Dogecoin in Freefall: DOGE Extends Losses as Open Interest & Funding Rates Nosedive

Dogecoin's slump worsens as traders flee—open interest and funding rates tank. The memecoin that roared now whimpers.

Blood in the water? DOGE's derivatives market flashes red as leveraged positions unwind. Retail's favorite joke asset isn't laughing anymore.

When the funding rate flips negative, even the diamond hands sweat. Another reminder that in crypto, 'to the moon' often ends with 'crash landing.'

Dogecoin faces surging liquidations as open interest and funding rates shrink

Interest in Dogecoin remains shaky on the first day of August, reflecting the risk-off sentiment in the broader cryptocurrency market. CoinGlass data highlights a significant decline in DOGE futures Open Interest (OI), by 36% to $3.42 billion, compared to its July peak of $5.35 billion.

Should the OI decline persist, speculative demand for Doge may continue shrinking, hitting its price.

Dogecoin Futures Open Interest | Source: CoinGlass

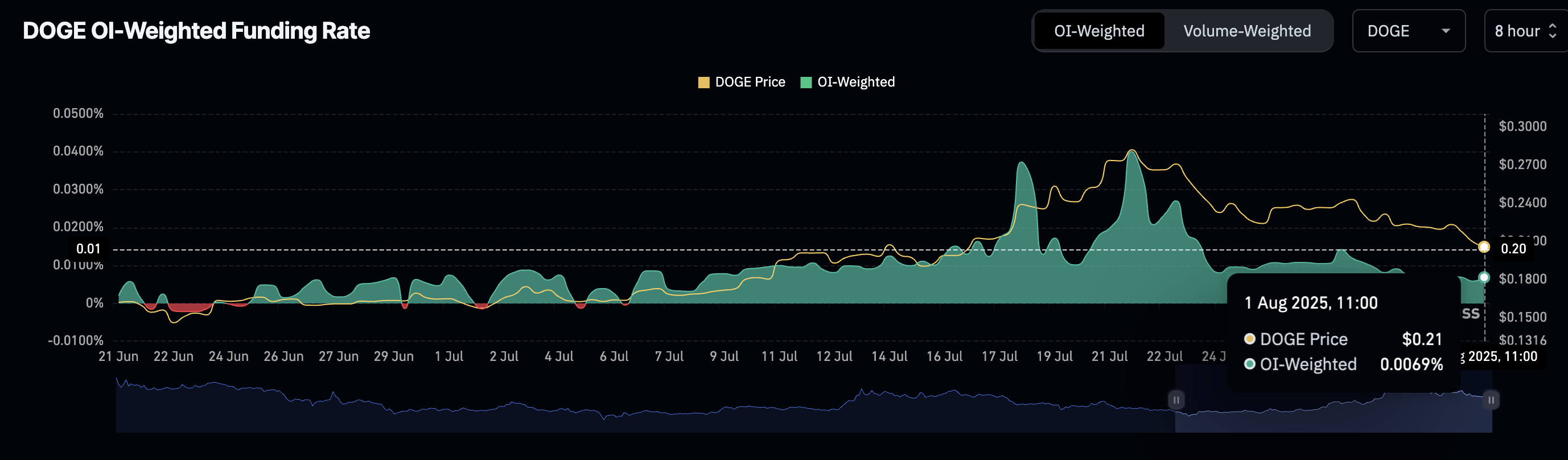

Dogecoin’s bullish outlook could also remain on the back foot as the futures-weighted funding rate drops. Based on the chart below, this fundamental indicator, which peaked at 0.0401 on July 21, averages around 0.0069, suggesting that fewer traders are leveraging long positions in DOGE and thus expect its price to increase.

Dogecoin futures weighted fund rates |Source: CoinGlass

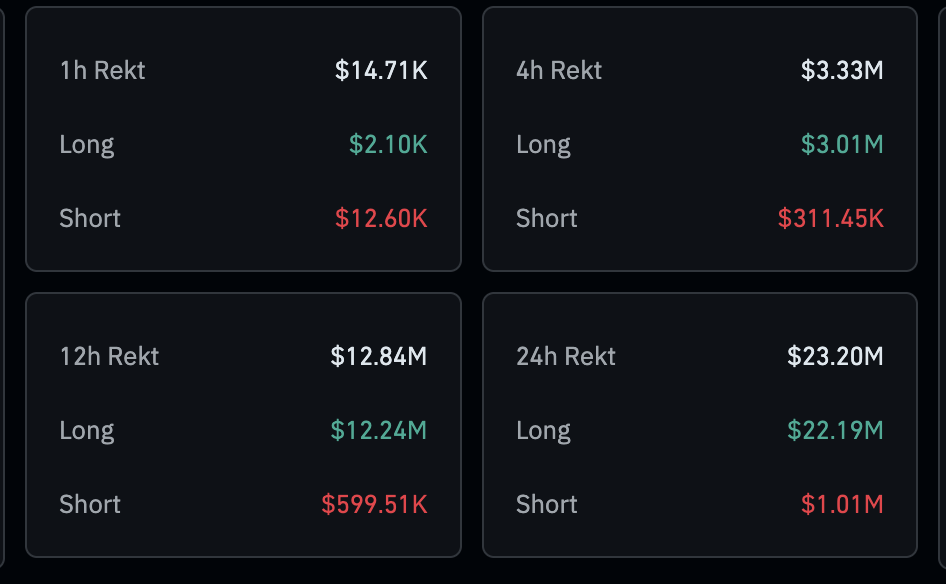

Also notable is the surge in liquidations over the past 24 hours, averaging $23 million. Long position holders were hit hard, accounting for approximately $22 million of the total liquidations compared to around $1 million in shorts.

Dogecoin liquidation stats |Source: CoinGlass

Technical outlook: Can Dogecoin defend key support?

Dogecoin upholds a strong bearish outlook after extending the decline from its July 21 peak of $0.2875. The downward-trending Relative Strength Index (RSI) on the daily chart, which currently stands below the midline, reinforces the bearish grip.

Investors will likely continue de-risking, with some taking profits in upcoming sessions, especially given the sell signal maintained by the Moving Average Convergence Divergence (MACD) indicator since Sunday.

Key levels of interest for traders are the 100-day Exponential Moving Average (EMA) at $0.2028, which helped stabilize the price on Friday. In the event that bears sell aggressively, the next key level to monitor lies at $0.1888, which had been tested as support on July 16.

DOGE/USDT daily chart

A decline in volume from a weekly peak of $3.12 billion to $841 million points toward seller exhaustion. Hence, upholding support above $0.2000 is key to allow bulls to regroup before the next attempt at recovery.

The confluence formed by the 50-day EMA and the 200-day EMA at around $0.2074 might delay the recovery, but if broken, Dogecoin could accelerate the rebound toward recent highs of $0.2875.

Open Interest, funding rate FAQs

How does Open Interest affect cryptocurrency prices?

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

How does Funding rates affect cryptocurrency prices?

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.