Solana Price Forecast: Will SOL Shatter Resistance in August 2025?

- What's the Current Technical Picture for Solana?

- How Are Institutional Players Positioning Themselves?

- What Regulatory Developments Could Impact SOL?

- Where Could SOL Price Go in August?

- Is Solana Still a Good Investment?

- Solana Price Prediction FAQs

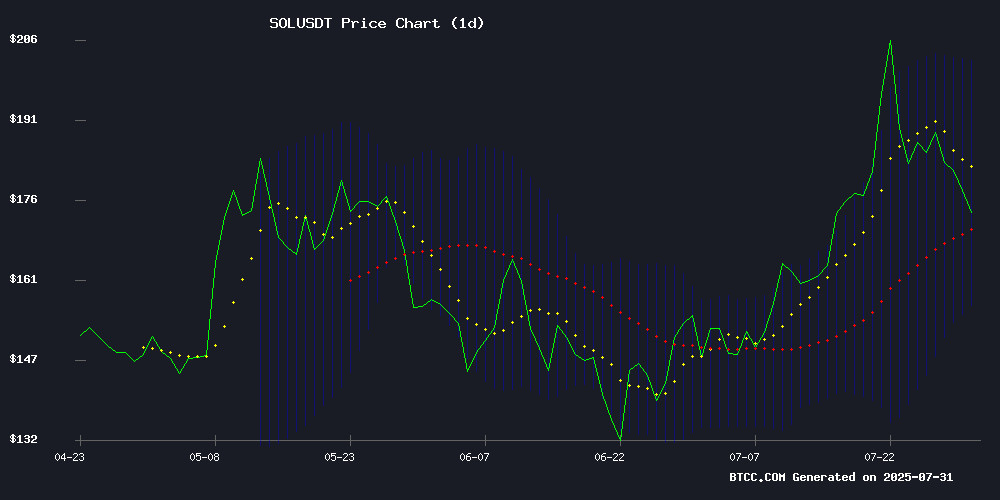

Solana (SOL) enters August 2025 at a critical technical juncture, trading at $177.30 after a 40% July rally. Our analysis reveals a neutral-bearish short-term outlook with key levels at $156 support and $201 resistance. While institutional investors have scooped up $367 million worth of SOL during recent dips, regulatory uncertainty around the 21Shares ETF filing and emerging competition from projects like Remittix create mixed signals. The BTCC team examines SOL's technical setup, ecosystem developments, and market sentiment to help traders navigate this volatile period.

What's the Current Technical Picture for Solana?

SOL presents a textbook consolidation pattern as of August 1, 2025, trapped between immediate support at $156.80 and resistance at $201.89. The price currently hovers just below the 20-day moving average ($179.34), with the MACD showing a slight bullish divergence at 2.7953 despite both signal lines remaining negative (-12.31/-15.10).

"This is classic indecision territory," notes the BTCC research team. "The Bollinger Bands are tightening, and we're seeing reduced volume - typically precedes a significant move." TradingView data shows daily volume down 14.88% to $5.36 billion, while CoinMarketCap reports SOL's market cap holding steady at $95.97 billion.

How Are Institutional Players Positioning Themselves?

Blockchain analytics reveal whales accumulated 2.03 million SOL ($367 million) during last week's dip, coinciding with exchange balances dropping to yearly lows. This accumulation occurred as funding rates flirted with negative territory - historically a contrarian indicator signaling potential trend reversals.

The institutional interest isn't surprising given Solana's ecosystem growth:

| Metric | Value | Monthly Change |

| DeFi TVL | $9.85B | +14% |

| DEX Volume | $82B | +30% |

| Network Revenue | $4.3M | +13% |

What Regulatory Developments Could Impact SOL?

All eyes remain on 21Shares' amended spot SOL ETF filing with the SEC, which now addresses concerns about in-kind redemptions. The Cboe BZX Exchange-listed product represents a crucial test case for altcoin ETFs following bitcoin and Ethereum's success.

Meanwhile, the ecosystem faces growing competition from projects like Remittix (launching Q3 wallet beta) and Unilabs Finance, which has raised $7 million in its fifth presale round. "These developments create both challenges and opportunities for Solana," observes a blockchain analyst who requested anonymity. "The network must demonstrate it can maintain developer mindshare while scaling."

Where Could SOL Price Go in August?

Technical analysis suggests two probable scenarios:

A daily close above $179.34 could trigger momentum toward $201.89, with a breakout potentially reaching July's high of $215. This WOULD require renewed institutional buying and positive ETF developments.

Failure to hold $156.80 support may lead to a test of $140, especially if Bitcoin experiences volatility. Negative ETF news or ecosystem outflows could accelerate downward pressure.

The BTCC team emphasizes watching these key indicators:

- Exchange net flows (CoinMarketCap data)

- Funding rates (TradingView derivatives data)

- ETF approval progress (SEC filings)

- Ecosystem TVL changes (DeFiLlama)

Is Solana Still a Good Investment?

For investors with 6+ month horizons, SOL's fundamentals remain strong:

- #5 market cap position

- Leading NFT and DeFi ecosystem

- Institutional backing from VanEck etc.

However, short-term traders should prepare for volatility. "August often brings summer doldrums to crypto markets," cautions a BTCC market strategist. "Patience and position sizing are crucial here."

This article does not constitute investment advice. Always conduct your own research before trading.

Solana Price Prediction FAQs

What is Solana's price prediction for August 2025?

SOL currently trades in a $156-$201 range. Technicals suggest a breakout in either direction is likely, with the 20-day MA at $179.34 acting as immediate resistance.

Is Solana a good investment compared to newer projects?

While projects like Unilabs Finance offer higher risk/reward potential, SOL provides relative stability as an established LAYER 1 with institutional backing and proven use cases.

How does the Solana ETF progress affect price?

Positive ETF developments could trigger institutional inflows, while rejections or delays may cause short-term selloffs. The 21Shares filing is particularly crucial for mid-term price action.

What are Solana's strongest competitors right now?

Beyond Ethereum, solana faces growing competition from Bitgert's Brise Chain (partnered with Sallar Network) and specialized projects like Remittix in payments.

Where can I trade SOL with low fees?

BTCC offers competitive SOL/USDT trading pairs with tight spreads and DEEP liquidity, suitable for both spot and derivatives traders.