Bitcoin Price Prediction 2025: Bullish Signals Emerge Despite Market Volatility

- BTC Technical Analysis: The Bullish Case Beneath the Surface

- Institutional Moves That Could Reshape Bitcoin's Future

- Macroeconomic Crosscurrents Impacting Crypto

- Geopolitical Wildcards: Indonesia's Bitcoin Gambit

- The Road to $200K: Realistic or Wishful Thinking?

- Frequently Asked Questions

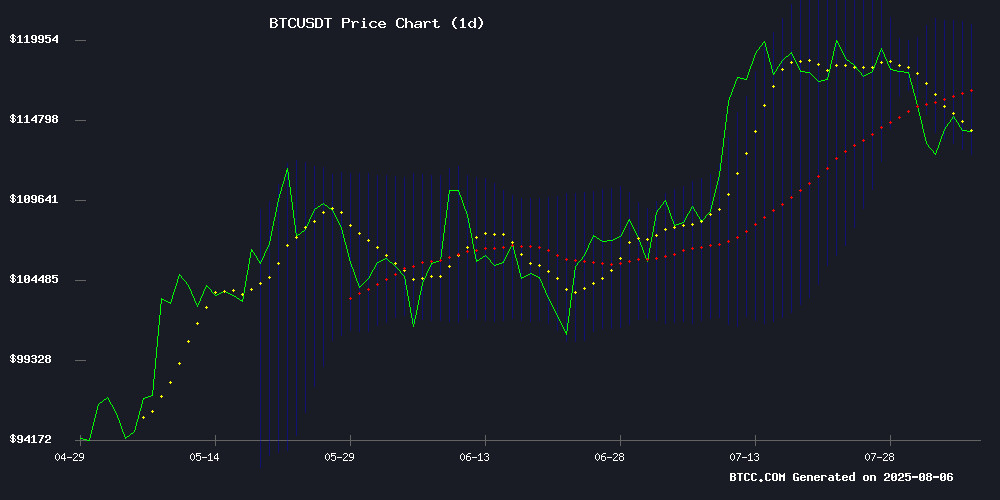

As we navigate August 2025's crypto landscape, Bitcoin presents a fascinating paradox - technical indicators flash bullish while macroeconomic headwinds create turbulence. The BTCC research team analyzes current BTC price action at $114,047.76, revealing a market poised between short-term caution and long-term optimism. Institutional accumulation, miner expansion, and surprising geopolitical developments suggest Bitcoin's path to $200K remains intact despite recent pullbacks.

BTC Technical Analysis: The Bullish Case Beneath the Surface

Bitcoin's current price sits just below its 20-day moving average ($116,765.73), which might concern some traders. However, the MACD tells a different story - with the MACD line at 2,160.96 crossing above the signal line at 469.67, we're seeing classic bullish momentum building. The Bollinger Bands paint a neutral picture for now, with the price comfortably between the upper ($120,953.37) and lower ($112,578.10) bands.

What's interesting is how bitcoin has been testing these levels. We saw a sharp drop to $112,000 followed by a quick rebound to $115,000 - classic whale behavior shaking out weak hands. The Fair Value Gap between $114,000-$115,500 has become a battleground, and whichever side breaks first could determine our next major move.

Institutional Moves That Could Reshape Bitcoin's Future

The smart money isn't sitting idle. Galaxy Digital's Q2 pivot caught many by surprise - turning a $295 million Q1 loss into a $30.7 million profit while accumulating 4,272 additional BTC. They now hold 17,102 BTC ($1.95 billion at current prices), effectively taking coins off the market.

Meanwhile, Chinese miner Cango demonstrates the mining sector's relentless expansion. Their July production hit 650 BTC (a 44% monthly increase) after deploying $256 million in new Bitmain rigs. With 4,529.7 BTC in reserves, they've joined the top 20 public BTC holders globally.

| Indicator | Value |

|---|---|

| Current Price | 114,047.76 USDT |

| 20-day MA | 116,765.73 USDT |

| MACD Line | 2,160.96 |

| Signal Line | 469.67 |

| Bollinger Upper | 120,953.37 USDT |

| Bollinger Lower | 112,578.10 USDT |

Macroeconomic Crosscurrents Impacting Crypto

The Fed's policy dilemma has never been more acute. July's services PMI at 50.1 (barely above contraction) combined with an employment index plunge to 46.4 creates textbook stagflation risks. Yet the price index surged to 69.9 - October 2022 highs. Bitcoin's dual nature as both risk asset and inflation hedge means it's getting pulled in both directions.

Adding to the complexity, Binance Futures volume hit $2.55 trillion in July - a six-month high showing traders are capitalizing on this volatility. As one analyst quipped, "When the waters get choppy, the sharks come out to feed."

Geopolitical Wildcards: Indonesia's Bitcoin Gambit

In a move that could reshape emerging market crypto adoption, Indonesia is seriously considering Bitcoin as a reserve asset. Their unique angle? Leveraging abundant geothermal and hydro resources for mining operations. With a $1.4 trillion GDP and 280 million people, this isn't some fringe experiment - it's potential mainstream validation on a national scale.

The Road to $200K: Realistic or Wishful Thinking?

Despite the current correction (down 7.2% from July's $123K ATH), the $200K 2025 target persists among serious analysts. The math makes sense when you consider:

- Institutional accumulation tightening supply

- Miner expansion increasing network security

- Geopolitical adoption reducing sell pressure

- Macro uncertainty driving hedge demand

That said, we're not out of the woods yet. The $112,500 support needs to hold, and breaking through the $116,200 resistance remains crucial for confirming bullish continuation.

Frequently Asked Questions

Is now a good time to buy Bitcoin?

With Bitcoin currently testing key support levels and showing bullish momentum indicators, many analysts see this as an attractive entry point. However, always conduct your own research and consider dollar-cost averaging to mitigate timing risks.

What's driving Bitcoin's price volatility in August 2025?

The current volatility stems from conflicting macroeconomic signals (stagflation fears), institutional accumulation patterns, and technical factors like the Fair Value Gap between $114,000-$115,500.

How reliable is the $200K Bitcoin price prediction?

While not guaranteed, the $200K target aligns with historical halving cycles, increasing institutional adoption, and macroeconomic trends favoring hard assets. The BTCC research team considers it a plausible scenario if current accumulation patterns continue.

Why are institutions accumulating Bitcoin during market uncertainty?

Sophisticated investors view Bitcoin as both a hedge against monetary inflation and a scarce digital asset with asymmetric upside potential. Current prices represent discounts from recent highs, creating accumulation opportunities.