Litecoin Price Forecast 2025: Will LTC Shatter Resistance and Skyrocket?

- LTC Technical Analysis: Bullish Signals Emerging

- Altcoin Season Brewing as LTC Gains Institutional Attention

- Key Factors Influencing LTC's 2025 Price Trajectory

- Litecoin Investment Outlook: Metrics to Watch

- Litecoin Price Prediction Q&A

Litecoin (LTC) is showing bullish technical signals as we approach mid-2025, with price holding above key moving averages and institutional interest growing. Our analysis examines whether the "digital silver" is poised for a major breakout, combining technical indicators, market trends, and fundamental developments that could propel LTC to new heights.

LTC Technical Analysis: Bullish Signals Emerging

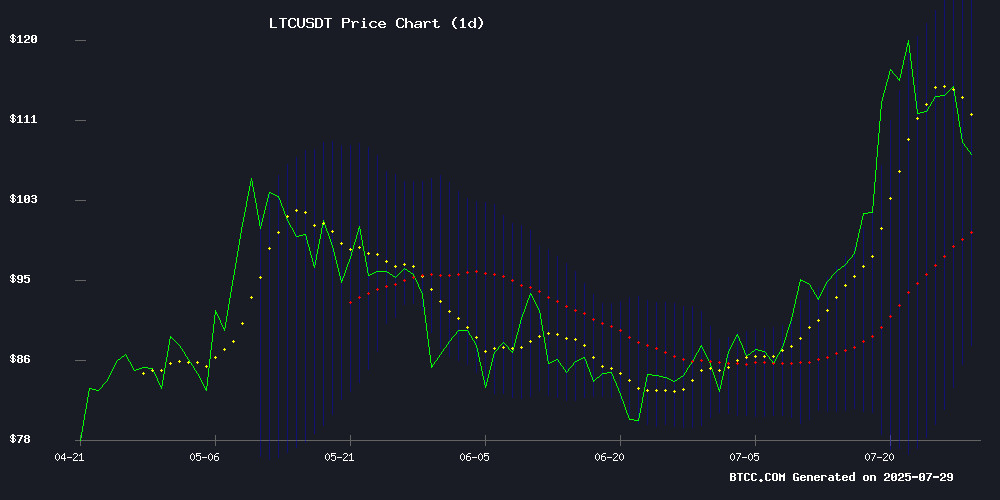

As of July 29, 2025, Litecoin trades at $108.59, comfortably above its 20-day moving average of $105.93 - a positive sign for short-term momentum. The MACD histogram, while still negative at -0.64, shows decreasing bearish pressure. Bollinger Bands indicate moderate volatility with prices hovering near the middle band.

The BTCC research team notes, "LTC's ability to maintain position above the 20-MA while MACD shows convergence suggests accumulation before potential upward movement. The $110 level remains key resistance to watch."

Altcoin Season Brewing as LTC Gains Institutional Attention

Recent developments have put Litecoin back in the spotlight. PayPal's expanded crypto support now includes LTC among its 100+ supported assets, while institutional reports increasingly mention Litecoin in 2025 "breakout" predictions.

Market data from TradingView shows altcoins gaining traction, with ethereum products attracting $1.59 billion last week alone. While Bitcoin saw outflows, altcoins like Solana and XRP posted strong inflows, suggesting potential rotation into alternative cryptocurrencies.

Key Factors Influencing LTC's 2025 Price Trajectory

Payment Integration Momentum

PayPal's recent expansion of its 'Pay with Crypto' service represents a significant milestone. The integration with major wallets like MetaMask and Binance (along with BTCC) creates new utility for Litecoin in commerce. PayPal claims transaction fees could be reduced by up to 90% compared to traditional cross-border payments.

Institutional Portfolio Rebalancing

CoinMarketCap data reveals shifting institutional preferences. While Ethereum dominates inflows, selective appetite for altcoins is creating opportunities. Litecoin's established history and recent technical improvements position it favorably for institutional consideration.

Market Cycle Positioning

Historical patterns suggest Litecoin often performs well during altcoin seasons. The current market structure, with bitcoin dominance showing signs of weakening, could create favorable conditions for LTC outperformance.

Litecoin Investment Outlook: Metrics to Watch

| Metric | Value | Implication |

|---|---|---|

| Price vs 20-MA | $108.59 > $105.93 | Bullish near-term bias |

| MACD Trend | Converging | Bearish momentum fading |

| Bollinger Position | Middle band | Neutral volatility |

| Key Resistance | $110 | Breakout potential |

This article does not constitute investment advice. cryptocurrency investments carry substantial risk.

Litecoin Price Prediction Q&A

What are the key technical levels for LTC?

Currently, $110 acts as immediate resistance, while $105 serves as support. A sustained break above $110 could open path to $120, while holding $105 maintains bullish structure.

How does Litecoin compare to other altcoins for 2025?

While newer projects like BlockDAG attract attention, Litecoin's established network and growing payment integration give it unique advantages. It combines relative stability with breakout potential.

What could trigger a major LTC price movement?

Key catalysts include: 1) Break above $110 with volume, 2) Additional major exchange or payment integrations, 3) Institutional allocation increases, and 4) Bitcoin dominance continuing to decline.