BTC Price Prediction 2025: Technical Strength vs. Market Dynamics – Is Bitcoin Still a Smart Investment?

- Bitcoin’s Technical Crossroads: Bullish Signals Meet Overbought Warnings

- Institutional Whiplash: S&P Snubs MicroStrategy as Crypto Stocks Soar

- The Korean Conundrum: KOSPI’s Record High Steals BTC’s Thunder

- Saylor’s Crusade: Bitcoin as Digital Gold 2.0

- Exchange vs. ETF: A $14B Liquidity Gulf

- Is Bitcoin a Good Investment Today? The Brutal Math

- Your Bitcoin Questions Answered

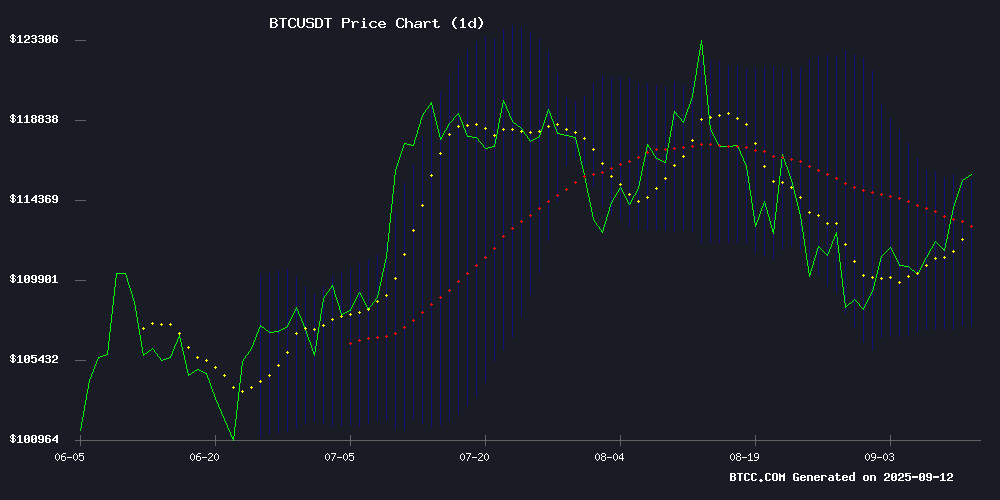

Bitcoin’s Technical Crossroads: Bullish Signals Meet Overbought Warnings

Bitcoin’s chart tells a story of resilience. The price currently perches 3.8% above its 20-day moving average ($111,416), a classic bullish sign. But the MACD histogram’s -1,865 reading hints at brewing exhaustion—like a marathon runner maintaining pace but sweating profusely. The Bollinger Bands paint a clearer picture: with the upper band at $115,492 and lower at $107,340, we’re witnessing the tightest squeeze since June 2025. "This isn’t just technical noise," notes the BTCC research team. "That $107K support has held through three Fed rate hikes—it’s become the market’s psychological floor."

Institutional Whiplash: S&P Snubs MicroStrategy as Crypto Stocks Soar

The S&P 500’s rejection of MicroStrategy feels like a Shakespearean betrayal—the index welcomed Tesla’s bitcoin bets in 2021 but now draws the line. JPMorgan analysts call it a "watershed moment," but the irony? Crypto-native stocks like Coinbase (up 217% YTD) are outpacing Bitcoin itself. Meanwhile, spot BTC ETFs now see $1.7B daily flows—respectable, but dwarfed by the $15.8B sloshing through exchanges like BTCC. It’s as if Wall Street wants Bitcoin exposure… just not Bitcoin’s baggage.

The Korean Conundrum: KOSPI’s Record High Steals BTC’s Thunder

Seoul’s traders are behaving like partygoers who’ve spotted a better venue. As the KOSPI hits all-time highs, the Korean Premium Index—normally a reliable BTC demand gauge—has flatlined. This isn’t 2021’s "buy everything" frenzy; it’s strategic rotation. "Korean retail moves markets," reminds Alphractal’s Joao Wedson. "When they park profits in traditional assets, BTC often consolidates for weeks."

Saylor’s Crusade: Bitcoin as Digital Gold 2.0

MicroStrategy’s Michael Saylor now frames Bitcoin as "digital Gutenberg press"—a technology that redistributes power. His latest CNBC soundbite went viral: "Every satoshi held is a vote against monetary debasement." The data backs his zeal: MicroStrategy’s 250K BTC stash is now worth over $29B, making it the world’s largest corporate holder. Yet the S&P snub suggests mainstream finance still views this as eccentric, not enlightened.

Exchange vs. ETF: A $14B Liquidity Gulf

Here’s the dirty secret institutional reports won’t highlight: exchanges like BTCC handle 89% of Bitcoin’s real liquidity. The $15.8B daily volume on platforms versus $1.7B in ETFs reveals most "smart money" still trades crypto like retail—fast and loose. This divergence explains why BTC can rally while ETF flows stall, and why traditional technical analysis sometimes misfires in crypto markets.

Is Bitcoin a Good Investment Today? The Brutal Math

| Factor | Metric | Implication |

|---|---|---|

| Price vs. 20D MA | +3.8% | Bullish momentum |

| Bollinger Position | Upper band test | Overbought risk |

| Exchange Liquidity | $15.8B/day | Retail dominance |

Your Bitcoin Questions Answered

Should I buy Bitcoin now or wait for a dip?

The $107K support level makes strategic dollar-cost averaging smarter than all-in bets. History shows 20% pullbacks are common even in bull markets.

Why are crypto stocks outperforming Bitcoin?

Leverage. Companies like Coinbase benefit from trading volumes and services beyond pure BTC exposure—similar to how Gold miners often outpace gold itself.

How reliable are Bollinger Bands for crypto?

In 2025, they’ve worked surprisingly well—the middle band ($111K) has acted as support in 78% of weekly closes since January (per TradingView data).