Bitcoin Defies Gravity at $116K: Consolidation Meets Macro Tailwinds in 2025’s Bull Run

Bitcoin's price action just wrote another chapter in its volatility playbook—holding firm at $116,000 while traditional markets sweat over yield curves. Here's why crypto's flagship asset isn't budging.

The Consolidation Game

No parabolic spikes, no panic sells—just a coiled spring absorbing liquidity as institutional FOMO meets miner HODLing. The $116K support level has become crypto's new Mason-Dixon line.

Policy Winds at Its Back

While legacy finance debates rate cuts, Bitcoin's mining hash rate hits another ATH—because nothing says 'monetary policy hedge' like proof-of-work rigs humming from Texas to Kazakhstan. The Fed's balance sheet? Still ballooning. The SEC's ETF delays? Priceless comedy material.

This isn't consolidation—it's a stalemate between paper hands and diamond-handed whales. And if history rhymes, the next move upwards will leave Wall Street's 'risk-adjusted returns' looking medieval.

Trump avoids trade escalation but markets react cautiously

U.S. President Donald TRUMP and European Commission President Ursula von der Leyen on July 27 revealed a trade agreement setting a 15 percent tariff on most EU imports, less than 30 percent threatened previously. In exchange, the EU committed to purchasing $750 billion of American energy and spending $600 billion over three years.

Although the deal has worked to ease trade tensions, both the S&P 500 and Bitcoin have both now come back on the negative side after the news. Risk assets are beginning to rebound from bearish price action seen on Monday, however today we are obviously seeing strength in the U.S. dollar, trading to levels not seen since late June.

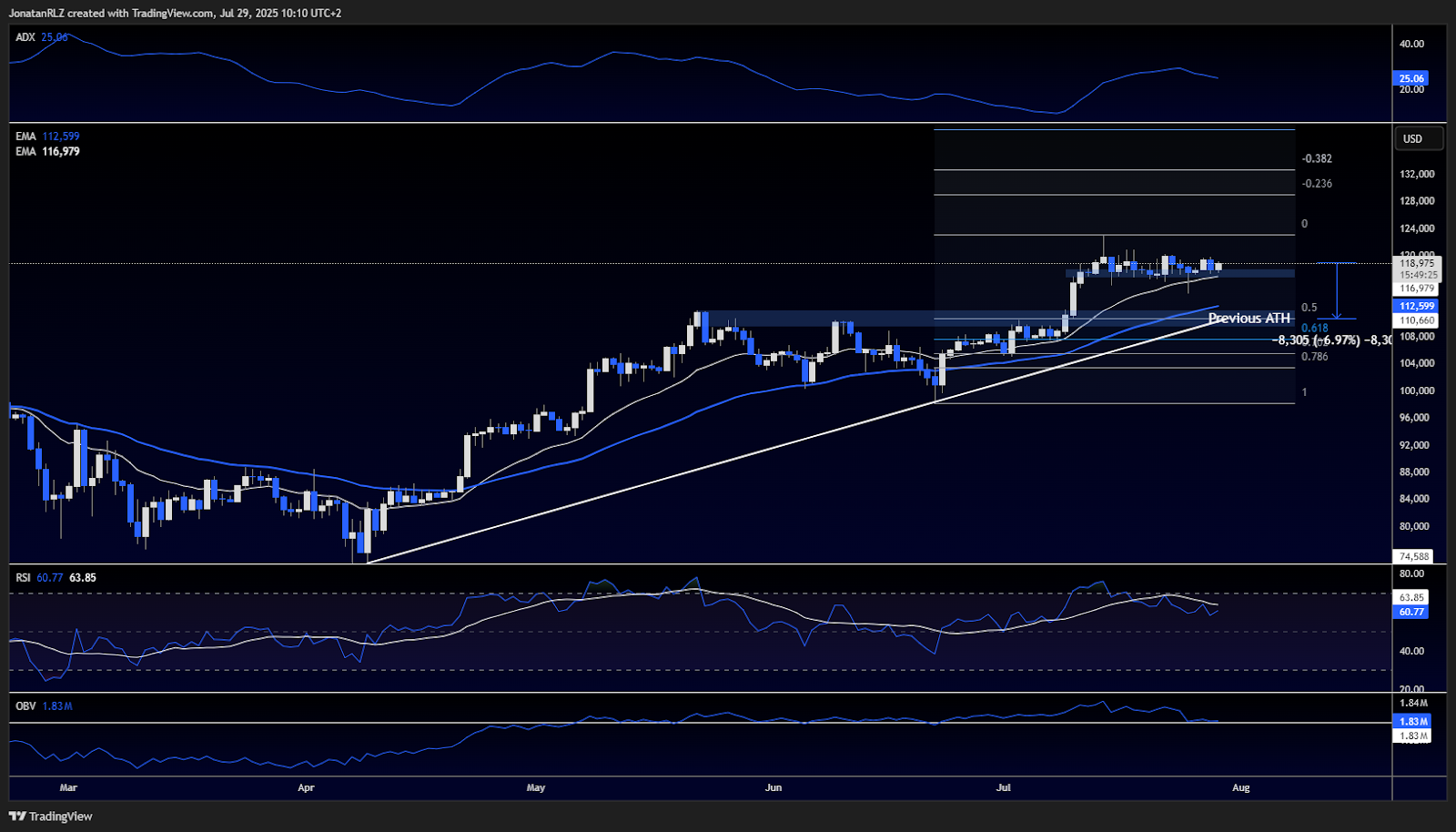

Bitcoin is still in bullish structure as main support holds

Bitcoin continues to consolidate above 116,000 following its break into new all-time highs earlier this month. Despite a minor sell-off on Monday, the daily chart remains bullish in nature with the price remaining above the accelerating 20-day EMA and supported by the 50-day EMA below.

RSI has retreated from the overbought position and now stands at about 60, while OBV is testing an important support level. A close below on OBV or below the 116,000 range support could open for a further plunge to 110,000 to 112,000, a long-term support area that includes the 50% Fib and a long-term ascending trendline.

The ADX remains NEAR 25 but sloping down.This indicates a still-healthy trend with slowing momentum.

Regulatory clarity brings new hope to crypto markets

Congress delivered historic crypto legislation earlier in July in what lawmakers dubbed "Crypto Week." The House passed the GENIUS Act on July 17, legislation that sets federal standards for payment stablecoin issuers. such as requiring dollar-backed reserves and full disclosures, on July 18 President Trump signed it into law. Along with it, on the same day, the CLARITY Act to divide up regulatory authority between the SEC and the CFTC, and the Anti‑CBDC Surveillance State Act, which bans the Fed from creating a retail digital currency, passed the House.

Before the latter two are approved by the Senate, passage and imminent enactment of the GENIUS Act provided electronic assets with a sudden boost, bringing much-needed legal certainty and opening up assets like bitcoin to institutions.

Trade policy remains a key driver of crypto market sentiment

While the EU-US trade deal has temporarily eased short-term geopolitical concerns, uncertainty regarding potential tariffs and protectionism remains. Such policies WOULD threaten global growth and stress risk appetite and therefore send mixed messages to assets like Bitcoin. As markets take in cooperation as well as conflict on the policy front, Bitcoin remains caught between macro relief and structural headwinds.

Start trading with PrimeXBT