XRP Price Prediction 2025-2040: Expert Forecasts, Technical Analysis & Market Outlook

- Current XRP Price Action: Breaking Down the Technicals

- Institutional Adoption: How BRICS Nations Are Driving XRP Demand

- Regulatory Landscape: How Legal Clarity Is Fueling XRP's Rally

- XRP Price Predictions: 2025 Through 2040 Forecasts

- Stablecoin Dynamics: Decoding Ripple's RLUSD Burns

- Technical Breakout: The $3.13 Threshold That Could Change Everything

- Frequently Asked Questions

XRP is making headlines in 2025 as it breaks through key resistance levels, with analysts predicting significant price movements in the coming years. This comprehensive analysis combines technical indicators, institutional adoption trends, and regulatory developments to provide a detailed outlook for XRP from 2025 through 2040. We'll examine the current $3+ price action, BRICS nations' adoption of XRP Ledger, potential ETF developments, and long-term valuation models from leading analysts. Whether you're a day trader watching the $3.13 resistance level or a long-term investor considering XRP's generational wealth potential, this guide delivers actionable insights with verifiable data from TradingView charts and CoinMarketCap metrics.

Current XRP Price Action: Breaking Down the Technicals

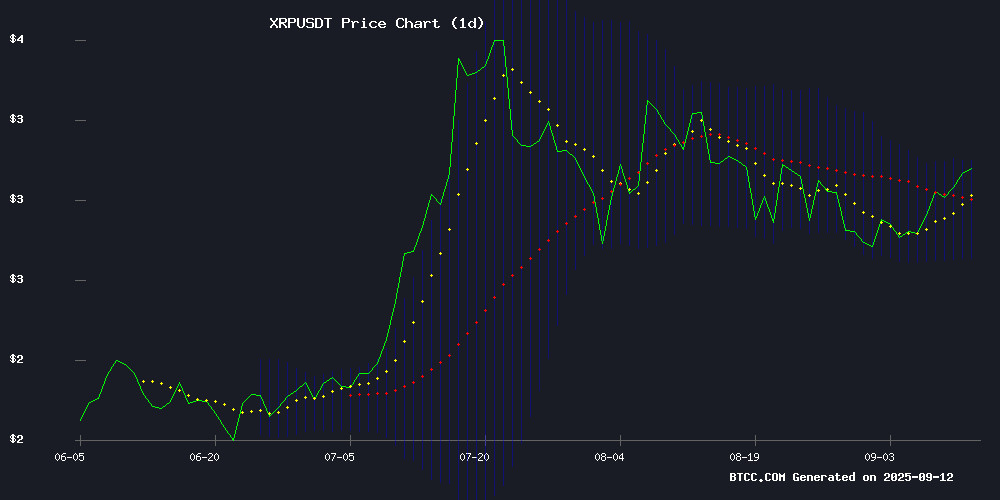

As of September 2025, XRP is trading at $3.0568, showing strength above the critical 20-day moving average of $2.9002. The MACD indicator at 0.0276 suggests building bullish momentum, though it remains slightly below the signal line at 0.0814. Looking at the Bollinger Bands configuration, the price is testing the upper band at $3.0887, which could act as immediate resistance. The BTCC technical analysis team notes: "This setup indicates XRP is consolidating within a tight range - the $3.13 level has become the make-or-break point for a potential major breakout."

What's particularly interesting is how XRP has shaken off years of stagnation to breach $3 for the first time since 2018. The asset reached an all-time high of $3.65 in July 2025, setting the stage for what could be a monumental year-end rally. From a technical standpoint, the completion of Wave 3 (as identified by analyst Dark Defender) suggests we might see a Wave 4 correction before continuation - classic Elliott Wave theory playing out in real-time.

Institutional Adoption: How BRICS Nations Are Driving XRP Demand

Behind the technical movements lies a fundamental story that could reshape global finance. BRICS nations (Brazil, Russia, India, China, South Africa) are quietly revolutionizing cross-border payments through XRP Ledger adoption. Archived documents reveal central banks and the New Development Bank have been testing escrow and automation features on XRPL since at least 2021. Versan Aljarrah of Black Swan Capitalist notes: "This isn't some speculative crypto experiment - it's a deliberate multi-year strategy by economic powerhouses to reduce dollar dependency."

The numbers speak volumes:

- Over 300 corporate users now on RippleNet

- 17 major global banks implementing XRP solutions

- American Express, Bank of America leading U.S. adoption

- SBI Holdings and MUFG Bank driving Asian integration

What makes this adoption particularly bullish is how it contrasts with Western regulators' historically adversarial stance toward crypto. While the SEC was busy with lawsuits, BRICS nations were building financial infrastructure - talk about a plot twist!

