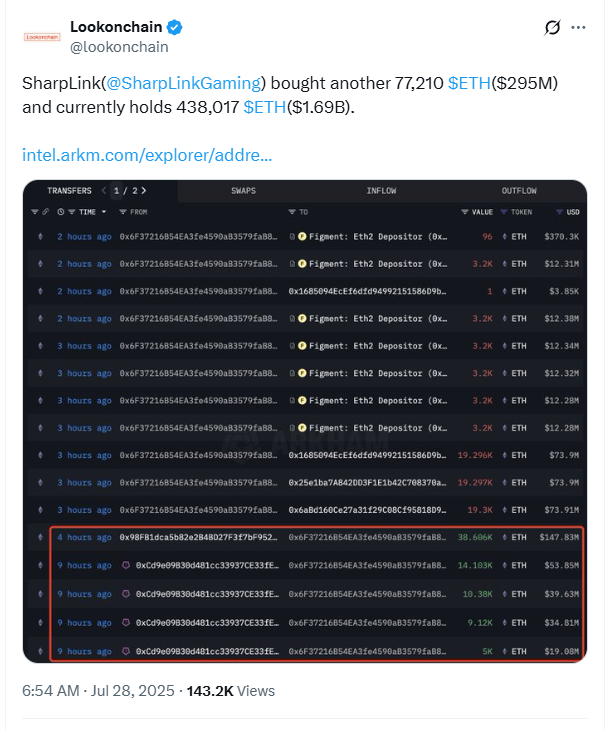

SharpLink’s $295M ETH Splurge Outpaces Entire Ether Issuance for June 2025

Wall Street's latest crypto play just flipped Ethereum's economics on its head. SharpLink dropped a cool $295 million on ETH—more than the network minted all last month. Talk about bending the rules of digital scarcity.

Who needs block rewards when you've got VC money?

The move signals institutional players are still hungry for ETH despite recent market turbulence. While retail traders panic-sell, the big boys are accumulating—proving once again that crypto's 'decentralized' ethos looks different from the penthouse suites.

Funny how Ethereum's 'ultrasound money' narrative gets tested the moment someone writes a check bigger than the protocol's own issuance. Maybe Satoshi should've included a 'rich people exception' clause in the whitepaper.

Source: Lookonchain

SharpLink is the second company to hold more than $1.5 billion worth of ETH in its treasury, with Bitmine Immersion Tech taking the top spot as its ETH holdings exceed $2 billion.

“Banks close on weekends. ethereum runs 24/7,” the firm said in a X post on Sunday.

On July 18, Cointelegraph reported that SharpLink has filed an amended prospectus with the regulators in a bid to increase its stock sale from $1 billion to $6 billion. The majority of the proceeds from the sale will be used to buy ETH.

Talent acquisition spree

On Friday, SharpLink announced that it had hired Joseph Chalom as its new co-CEO.

Chalom had worked for 20 years at BlackRock, the largest asset management firm in the world. At SharpLink, he will be responsible for shaping and executing the company’s global strategy.

In May, the company nominated Consensys CEO Joseph Lubin as its chairman of its board of directors.

Ether supply shock

ETH purchases by corporations and institutional investors via ETFs can create a supply shortage for ETH, which can theoretically push the price.

On Thursday, BitMine Immersion Technologies stated that it held more than 566,000 ETH, worth more than $2 billion at time of publication. Additionally, the firm announced its ambitious plan of holding at least 5% of ETH’s total supply, which amounts to 6 million Ether worth more than $23 billion at the time of writing.

Currently, 6.73% of ETH’s total supply, 8.12 million Ether worth more than $31 billion, is collectively being held by corporations and ETFs combined, according to Strategic ETH Reserve.