Fed Rate Cuts Won’t Save Crypto Markets—Here’s Why Bulls Should Worry

Markets are frothing over the Fed’s potential rate cuts—but crypto traders might be setting themselves up for disappointment. Here’s the cold, hard truth.

The Liquidity Mirage

Cheap money doesn’t guarantee a crypto rally. Past cycles show Bitcoin and altcoins often lag traditional markets when monetary policy shifts. The 2019 'insurance cut'? BTC dumped 20% within weeks.

Institutional Game Theory

Wall Street’s algos now dominate price action. If risk assets get a Fed boost, capital could rotate out of crypto into oversold equities—leverage liquidations would follow.

The Regulatory Wildcard

Rate cuts won’t stop the SEC from strangling stablecoins or hunting down 'unregistered securities.' Ask any XRP holder how macroeconomic policy helped their bags.

Bottom line: Crypto doesn’t trade on fundamentals—it trades on hopium. And right now, the Fed’s printer might be out of ink. (But hey, at least hedge funds will collect management fees while your portfolio burns.)

A Fed Rate Cut Could Be a Sign of Recession

A recent report from BeInCrypto revealed that the probability of a Fed rate cut in September 2025 has climbed above 90%. This is clearly what investors are hoping for. Analysts believe this optimistic sentiment will help sustain market momentum through 2025.

Lower interest rates usually reduce borrowing costs. This encourages more investment in riskier assets like cryptocurrencies.

However, past data show that major rate-cutting cycles occur just before or during economic recessions.

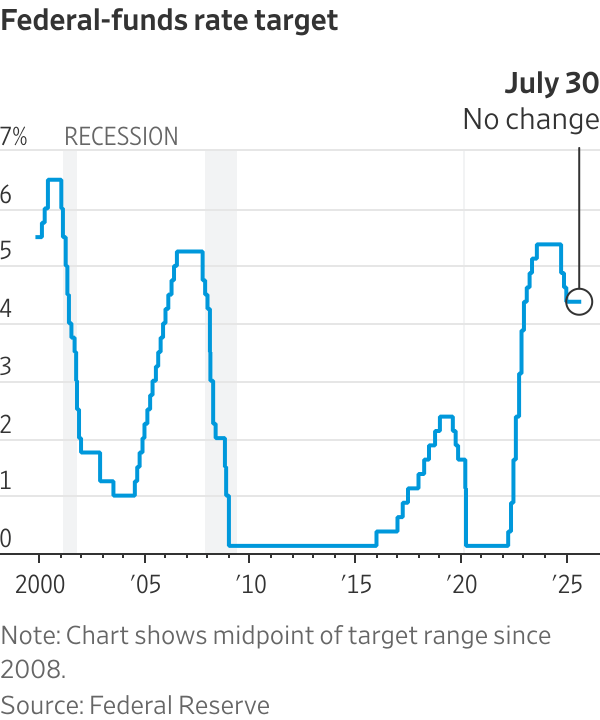

Fed data indicates that major recessions in 2001, 2008, and 2020 all began with rate cuts.

This historical pattern contradicts investor expectations and has prompted many retail investors to question its reasoning.

“If rate cuts supposedly boost lending, why do the gray bars (recessions) show up after the Fed cuts rates?” investor John Smith asked on X.

John Smith’s question appears valid, especially when considering the recent performance of tech stocks, which mirrors the dot-com bubble period.

“Tech stocks are outperforming the S&P 500 by the largest margin since the peak of the DOT Com Bubble,” markets data provider Barchart commented.

Guilherme Tavares, CEO of i3 Invest, also sees the S&P 500’s overheating as driven by AI hype. He voiced concern about investors planning to buy and hold for the long term.

Fed Rate Cut Might Not Be Good News for Crypto

Expert opinion helps answer John Smith’s earlier question.

The Fed’s shift toward easing monetary policy—often called a “Fed pivot”—may trigger short-term bullish reactions in stocks and crypto by lowering rates and encouraging risk-taking.

But if history is a reliable guide, this policy shift could merely be a reaction to existing recession signals. In a recent report, Henrik Zeberg, Head Macro Economist at Swissblock, explained the current situation.

Foreword: August 2025 Zeberg Letter

"The Illusion of strong Labor Market was shattered by Friday's NFP Report. It is time to prepare"

(Henrik Zeberg, August 1st)

Get the FULL REPORT BY SIGNING UP HERE:https://t.co/HPVoam0nTs

Here are the forewords:

A Turning Point in Labor…

Zeberg stated that Swissblock’s Business Cycle Model had warned of a coming recession since late 2024.

He argued that the current cracks in the labor market confirm that warning.

“This deterioration in labor data is not just a one-month anomaly; it’s a sign that the economic tide is beginning to turn—one that investors ignore at their peril,” said Zeberg.

In simple terms, a Fed rate cut doesn’t mean the Fed is trying to prevent an economic slowdown. It means they’re reacting to one that’s already underway.

Lower rates don’t automatically revive lending. If businesses are unstable or consumers have lost jobs, they won’t borrow—even if money is cheap.

The current excitement about a potential Fed cut may only create a temporary boost. While the S&P 500 and Bitcoin are hitting new highs, Zeberg warns that this may be the end-of-cycle euphoria. He likens it to a last shot of adrenaline for an aging bull.

“This is a double-edged sword: while a pivot could extend the risk-asset melt-up a bit longer, it WOULD be happening for the wrong reasons—namely, because the economy is faltering. New liquidity can inflate valuations even further into unsustainable territory, setting the stage for an even more dramatic correction later on,” Zeberg added.

Finally, Henrik Zeberg issued a chilling forecast: the upcoming market downturn could be historic—potentially the worst crash since the 1930s.