Litecoin Price Forecast: Will LTC Surge 77% to $200 in 2025?

- What Does Litecoin's Technical Setup Reveal?

- How Is Market Sentiment Impacting LTC?

- What Regulatory Factors Could Affect LTC?

- Can Litecoin Realistically Reach $200?

- Litecoin Price Prediction Q&A

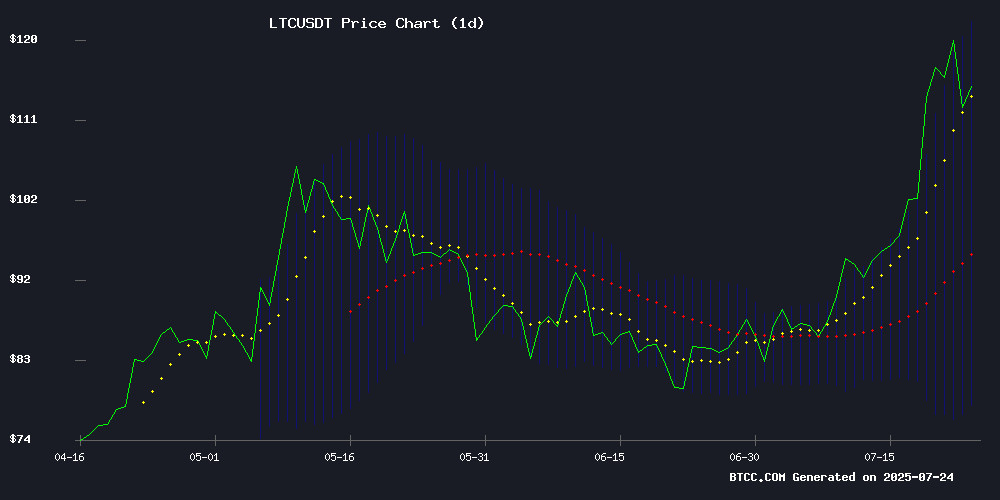

Litecoin (LTC) is showing bullish technical signals as it trades above key moving averages while the broader crypto market faces profit-taking pressure. Currently priced at $113, LTC needs significant catalysts to reach its $200 target - a 77% rally from current levels. This analysis examines the technical setup, market sentiment, and regulatory factors that could determine Litecoin's price trajectory through Q3 2025.

What Does Litecoin's Technical Setup Reveal?

LTC currently trades at $113, comfortably above its 20-day moving average ($99.92) and testing the upper Bollinger Band ($121.46). The MACD histogram remains negative at -2.81 but shows narrowing bearish divergence, suggesting weakening downward momentum.

Source: BTCC Trading Platform

"The $113 level represents a 13% premium to the 20-DMA, which historically acts as strong support during uptrends," noted a BTCC market analyst. "Traders should watch for a decisive close above the upper Bollinger Band to confirm continuation."

How Is Market Sentiment Impacting LTC?

The cryptocurrency market saw its sharpest correction in weeks, with altcoins particularly affected. Total market capitalization dropped 5% to $3.78 trillion, while the altcoin-specific market cap plunged nearly 10% from $1.57 trillion to $1.4 trillion (data from CoinMarketCap).

Despite this, Litecoin has shown relative strength, maintaining its position above critical support levels. The Relative Strength Index at 64 indicates growing buying pressure without yet reaching overbought territory.

What Regulatory Factors Could Affect LTC?

The SEC's recent actions have created uncertainty in crypto markets. After initially approving NYSE Arca's listing of the Bitwise 10 Crypto Index ETF on July 22, the regulatory body abruptly froze the approval. This ETF would have included XRP alongside bitcoin and Ethereum, with smaller allocations to other altcoins.

This regulatory whiplash highlights the challenges facing crypto assets beyond Bitcoin and ethereum in gaining mainstream financial product approval. The development serves as a reminder that despite positive technical setups, macro crypto sentiment remains fragile.

Can Litecoin Realistically Reach $200?

A rally to $200 WOULD require a 77% increase from current levels. Here's the bull and bear case breakdown:

| Factor | Bull Case | Bear Case |

|---|---|---|

| Technical | Break above $121.46 could target $150 | MACD still negative; RSI may cool from 63 |

| Fundamental | ETF approvals/MWEB adoption | Regulatory headwinds persist |

| Market | BTC dominance drop altseason | Broader crypto correction |

"LTC needs sustained volume above $1.5B daily to support $200," the BTCC analyst added. "Q3 2025 becomes plausible if Bitcoin can break through $75K resistance."

This article does not constitute investment advice. cryptocurrency investments are volatile and high risk.

Litecoin Price Prediction Q&A

What are the key technical levels to watch for LTC?

The $121.46 upper Bollinger Band represents immediate resistance, while the 20-day MA at $99.92 serves as crucial support. A break above resistance could open path to $150, while losing support might test the 50-day MA around $92.

How does Litecoin's performance compare to Bitcoin?

LTC has shown relative strength during the recent market correction. While many altcoins dropped 6-20%, Litecoin maintained its position above key support levels, suggesting stronger accumulation by long-term holders.

What catalysts could drive LTC to $200?

Key potential catalysts include: 1) Successful Bitcoin ETF inflows spilling over to altcoins, 2) Clearer regulatory framework for crypto assets, 3) Increased MWEB adoption enhancing Litecoin's privacy features, and 4) Rotation from Bitcoin to altcoins during next market upturn.

What risks could prevent LTC from reaching $200?

Major risks include: 1) Continued regulatory uncertainty, 2) Bitcoin dominance remaining high, limiting altcoin rallies, 3) Macroeconomic conditions turning risk-off, and 4) Failure to maintain trading volume above $1.5B daily.