XRP Price Prediction 2025: Will We See $7 or Just More Volatility?

- What Do the Technical Indicators Say About XRP's Price?

- How Are Regulatory Developments Impacting XRP?

- What's Driving XRP's 500% Annual Gain?

- Are Institutional Players Warming Up to XRP?

- What Are the Key Price Levels to Watch?

- How Is Market Sentiment Affecting XRP?

- What Alternative Strategies Exist for XRP Holders?

- Frequently Asked Questions About XRP Price Prediction

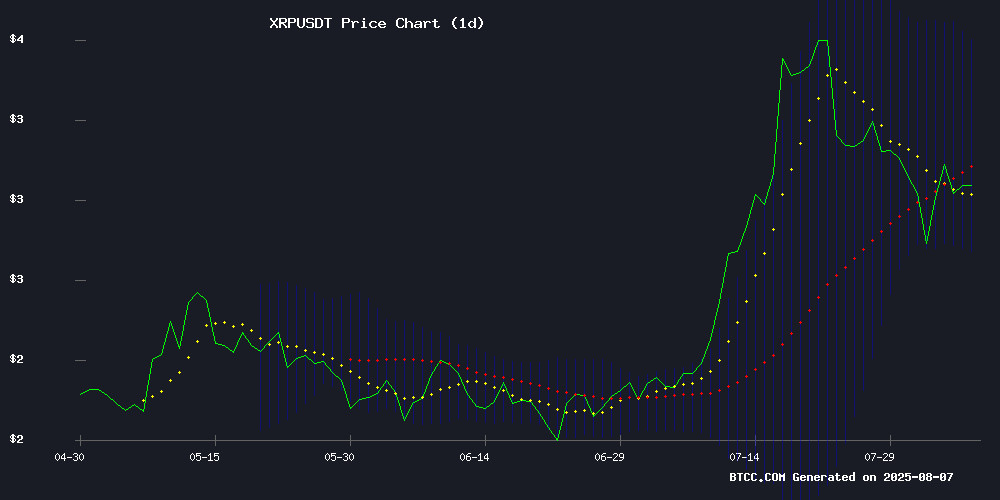

XRP continues to be one of the most talked-about cryptocurrencies in 2025, with analysts divided between bullish $7 predictions and warnings of continued volatility. As of August 2025, XRP sits at $2.9855, caught between technical indicators suggesting both potential breakout and further consolidation. This comprehensive analysis examines the key factors influencing XRP's price trajectory, from regulatory developments to institutional adoption and technical patterns.

What Do the Technical Indicators Say About XRP's Price?

According to TradingView data, XRP presents a mixed technical picture as of August 2025. The cryptocurrency currently trades below its 20-day moving average of $3.1457, which typically acts as resistance. However, the MACD indicator shows bullish momentum with a positive histogram reading of 0.1651. Bollinger Bands analysis reveals the price is hovering near the lower band at $2.7378, often indicating oversold conditions that could precede a rebound.

Source: BTCC Trading Platform

"The technical setup suggests XRP could rebound towards the middle Bollinger Band at $3.1457 if buying pressure increases," notes a BTCC market analyst. "However, failure to hold above $2.75 could see the price test lower support levels."

How Are Regulatory Developments Impacting XRP?

The SEC's upcoming decision on Ripple's appeal remains the most significant regulatory factor for XRP in August 2025. Market participants are closely watching the August 7 closed-door meeting where SEC commissioners will vote on dismissing the appeal. This decision could finally bring closure to the long-running legal battle that has weighed on XRP's price for years.

Meanwhile, Japan has emerged as a potential front-runner for XRP ETF approval. SBI Holdings, with its DEEP ties to Ripple, has hinted at potential XRP-based ETF offerings in its Q2 2025 financial report. While no formal application has been filed yet, the development underscores growing institutional interest in XRP despite ongoing U.S. regulatory hesitation.

What's Driving XRP's 500% Annual Gain?