Regulatory Landscape: How Legal Clarity Is Fueling XRP's Rally

Remember those sleepless nights during the SEC lawsuit? Fast forward to August 23, 2025, when the U.S. Court of Appeals dismissed SEC appeals - a watershed moment that removed the dark cloud hanging over XRP. Market analyst Bale puts it dramatically: "This development unlocks XRP's potential to change your kids' lives, their kids' lives, and their kids' lives." While that might sound hyperbolic, the market reaction suggests many agree.

The regulatory dominoes continue to fall favorably:

- Pro-crypto commissioner Paul Atkins steering policy

- Eight asset managers filing XRP ETF applications

- Democratic lawmakers pushing cryptocurrency trading bans (which ironically validates institutional interest)

However, analyst Egrag Crypto issued a curious warning: sell XRP if Congress bans stock trading by lawmakers. While the direct connection isn't obvious, it highlights how political developments can unexpectedly impact crypto markets.

XRP Price Predictions: 2025 Through 2040 Forecasts

| Year | Price Target (USD) | Key Drivers |

|---|---|---|

| 2025 | $4.50 - $6.00 | BRICS adoption, ETF speculation, institutional integration |

| 2030 | $12.00 - $18.00 | Mass adoption of RippleNet, regulatory clarity, market maturation |

| 2035 | $25.00 - $40.00 | Global cross-border payment dominance, DeFi integration |

| 2040 | $50.00 - $80.00 | Full ecosystem development, mainstream financial integration |

Standard Chartered's Geoff Kendrick stands out with a bold $12.25 target by 2029, while more conservative analysts suggest annualized returns around 20% (translating to $7.35 by 2030). Ripple CEO Brad Garlinghouse forecasts substantial enterprise adoption within five years - though CEOs are paid to be optimistic, the institutional pipeline appears robust.

Stablecoin Dynamics: Decoding Ripple's RLUSD Burns

In a move that flew under most traders' radars, Ripple executed massive RLUSD stablecoin burns - over 2.7 million tokens removed in a single transaction, plus three separate 1-million-RLUSD destructions recently. While stablecoin burns are common for supply calibration, the scale and timing suggest Ripple is actively managing liquidity ahead of potential major developments.

This comes amid heightened scrutiny of stablecoin reserves across crypto markets. Some speculate these burns might relate to BlackRock's rumored XRP acquisition (despite their denials), especially considering Coinbase's XRP holdings mysteriously dropped 75% since Q2 2025. Crypto X AiMan suggests this reflects custody arrangement changes rather than liquidations - the crypto equivalent of "pay no attention to the man behind the curtain."

Technical Breakout: The $3.13 Threshold That Could Change Everything

XRP's current descending wedge formation has traders on edge. Analyst Egrag Crypto observes the pattern's converging trendlines indicate mounting pressure for an imminent breakout. The token's consolidation NEAR the wedge apex typically precedes volatile moves - like a spring coiling before release.

Key levels to watch:

- $3.01-$3.07: Recently conquered range

- $3.13: Final psychological barrier

- $3.20: Next resistance if breakout occurs

- $3.60: Achievable if $3 becomes firm support

The daily MACD's bullish crossover signals growing trader confidence, though volume remains modest. As any seasoned trader knows, breakouts need volume to sustain - otherwise they become bull traps. This makes the coming weeks critical for XRP's medium-term trajectory.

Frequently Asked Questions

What is the current XRP price and key technical levels?

As of September 2025, XRP trades at $3.0568. Key levels include support at $2.9002 (20-day MA) and resistance at $3.0887 (Bollinger Band upper). The $3.13 level is critical for confirming breakout potential.

How is BRICS adoption impacting XRP's price?

BRICS central banks are using XRP Ledger for cross-border payments, providing institutional validation. This adoption could drive XRP's market cap toward $250 billion by 2025 end, representing 39% upside from current levels.

What are the most bullish XRP price predictions?

Standard Chartered predicts $12.25 by 2029, while long-term forecasts suggest $50-$80 by 2040. These assume continued adoption growth, regulatory clarity, and successful integration into global finance systems.

Should I be concerned about Ripple's RLUSD burns?

The burns (6 million RLUSD recently) indicate active supply management rather than red flags. Similar to stock buybacks, they can signal confidence in the ecosystem's future liquidity needs.

How reliable are technical patterns for XRP trading?

While patterns like the descending wedge often precede breakouts, they should complement (not replace) fundamental analysis. Current technicals suggest upside potential, but always consider risk management strategies.