Ether Stumbles: ETH Validator Exit Queue Hits 18-Month High—What’s Next for the Network?

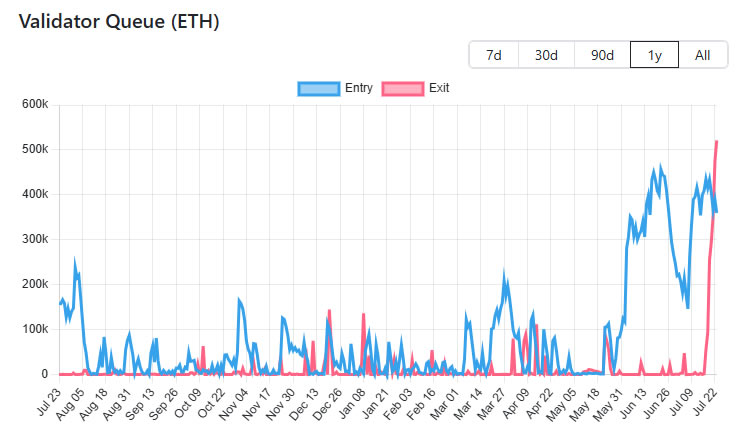

Ethereum's validator exodus hits a wall—18 months' worth of pent-up exits are clogging the chain. The queue hasn't been this backed up since the Shanghai upgrade frenzy. Is this a blip or the start of a staking crisis?

Behind the backlog: Validators trying to unstake ETH face their longest wait since early 2024. The exit queue—capped at 1,800 validators per day—is buckling under demand. Meanwhile, the activation queue sits near zero, creating a lopsided pressure valve.

Market jitters meet protocol mechanics. Some see this as profit-taking after ETH's 90% rally from January lows. Others whisper about institutional players testing exit liquidity before the next big move. Either way, the staking yield just got 18% less attractive—if you can even get out.

Closing thought: Nothing unites crypto like a good old-fashioned bottleneck—where 'decentralized' meets 'please hold, your transaction is important to us.'

Ethereum validator exit queue surges. Source: ValidatorQueue

Profit taking or repositioning?

Despite the apparent exodus, there is also 390,000 ETH worth around $1.2 billion in the entry queue, meaning that the net amount being unstaked is only around 255,000 ETH.

Additionally, the entry queue has significantly increased since early June, when Ether treasury companies such as SharpLink and Bitmine started aggressively accumulating the asset. The majority of corporate strategy firms have said they will stake ETH for additional yields.

The number of active validators is also at an all-time high of just below 1.1 million, as is the amount staked, which is around 35.7 million ETH, or almost 30% of the total supply, worth around $130 billion.

Ether price dips from 2025 high

The asset has retreated around 7% from its seven-month high of $3,844, which it hit on Monday, dipping below $3,550 during late trading on Wednesday as traders lock in profits.

ETH prices had recovered marginally to $3,643 at the time of writing and remain up more than 50% over the past month.

There has also been a huge demand from US spot Ether ETFs, which have seen more than $2.5 billion in inflows over the past six trading days, and that is without a staking ETF being approved.

“We have seen $8 billion in net inflows through DeFi bridges into ethereum mainnet over the last three months and a sizeable increase in Ethereum ETF inflows, despite BTC ETF seeing outflows,” Apollo Capital’s chief investment officer, Henrik Andersson, told Cointelegraph.

“This demonstrates interest from onchain natives and institutions,” he added.

Lido liquid staking token briefly depegs

Tron founder Justin Sun also recently removed around $600 million worth of ETH from the Aave DeFi lending platform, causing a brief depeg in stETH (STETH $3,555.85), Lido’s liquid staking token, and a sharp drop in liquidity on Aave.

This may have added to the exit queue as panicked yield farmers attempted to convert stETH back to ETH, or sell it on secondary markets, observed Marcin Kazmierczak, co-founder at RedStone staking platform.