BNB Price Forecast: Bulls Eye $1,000 as Rising TVL and Stablecoin Supply Boost Outlook

BNB's charging toward four digits—fueled by surging total value locked and a rock-solid stablecoin foundation.

DeFi's Sleeping Giant Wakes

TVL isn't just climbing—it's exploding. More assets locked means more utility, more demand, and frankly, more reasons for traders to ditch traditional finance's paperwork parade.

Stablecoins: The Silent Bull Market Engine

While everyone watches price charts, smart money's watching stablecoin flows. Increased supply signals serious capital deployment—not just speculative gambling.

Technical Breakout Imminent

The charts scream momentum. Every resistance level looks like tissue paper as institutional and retail buyers pile in. That $1,000 target? It's not hopeful—it's inevitable.

Traditional finance still thinks crypto's a sideshow while BNB's building the main stage. Maybe they'll notice when their clients start asking why their portfolios aren't performing like digital assets.

On-chain metrics show a bullish bias

Arthemis Terminal data shows that BNB’s TVL increased to $7.74 billion on Sunday from $7.3 billion on September 2, nearing its record high levels of $7.8 billion. Rising TVL indicates growing activity and interest within BNB’s ecosystem, suggesting that more users are depositing or utilizing assets within BNB-based protocols.

-1758007397257-1758007397270.jpeg)

BNB TVL chart. Source: Artemis

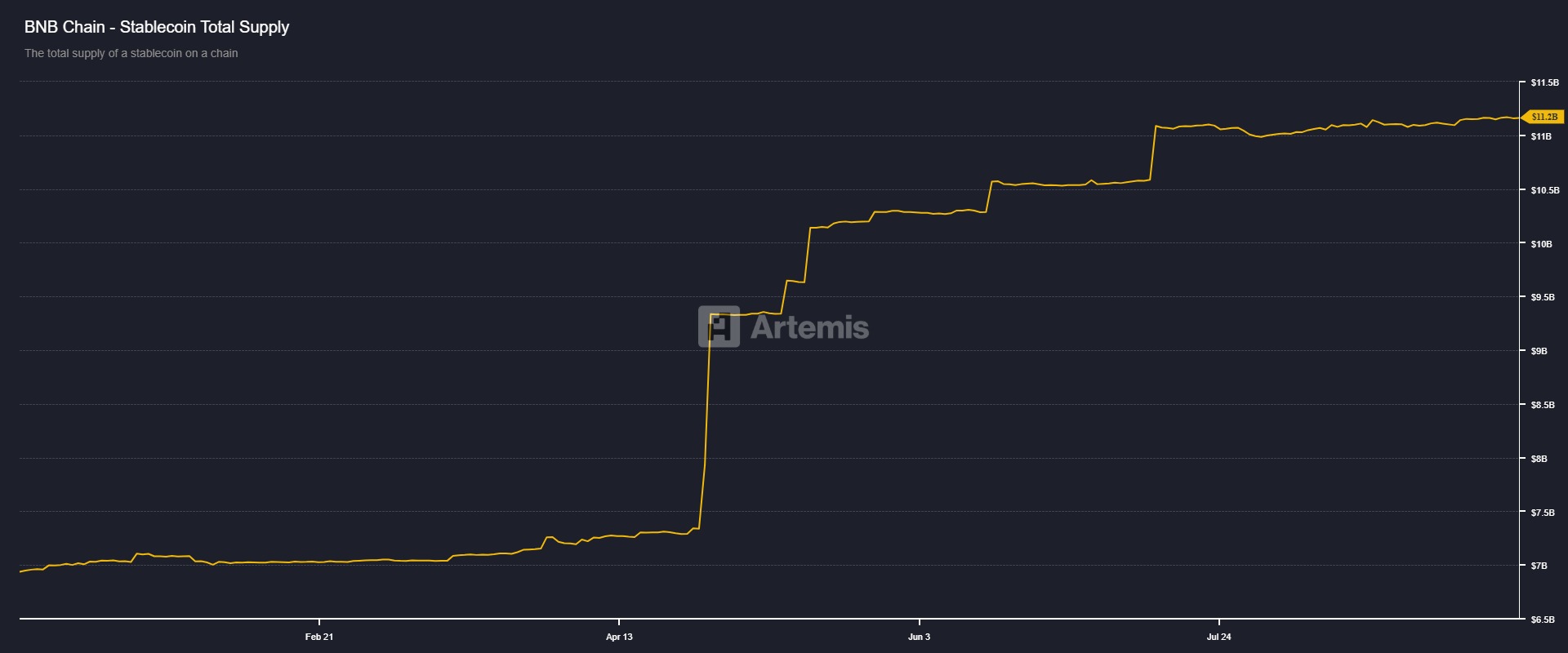

Apart from rising TVL, Artemis terminal data show that BNB’s stablecoin total supply has risen since mid-July and currently stands at $11.2 billion. Such stablecoin activity and value increase on the BNB project indicate a bullish outlook, as they boost network usage and can attract more users to the ecosystem.

BNB stablecoin total supply chart. Source: Artemis

On the derivatives front, BNB’s futures’ Open Interest (OI) at exchanges stands at $1.66 billion on Tuesday, nearing its record highs. Rising OI represents new or additional money entering the market and new buying, which could fuel the current BNB price rally.

BNB open interest chart. Source: Coinglass

BNB Price Forecast: Will BNB hit $1,000 mark?

BNB price reached a new all-time high of $944.95 on Sunday, but failed to maintain the gains and declined slightly to start the week. At the time of writing on Tuesday, BNB recovers slightly, trading above $929.

If BNB continues its recovery and closes above its record high of $944.45, it could extend its gains toward its psychological level of $1,000.

The Relative Strength Index (RSI) on the daily chart reads 66, pointing upward and well below overbought conditions, indicating bullish momentum. Additionally, the Moving Average Convergence Divergence (MACD) showed a bullish crossover last week, which remains in effect, supporting the bullish thesis.

BNB/USDT daily chart

However, if BNB faces a correction, it could extend the decline toward its key psychological support at $900.