Windtree Therapeutics Aims for $520M Mega-Round to Lock Down BNB Reserves

Biopharma meets blockchain in a high-stakes capital grab.

Windtree Therapeutics isn't playing small ball—the firm's gunning for a half-billion-dollar war chest to corner the BNB market. Because nothing says 'stablecoin security' like betting the farm on Binance's volatile darling.

The $520M ask raises eyebrows across both TradFi and crypto circles. That's Series D money in a seed-stage crypto winter—but when has irrational exuberance ever stopped a bull market?

One hedge fund manager quipped: 'They'll need more than tree metaphors to grow this money forest.' Meanwhile, BNB whales are circling—smelling either blood or opportunity, depending on who's holding the bags.

Windtree Commits $520 Million to Build a BNB Treasury

According to a press release issued by Windtree on July 24, the company entered into an agreement to sell its common stock to raise up to $500 million. This will create an equity line of credit (ELOC).

An ELOC is a flexible funding arrangement where the company can sell shares over time to draw funds, much like a credit line. The second is a $20 million stock purchase agreement with Build and Build Corp. This brings the total potential funding to $520 million.

The company stated that 99% of the funds will be directed toward building a substantial BNB reserve. This decision is a strategic MOVE to diversify its financial holdings and capitalize on the growing cryptocurrency market.

However, Windtree stressed that the ELOC cannot be utilized until stockholders approve an increase in the company’s authorized shares.

“Pending stockholder approval, the opportunity to secure additional funds for purchasing more BNB cryptocurrency is essential to our strategy,” Windtree CEO Jed Latkin stated.

This announcement follows closely on the heels of a strategic partnership with Kraken. On July 22, the firm announced that Kraken will manage its BNB-focused crypto treasury program.

The cryptocurrency exchange will provide custody, trading, and over-the-counter (OTC) services. The partnership aims to ensure secure management and liquidity for Windtree’s cryptocurrency holdings, leveraging Kraken’s expertise in digital asset infrastructure.

“The parties have signed a term sheet, to be memorialized in a definitive agreement following shareholder approval of Windtree’s previously announced securities purchase agreement, with potential for up to an additional $140 million in future subscriptions, led by Build and Build Corp,” the press release reads.

Besides Windtree, Nano Labs, a Web 3.0 infrastructure and product solution provider, has also launched a BNB treasury strategy. In late June, the firm revealed its plans to acquire $1 billion worth of BNB. To kickstart this reserve, Nano Labs bought $50 million in BNB earlier this month.

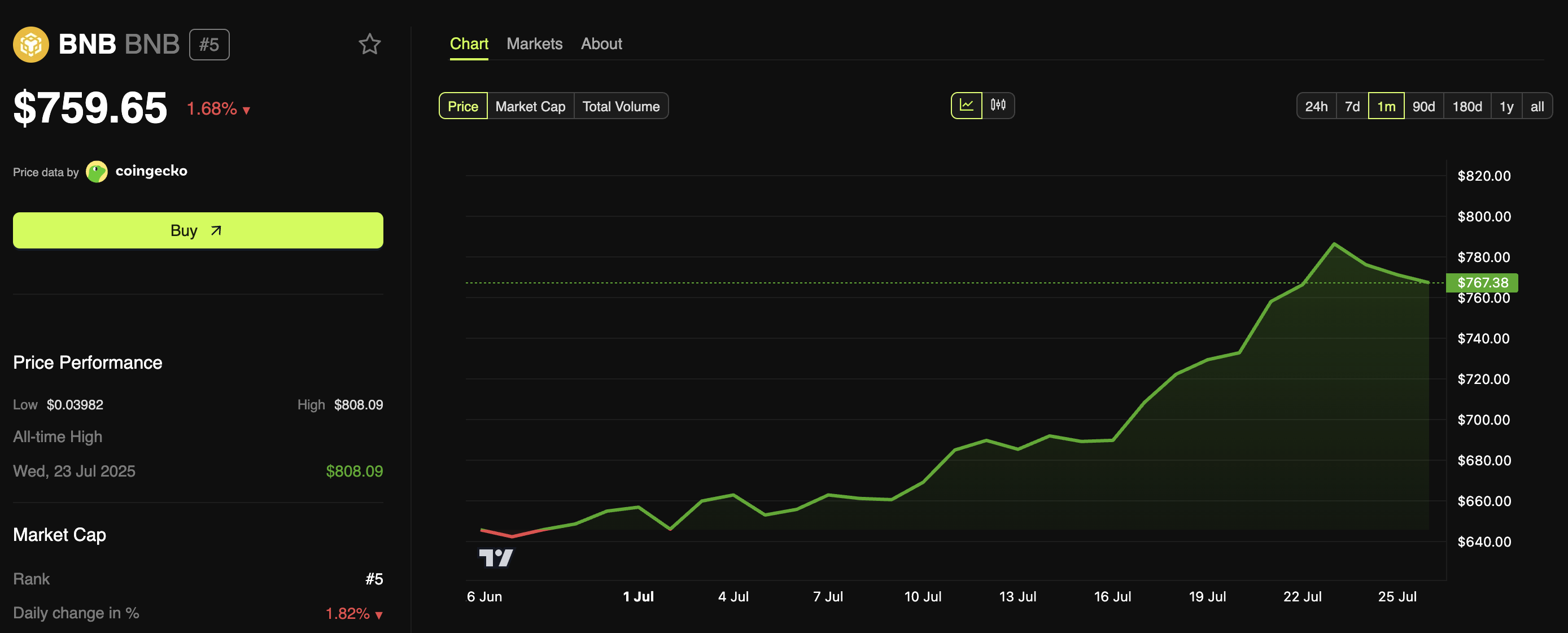

Meanwhile, this institutional interest in BNB comes at a time of heightened market activity for the cryptocurrency. According to data from BeInCrypto, the altcoin’s value has appreciated 17.5% over the past month.

In fact, on July 23, BNB reached an all-time high. Nevertheless, the price saw a slight correction after this peak.

At the time of writing, the coin was trading at $759. This represented a decline of 1.68% over the past day. Despite this dip, the firms’ commitment to BNB signals increased confidence in its future potential.