Rebalance periodically—if MORPHO grows to outsized weight, reduce exposure to lock gains.

9. Risks and Headwinds to Watch

While the thesis is strong, intelligent investors must remain cognizant of potential roadblocks.

- Execution risk — V2 upgrades or cross-chain rollout may be delayed or underdeliver.

- Liquidity risk & token unlock overhang — large unlocks could exert downward pressure.

- Regulatory risk — lending protocols face scrutiny, especially if perceived as lending/borrowing intermediaries.

- Competition — other DeFi optimizers or layer-2 native lenders may steal narrative.

- Yield compression — as DeFi scale increases, margins tighten, reducing incentive.

- Sentiment swings — MORPHO is not immune to crypto market cycles and hype fades.

A balanced view protects against blind optimism.

/ You can claim a welcome reward of up to 10,055 USDT\

10. FAQs: Morpho (MORPHO) and DeFi Token Outlook

Q1: Is Morpho (MORPHO) a good investment in 2025?

Yes, for risk-tolerant investors. The protocol’s structural yield advantage, governance alignment, and expansion roadmap make it a credible bet in DeFi. But manage expectations and risks.

Q2: What price could MORPHO reach by the end of 2025?

Forecasts vary, but many suggest $3 – $4+ as a realistic target under a positive scenario. Conservative estimates place it near $1.50–$2.50.

Q3: When is the best time to buy MORPHO?

Entry is ideal on confirmed breakouts above resistance, or after a pullback to support zones. Dollar-cost averaging is safer for uncertain timing.

Q4: How is MORPHO different from Aave or Compound?

Morpho layers a P2P matching engine on top of pool-based protocols, enabling better yield and borrowing efficiency. It also allows isolated/custom markets.

Q5: Where can I buy Morpho (MORPHO)?

On centralized exchanges (if listed) and via DEXes. Use pairs like MORPHO/USDT. Check liquidity and slippage.

Q6: What are the major risks of investing in MORPHO?

Execution risk, regulatory pressures, token unlock dilution, competition, yield compression, and sentiment volatility.

11. Final Takeaways and Strategic Insights

Morpho (MORPHO) presents a compelling, underappreciated case in DeFi. Its structural yield efficiency, expanding TVL, upgrade roadmap, governance alignment, and market mispricing combine to form a multi-vector thesis.

In 2025, MORPHO may not yet be a household DeFi name — but tokens with this blend of foundation and optionality often chart outsized paths.

If you want strategic insights to profit your portfolio, check out BTCC Academy for free educational frameworks and strategy guides.

How to Trade Crypto on BTCC?

This brief instruction will assist you in registering for and trading on the BTCC exchange.

Step 1: Register an account

The first step is to hit the “Sign Up” button on the BTCC website or app. Your email address and a strong password are all you need. After completing that, look for a verification email in your inbox. To activate your account, click the link in the email.

Step 2: Finish the KYC

The Know Your Customer (KYC) procedure is the next step after your account is operational. The main goal of this stage is to maintain compliance and security. You must upload identification, such as a passport or driver’s license. You’ll receive a confirmation email as soon as your documents are validated, so don’t worry—it’s a quick process.

Step 3. Deposit Funds

After that, adding money to your account is simple. BTCC provides a range of payment options, such as credit cards and bank transfers. To get your money into your trading account, simply choose what works best for you, enter the amount, and then follow the instructions.

- Fiat Deposit. Buy USDT using Visa/Mastercard (KYC required).

- Crypto Deposit. Transfer crypto from another platform or wallet.

Step 4. Start Trading

If you wish to follow profitable traders, you might go for copy trading, futures, or spot trading. After choosing your order type and the cryptocurrency you wish to trade, press the buy or sell button. Managing your portfolio and keeping track of your trades is made simple by the user-friendly interface.

Look more for details: How to Trade Crypto Futures Contracts on BTCC

BTCC FAQs

Is BTCC safe?

Based on its track record since 2011, BTCC has established itself as a secure cryptocurrency exchange. There have been no reports of fraudulent activity involving user accounts or the platform’s infrastructure. By enforcing mandatory know-your-customer (KYC) and anti-money laundering (AML) procedures, the cryptocurrency trading platform gives consumers greater security. For operations like withdrawals, it also provides extra security features like two-factor authentication (2FA).

Is KYC Necessary for BTCC?

Indeed. Before using BTCC goods, users must finish the Know Your Customer (KYC) process. A facial recognition scan and legitimate identification documents must be submitted for this process. Usually, it is finished in a few minutes. This procedure has the benefit of strengthening the security of the exchange and satisfying legal requirements.

Because their accounts will have a lower daily withdrawal limit, those who do not finish their KYC are unable to make deposits. It should be noted that those who present a legitimate ID without a facial recognition scan will likewise have restricted withdrawal options.

Is There a Mobile App for BTCC?

Indeed. For users of iOS and Android, BTCC has a mobile app. The exchange’s website offers the mobile app for download. Since both the web version and the mobile app have the same features and capabilities, they are comparable.

Will I Have to Pay BTCC Trading Fees?

Indeed. BTCC levies a fee for trade, just like a lot of other centralised exchanges. Each user’s VIP level, which is unlocked according to their available money, determines the different costs. The BTCC website provides information on the charge rates.

Can I Access BTCC From the U.S?

You can, indeed. According to its website, BTCC has obtained a crypto license from the US Financial Crimes Enforcement Network (FinCEN), which enables the cryptocurrency exchange to provide its services to investors who are headquartered in the US.

According to BTCC’s User Agreement document, its goods are not allowed to be used in nations and organisations that have been sanctioned by the United States or other nations where it has a licence.

BTCC Guide:

- How to Trade Crypto Futures Contracts on BTCC

- BTCC Guide-How to Deposit Crypto on BTCC?

- What is Crypto Futures Trading – Beginner’s Guide

- What is Leverage in Cryptocurrency? How Can I Trade at 100X Leverage?

- BTCC Review 2024: Best Crypto Futures Exchange

Crypto Buying Guides:

- How To Buy Bitcoin (BTC)

- How To Buy Picoin

- How To Buy Ethereum (ETH)

- How To Buy Dogecoin (DOGE)

- How To Buy Pepe Coin (PEPE)

- How To Buy Ripple (XRP)

Crypto Prediction:

- Ethereum (ETH) Price Prediction 2024, 2025, 2030 — Will ETH Reach $10,000?

- Ethereum Price Prediction 2024, 2025, 2030: How High Can ETH Go in 2024?

- Bitcoin (BTC) Price Prediction 2024, 2025, 2030 — Is BTC a Good Investment?

- Ripple (XRP) Price Prediction 2024, 2025, 2030 — Will XRP Reach $1 After SEC Lawsuit?

- Pi Coin Price Prediction 2024,2025,2030 — Is Pi Coin a Good Buy?

- Pepe (PEPE) Price Prediction 2024, 2025, 2030 – Will PEPE Reach $1

Scan to download