Crypto Bulls Lose $1B+ Amid Record US M2 Surge & Trump’s Rate Cut Pressure—What’s Next?

Crypto markets just got gored. Bulls bled over $1 billion this week as two tectonic forces collided: a record-high US money supply (M2) and former President Trump’s latest push for aggressive rate cuts. Here’s the damage.

M2 On Steroids

The Fed’s money printer isn’t just humming—it’s screaming. With M2 supply hitting uncharted territory, inflation hawks are circling. Yet crypto, the supposed inflation hedge, got caught in the crossfire. Irony tastes bitter, doesn’t it?

Trump’s Rate Cut Gambit

Politics meets monetary policy. Trump’s public pressure for deeper cuts sent traditional and crypto markets into a volatility tailspin. Because nothing says 'stable store of value' like a tweet-fueled liquidity frenzy.

Blood On The Blockchain

Leveraged longs got liquidated. Altcoins bled out. Even Bitcoin couldn’t escape the carnage. But let’s be real—when hasn’t crypto turned a macroeconomic tremor into a full-blown earthquake?

Silver Lining Playbook

History says crypto bulls lick their wounds—then come back hungrier. With the money supply ballooning and rate cuts looming, the next pump might already be loading. Just maybe keep some bandages handy.

Crypto market’s recent hiccup shakes out $1 billion in bullish positions

The total cryptocurrency market capitalization is down nearly 2% to $3.75 trillion at press time on Friday, printing its third consecutive day of losses. The broader market pullback stalls the highly anticipated altcoin season while increasing the risk of a new local top.

Total crypto market capitalization.

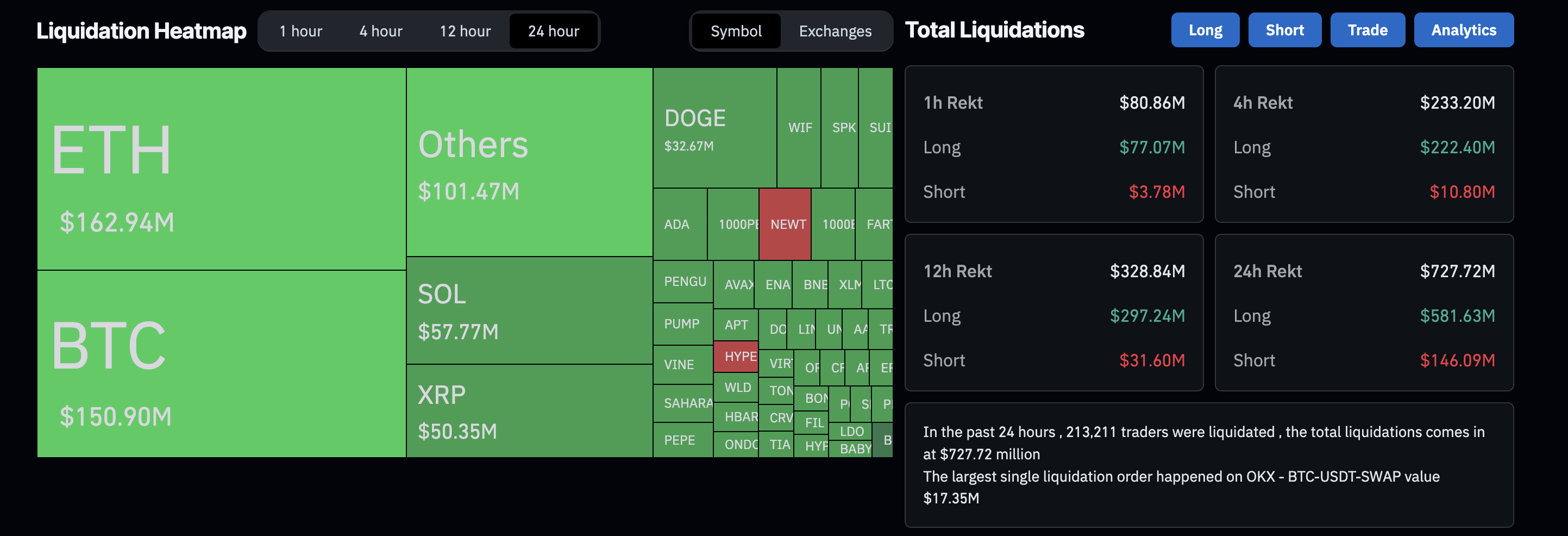

CoinGlass’s data shows that the recent pullback resulted in a total of $727 million in liquidation over the last 24 hours, wiping out the majority of bullish positions as evidenced by long liquidations of $581 million outpacing short liquidations worth $146 million.