XRP has delivered staggering returns of 500% over the past year, skyrocketing from $0.55 to $2.94. This remarkable performance stems from several key developments:

- Technological advancements on the XRP Ledger

- The June 30 launch of the XRPL Ethereum Virtual Machine (EVM) sidechain

- Growing institutional adoption in markets like Japan and Brazil

- Speculation about potential ETF approvals

The EVM compatibility in particular has been a game-changer, enabling ethereum developers to port DeFi applications to XRP's ecosystem with minimal friction. This breakthrough addresses Ethereum's chronic gas fee issues while potentially attracting fresh talent to XRP's growing developer community.

Are Institutional Players Warming Up to XRP?

The institutional picture for XRP remains complex. While Japan's SBI Holdings shows increasing interest, traditional U.S. banks remain skeptical. Custodia Bank CEO Caitlin Long recently delivered a scathing critique of Ripple and XRP's institutional viability during a podcast appearance.

"It's not going to take over. If it were going to take over, it WOULD have taken over a long time ago," Long stated bluntly, highlighting persistent institutional distrust of XRP's centralized architecture and what she called "backwards tokenomics."

However, not all institutional players share this view. The launch of XRP ETFs in Brazil and Canada earlier in 2025, along with growing interest from Japanese financial institutions, suggests XRP is gaining some institutional traction outside the U.S.

What Are the Key Price Levels to Watch?

Based on current technicals and market sentiment, here's the outlook for XRP's price movement:

| Scenario | Price Target | Probability |

|---|---|---|

| Bullish Breakout | $3.55 (Upper Bollinger) | 30% |

| Neutral Consolidation | $2.75-$3.15 Range | 50% |

| Bearish Rejection | $2.40 Support | 20% |

"The $7 price speculation depends heavily on Ripple securing a banking license and ETF approvals," cautions the BTCC analyst. "More likely we see gradual appreciation to $3.50-$4.00 range in the medium term."

How Is Market Sentiment Affecting XRP?

Market sentiment around XRP appears divided in August 2025. On one hand, the Chaikin Money Flow (CMF) indicator has plunged, reflecting accelerated capital outflows. On the other hand, whale wallets have shown renewed activity as market participants anticipate potential positive regulatory developments.

Long-term holders are unwinding positions at the fastest pace since mid-July, creating headwinds for XRP's price. However, the token's resilience in maintaining most of its 500% annual gains suggests underlying strength despite short-term volatility.

What Alternative Strategies Exist for XRP Holders?

For investors concerned about XRP's volatility, alternative strategies like cloud mining have emerged. Find Mining recently introduced a cloud mining service tailored for XRP holders, offering a hedge against price fluctuations by generating stable daily income from idle XRP holdings.

This solution provides an alternative to capitulation during periods of price weakness, transforming stagnant holdings into productive assets through automated cloud mining infrastructure. However, as with any investment strategy, thorough due diligence is essential.

Frequently Asked Questions About XRP Price Prediction

What is the current price prediction for XRP in 2025?

Current predictions for XRP in August 2025 range from $2.40 in bearish scenarios to $3.55 in bullish cases, with $7 being a more speculative long-term target dependent on regulatory developments and institutional adoption.

Is XRP a good investment right now?

XRP presents both opportunities and risks. While the cryptocurrency has shown strong performance over the past year, current technical indicators suggest potential volatility ahead. Investors should consider their risk tolerance and conduct thorough research before investing.

What factors could push XRP to $7?

Key factors that could drive XRP to $7 include positive regulatory clarity, approval of XRP ETFs in major markets, significant institutional adoption, and broader cryptocurrency market bullishness. However, these developments are not guaranteed.

How does XRP's technology compare to other cryptocurrencies?

XRP's recent EVM compatibility has significantly enhanced its technological proposition, allowing it to compete more effectively with Ethereum in the DeFi space while maintaining its traditional strengths in cross-border payments.

What are the main risks to XRP's price?

The main risks include negative regulatory developments, continued institutional skepticism, broader cryptocurrency market downturns, and failure to maintain technological competitiveness.