🚀 Bitcoin & Ethereum Surge: Asian Market Wrap Reveals Altcoin Opportunities – July 25, 2025

Crypto markets flex bullish momentum as Bitcoin and Ethereum lead the charge—altcoins ride the wave.

### Bitcoin Breaks Resistance

BTC smashes through key levels, leaving skeptics scrambling. Institutional inflows? Check. Retail FOMO? Building.

### Ethereum’s Smart Money Play

ETH’s upgrade-driven rally isn’t just tech—it’s a liquidity magnet. DeFi whales are stacking, not flipping.

### Altcoin Gems (or Landmines?)

From Solana’s speed narrative to BNB’s exchange dominance, traders chase alpha—while regulators draft ‘I-told-you-so’ memos.

Closer:

The market’s green, but remember: Wall Street still calls it ‘speculative’—right before quietly allocating 5% to crypto ETFs.

Top 3 Price Prediction: Bitcoin, Ethereum, Ripple – BTC, ETH, and XRP could correct further on fading bullish momentum

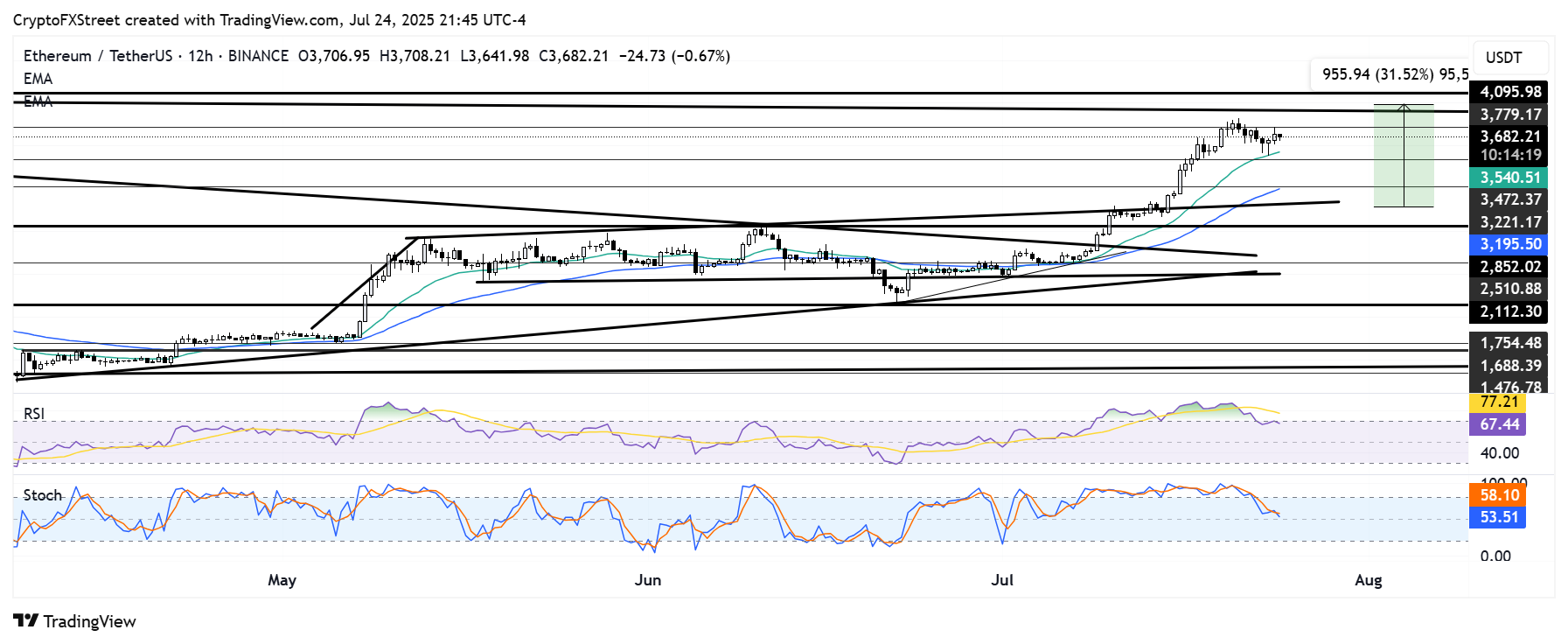

Bitcoin (BTC) price continues to trade within a tight consolidation range on Friday, suggesting a pause in bullish momentum. Meanwhile, ethereum (ETH) and Ripple (XRP) have slid nearly 3% and 10%, respectively, so far this week. Traders should be cautious as the momentum indicators of these cryptocurrencies show signs of fading bullish momentum.

Ethereum Price Forecast: BitMine holdings cross 560K ETH as ETHA hit $10 billion inflows on 1st anniversary

Ethereum (ETH) moved toward the $3,780 resistance on Thursday after crypto treasury company BitMine (BMNR) announced that it had grown its holdings to more than 560,000 ETH over the past week. Meanwhile, BlackRock iShares Ethereum Trust (ETHA) hit the $10 billion mark, becoming the third fastest ETF in history to reach the milestone.

Altcoin season stalls: PUMP, FARTCOIN, PENGU post double-digit losses as bullish momentum fades

Altcoin season stalls as Bitcoin (BTC) drops below $118,000, catalyzing a broader cryptocurrency market pullback. Pump.fun (PUMP), Fartcoin (FARTCOIN), and Pudgy Penguins (PENGU) lead the decline with double-digit losses over the last 24 hours, risking further losses as bullish momentum wanes.