Liquidations heatmap. Source: Coinglass

Interestingly, amid the three days of losses, bullish positions worth $1.23 billion have been liquidated compared to nearly $280 million in bearish positions, indicating a bull hunt in the market.

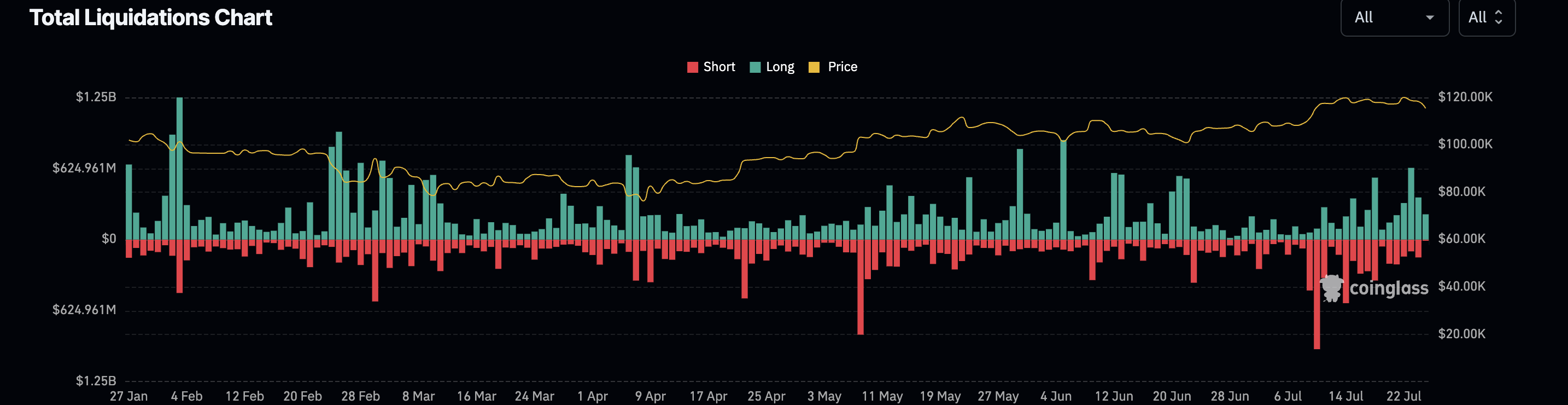

Total liquidations chart. Source: Coinglass

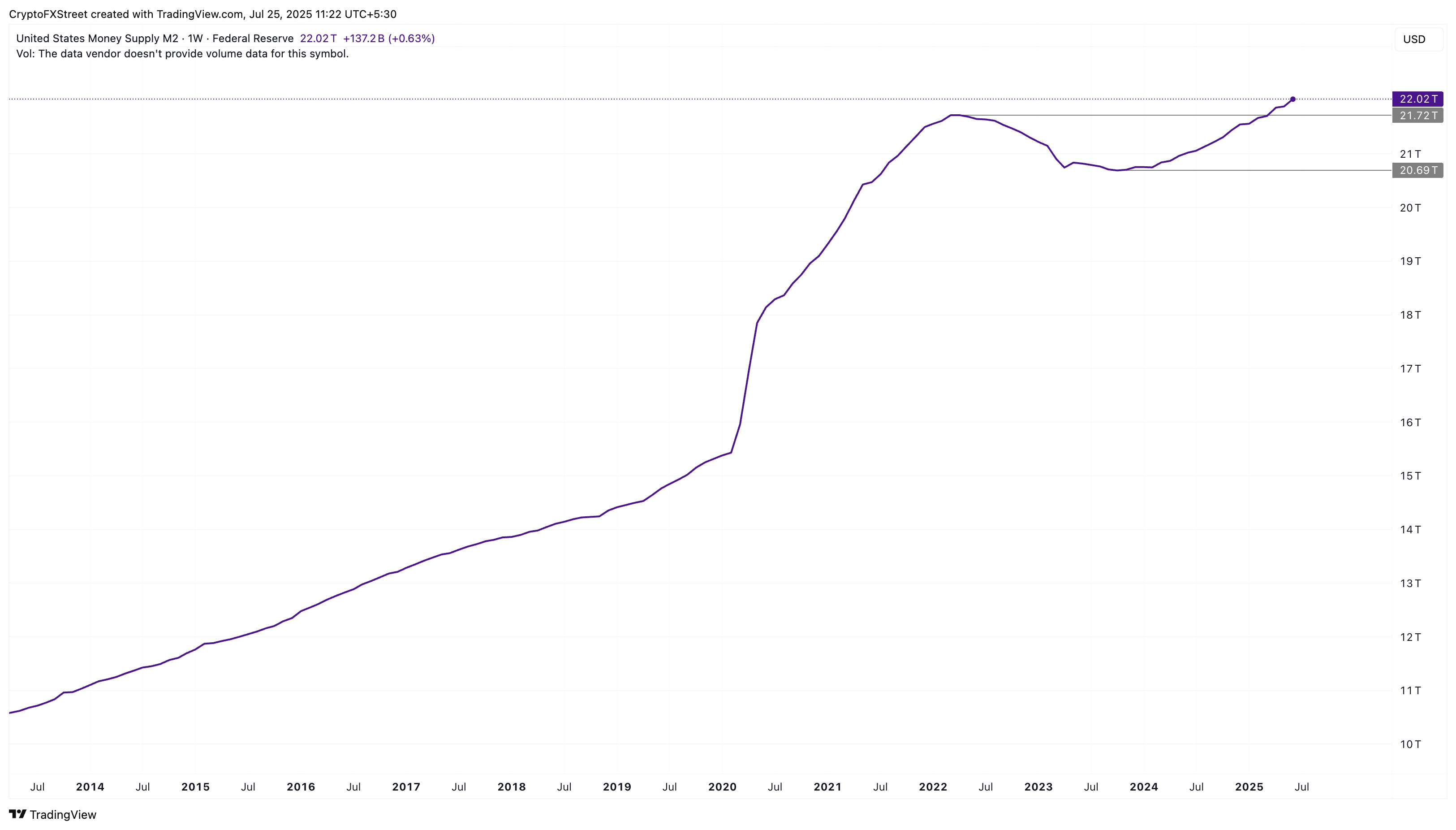

Crypto market could benefit from the record high US M2 Money Supply of over $22 trillion

Since the quantitative tightening cooldown in May 2022, the US M2 money supply, which includes cash, savings and other liquid assets, stood at an all-time high of $22.02 trillion as of press time on Friday. However, inflation remains at 2.7%, above the Federal target of under 2%.

US M2 money supply chart.

Typically, an increase in the M2 money supply suggests increased liquidity in the market, which could boost demand for speculative risk assets, such as Bitcoin (BTC). However, rising supply risks erode the US Dollar's purchasing power due to heightened inflation.

Amid increasing liquidity, inflation and the US Dollar risking its global dominance, a shift to alternatives seems the way forward. Multiple investment institutions and corporations are down this path, building bitcoin reserves and backing the idea of BTC as a “digital gold.”

