Bitcoin’s 600K Transaction Threshold: The Bullish Signal Crypto Traders Can’t Ignore

Bitcoin's network just flashed its most reliable momentum signal - and institutional money is paying attention.

The 600,000 Transactions Benchmark

When Bitcoin processes over 600,000 daily transactions, historical patterns suggest major price movements follow. This isn't just network activity - it's the market's pulse quickening.

Institutional Validation Cycle

High transaction volumes trigger algorithmic buying from quantitative funds. Traditional finance finally understands what crypto natives knew all along - network usage predicts price better than any Wall Street analyst's spreadsheet.

Technical Dominance Over Fundamentals

Forget earnings reports and P/E ratios. In crypto, the most sophisticated investors track on-chain metrics while traditional finance still debates whether Bitcoin has 'intrinsic value' - a concept about as relevant as a fax machine in 2025.

The threshold isn't just a number - it's the market's way of separating crypto believers from those still waiting for their bank's permission to invest.

Bitcoin’s 600,000 Transactions Threshold Takes Center Stage

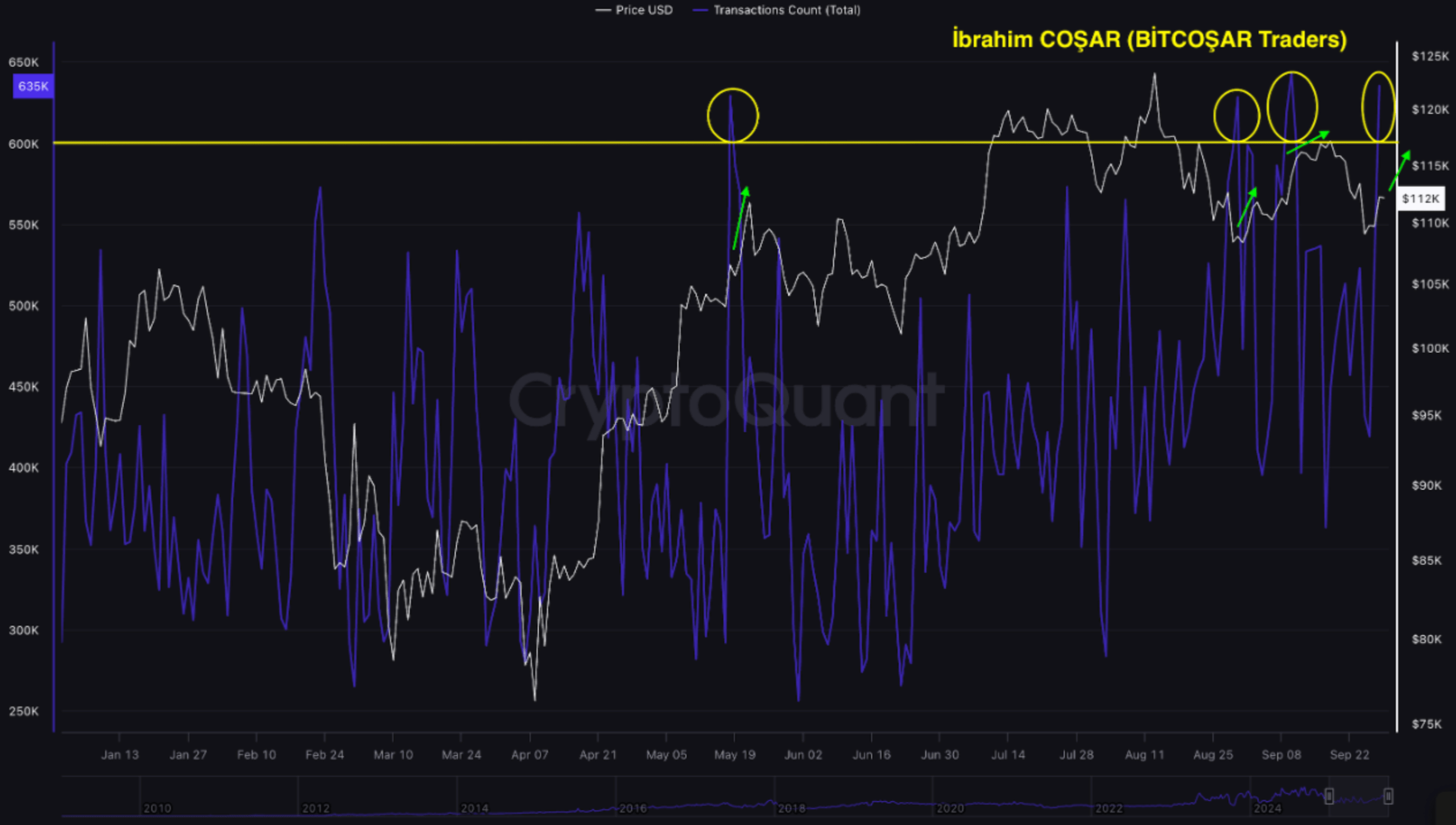

According to a CryptoQuant Quicktake post by contributor Ibrahim Cosar, an important correlation between BTC price and the total number of transactions over time stands out.

The analyst shared the following chart to highlight the relationship between Bitcoin’s price and the total number of transactions. Notably, whenever the total transaction count surges above the 600,000 level – or even approaches it – BTC’s price tends to initiate an upward move.

The above chart shows three previous instances in 2025 when BTC’s total transaction count climbed beyond 600,000, with an ensuing price appreciation. In May, there was a sharp price increase shortly following Bitcoin’s transaction count jump.

Similar combinations of transaction count increase and price action surge were witnessed in August and early September. The CryptoQuant analyst remarked that this pattern has become particularly evident since Q4 2024. Cosar added:

I’ve been studying on-chain data for a long time, but it’s rare to see such a clear pattern. The 600K transaction threshold seems to act almost like a signal that triggers Bitcoin’s “price engine.” This is my personal discovery, and the chart confirms it quite clearly.

The analyst stated that rising transaction activity on the network is a leading indicator of Bitcoin’s underlying usage and demand. As the number of transactions on the bitcoin network rises, the network becomes more vibrant and active.

The growing usage of the Bitcoin network creates a natural buying pressure on Bitcoin’s price, adding fuel to the cryptocurrency’s bullish momentum. According to Cosar, the 600,000 transaction level is an “activity explosion” threshold that leads to a “price explosion.”

That said, the analyst cautioned that no single factor can completely influence BTC’s price, as it is dependent on a mix of various factors, including macroeconomic backdrop, regulations, and trading activity.

Still, the significance of an on-chain indicator with such a strong correlation with BTC’s price should not be ignored. If the total transaction count rises past the 600,000 level again, expect BTC to hit a new record high.

Will BTC Fall Below $100,000?

Bitcoin’s inability to decisively break through its current ATH of $124,128, recorded on August 14, has bulls worried about the digital asset’s fading momentum. The cryptocurrency is currently at its most oversold level since April 2025.

From a technical standpoint, BTC has formed a bearish evening star pattern on the weekly chart, raising the possibilities of a price dip below $100,000. At press time, BTC trades at $114,117, up 3.8% in the past 24 hours.