Quantum AI Goes Big: Japanese Firm Snaps Up 3,000 BTC as US-Japan Trade Deal Sparks Treasury Yield Surge

Tokyo-based AI firm Quantum just made a power play—dropping a nine-figure bet on Bitcoin as global markets reel from shifting US-Japan trade dynamics.

The 3,000 BTC purchase lands right as Treasury yields climb, proving once again that crypto remains the ultimate hedge against traditional finance's mood swings. Because nothing says 'stable store of value' like algorithmic trading firms hoarding digital gold, right?

While Wall Street frets over basis points, the tech sector's diving headfirst into decentralized assets. Quantum's move signals what every crypto-native already knows: when nation-states flip-flop on trade policy, smart money flows to the blockchain.

One question remains—will this trigger a domino effect of corporate BTC accumulation, or is Quantum just front-running the inevitable CBDC chaos? Either way, the institutional FOMO meter just hit a new high.

Quantum Solutions enters Bitcoin’s land grab race

In a press release on Wednesday, Quantum Solutions joined the growing number of Japanese corporations in the race to acquire Bitcoin. The company aims to raise $10 million to purchase the initial phase of acquiring BTC, with the ultimate goal of reaching 3,000 BTC, valued at over $356 million, within the next 12 months.

Furthermore, the company stated, “amid ongoing yen depreciation and increasing international financial uncertainty, investment and holding of bitcoin are gaining importance.”

In addition to Quantum, several other Japanese companies are in the race, including Metaplanet, which holds 16,352 BTC as of July 24. Remix Points holds 1,051 BTC, while ANAP holdings and Machouse plan to build a 1,000 BTC reserve.

Japan’s rising financial uncertainty and the US trade deal

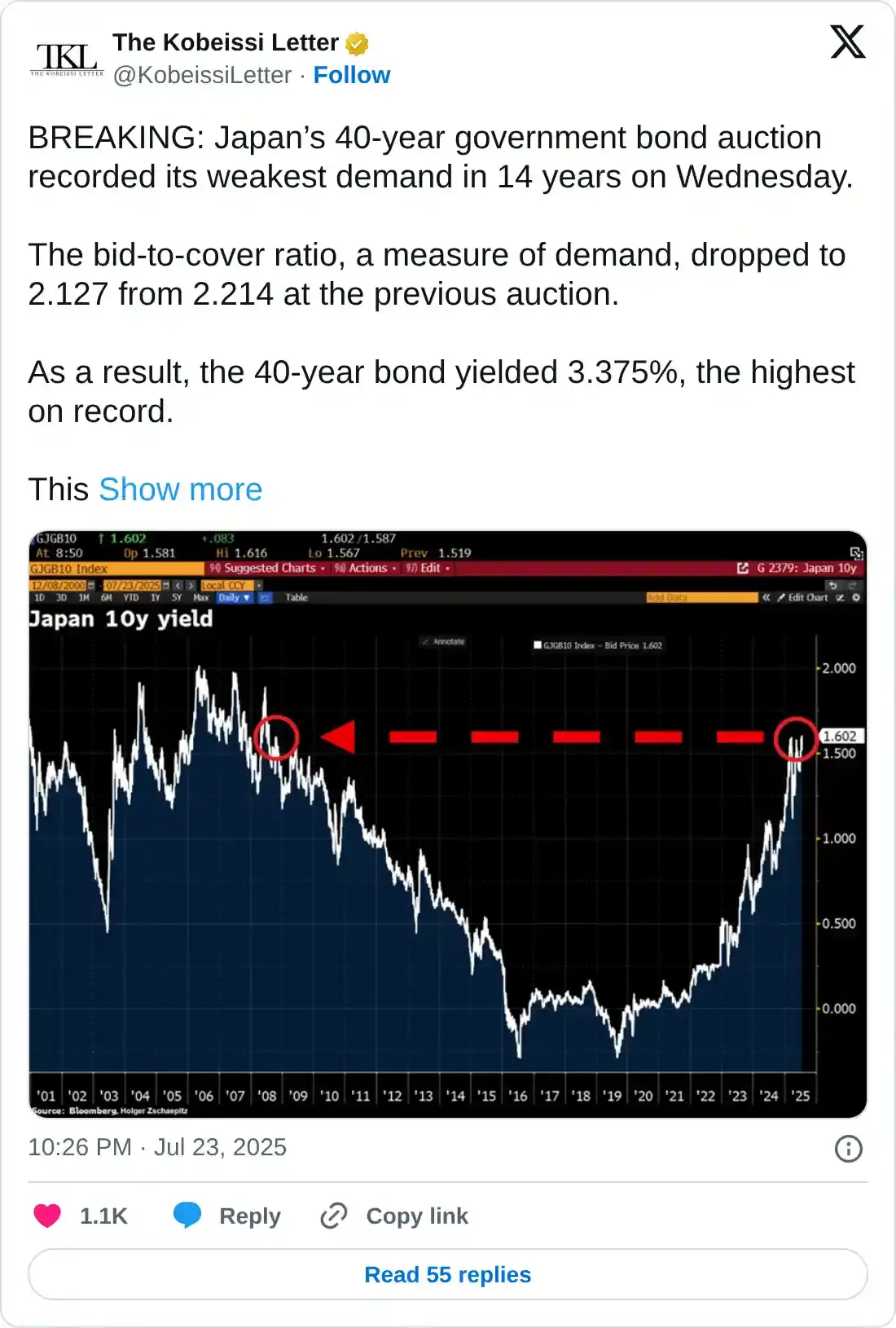

The shift in corporate sentiment toward Bitcoin aligns with the declining financial security in Japan, as reflected in its crashing Bond market. Japan’s 40-year government Bond yield reached a record high of 3.375% on Wednesday.

The bid-to-cover ratio dropped to 2.127 on Wednesday from 2.214, the lowest in 14 years, suggesting lower liquidity and risk-off sentiment among traders.

A comparatively short-term 10-year bond has reached a record high yield of 1.6% last seen during the 2008 financial crisis.

Amid such conditions, Japan has agreed to a new trade deal with the US, a shift powered by US President Donald Trump. The new deal puts a 15% "reciprocal tariff” on Japanese goods sold or businesses operating in the US, a $550 billion investment package in the US, and a 90% profit share from investments in the US.