Trump remains vocal on Powell and interest rate cuts

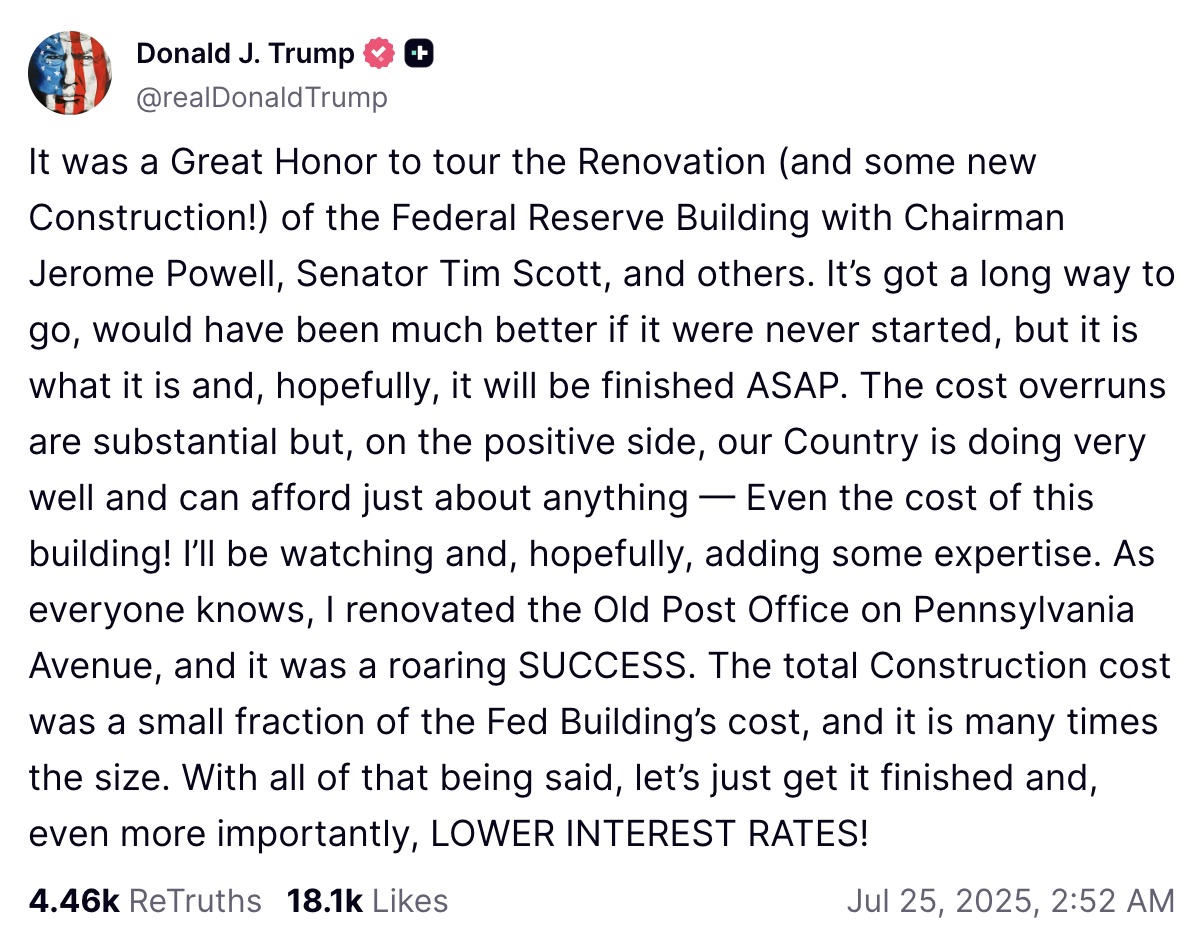

US President Donald TRUMP visited the Federal Reserve Building on Thursday to inspect renovations and new additions in the presence of Chairman Jerome Powell, Senator Tim Scott, and others. Trump highlighted the substantial cost overruns but remained optimistic, sharing, “Our country is doing very well and can afford just about anything.”

Apart from the renovations, Trump advocates the need to “LOWER INTEREST RATES!” while the Federal Open Market Committee (FOMC) points to two interest rate cuts coming later in 2025 for a total of 50 basis points.

Donald Trump's post. Source: Truth Social.

Typically, a rate cut boosts the inflow of speculative, risky assets, as investors have access to liquidity at lower rates, which could increase the crypto market valuation.