Pi Network Price Surge Ahead? Whale Gobbles Up 1.40 Million PI Tokens in Bold Dip Buy

A mystery wallet just placed a massive bet on Pi Network's future—snagging 1.40 million PI tokens while prices languish. Is this the smart money moving in, or another crypto gambler doubling down?

Whale alert: The PI scoop-up

While retail traders panic-sell, some deep-pocketed player sees blood in the water. The 1.4M PI purchase screams conviction—or reckless speculation. In crypto, the line between genius and madness vanishes faster than a memecoin rally.

Timing the bottom—or catching falling knives?

This whale's move comes as PI struggles to find footing. Either they've spotted undervalued gold... or they're about to learn why 'buy the dip' only works until the dip keeps dipping. Remember kids: in markets, 'early' and 'wrong' look identical until hindsight kicks in.

Wall Street's old 'be greedy when others are fearful' playbook meets crypto volatility. Let's see if this whale gets the payoff—or becomes another cautionary tale for the next bull run's 'how I lost everything' Reddit post.

Large investor extends the PI tokens buying spree for a week

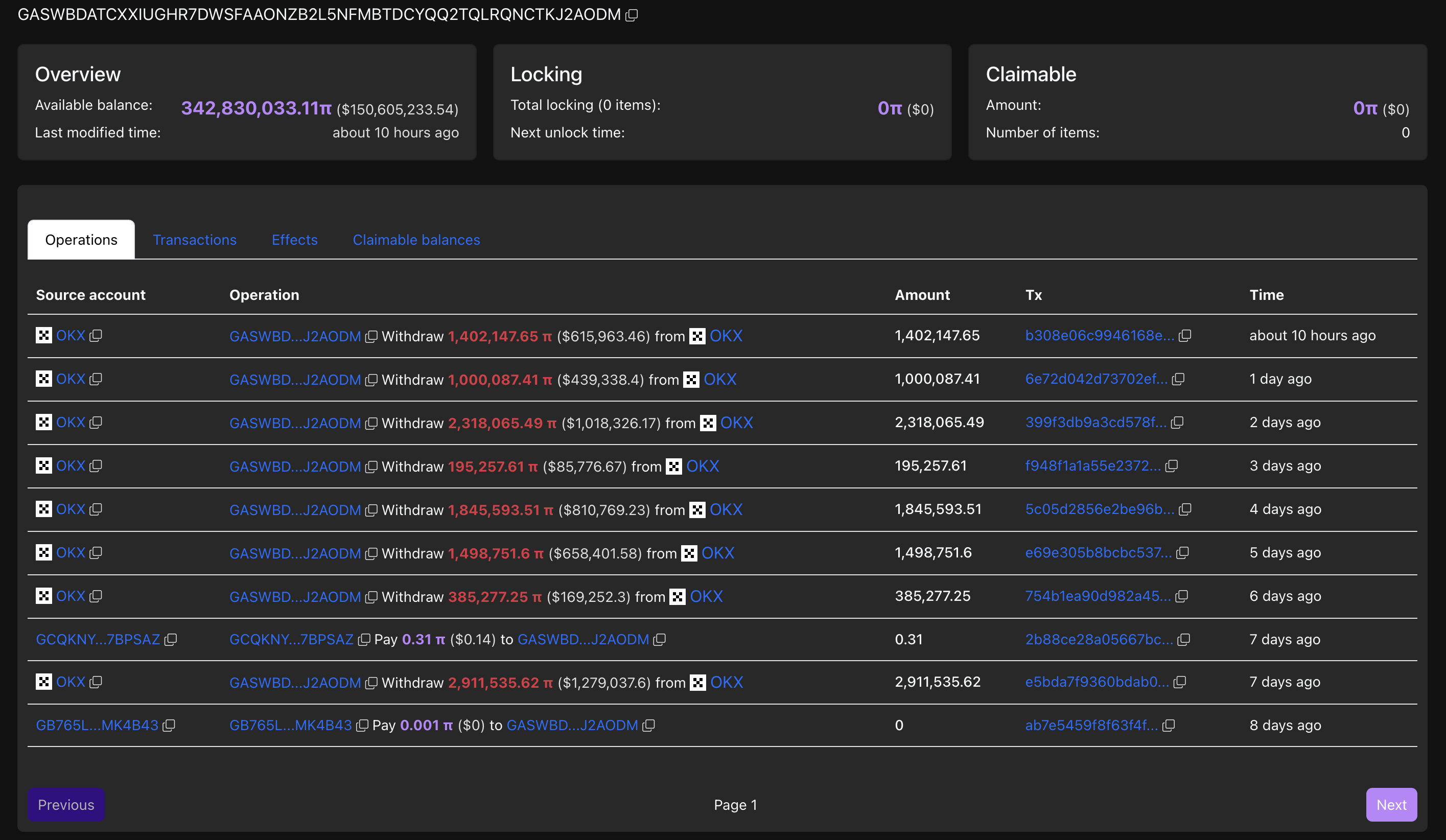

PiScan data indicates that the “GASWBD...J2AODM” wallet, potentially associated with a large investor, has added over 1.4 million PI tokens from the OKX exchange. The purchase marks the biggest transaction on the network in the last 24 hours.

Wallet transactions. Source: PiScan

It is worth noting that the large investor has acquired over 11 million PI tokens in the last seven days.

PI risks losing the $0.43 support level as buying pressure declines

PI fails to uphold the bullish momentum spark on Monday as overhead selling pressure at the 100-day Exponential Moving Average (EMA) results in the $0.43 support level retest. The support level has remained intact since July 15, avoiding a candlestick close below this level on the 4-hour chart.

If PI falls below this level, it could test the $0.42 level, marked by the low of July 15, followed by the $0.40 psychological level.

The Relative Strength Index (RSI) faces downside as it falls to 42 below the midpoint line, suggesting a decrease in buying pressure.

The Moving Average Convergence Divergence (MACD) is on the verge of closing below the signal line, which WOULD flash a trend reversal and a sell signal.

PI/USDT daily price chart.

On the other hand, a reversal above the 200-day EMA could reestablish a bullish trend, targeting the $0.50 psychological level.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.