BTC/USD Plunges to Two-Week Low—But Why Bears Shouldn’t Celebrate Yet

Bitcoin just nosedived to its lowest level in 14 days—yet the selloff smells more like a trap than a trend. Here’s why the bulls might still have the upper hand.

The Dip That Didn’t Stick

BTC/USD crumbled under pressure this week, testing levels not seen since mid-July. But veteran traders know: crypto never goes down without a fight. The ‘headwinds’ facing bears? A market that’s still up 60% YTD—and a legion of diamond-handed hodlers waiting to buy.

Wall Street’s Favorite Casino

While traditional investors fret over P/E ratios, crypto traders thrive on volatility. Today’s ‘crash’? Just another Tuesday in the most liquid unregulated market on Earth. (Bonus cynicism: at least here, the house always loses.)

The Bottom Line

This isn’t 2018. Institutional money, ETF flows, and that halving clock ticking down to April 2026 suggest one thing: any major BTC dip remains a buying opportunity—until proven otherwise.

BTC/USD

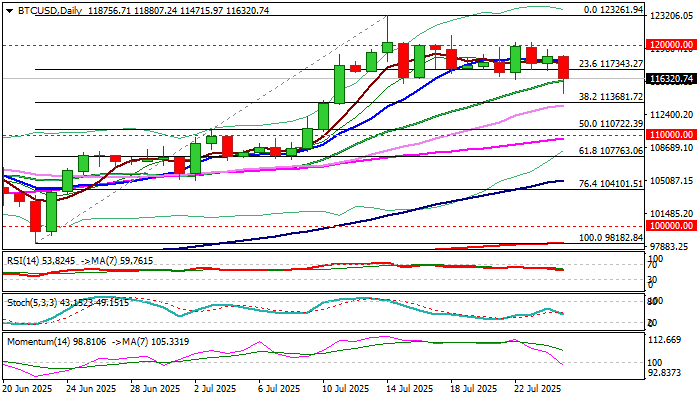

BTCUSD fell to the lowest in two weeks on Friday, on acceleration that resulted in losses of over 3% during Asian / early European session.

Weakened sentiment sparked fresh wave of sales that pushed the price through pivotal supports at 115.7K zone (recent consolidation range floor / 20DMA).

Violation of these supports generates initial bearish signal which will need confirmation on daily close below these levels and expose next trigger at 116.7K zone (Fibo 38.2% of 98182/123261 upleg), loss of which to signal reversal.

Weakening daily studies (14-d momentum is entering negative territory) could contribute to this scenario.

On the other hand, current strong bounce from new low warns of potential false break lower (today’s close above range floor needed to confirm) WOULD keep the price within existing range and sideline immediate downside risk.

117340; 118270; 120000; 121030.

116150; 114710; 113680; 112000.