Cardano (ADA) Primed for Breakout: Surging Open Interest & Bullish Bets Fuel Rally

Cardano's ADA isn't just climbing—it's got traders leaning in hard. Open interest spikes while bulls double down, signaling a potential storm brewing in the crypto markets.

Why the frenzy? ADA's defying gravity as institutional money creeps back into altcoins. The smart contract platform's recent upgrades finally seem to be shaking off its 'academic project' reputation.

But let's not pop champagne yet—crypto's favorite game remains 'buy the rumor, sell the news.' And as any jaded trader will tell you: what goes up must come down... unless you're Bitcoin. Maybe.

Bulls up the ante as Cardano Open Interest nears record high

In crypto market derivatives, Open Interest (OI) refers to capital held by active perpetual contracts of an asset. A spike in OI reflects increased interest in a coin among the derivatives traders, leading to heightened capital flow.

CoinGlass’ data shows the ADA OI surge 16.30% over the last 24 hours, reaching $1.44 billion, nearing its all-time high of $1.50 billion set on January 18.

Typically, leverage-driven activity results in sharp fluctuations in the swap price compared to spot market values. To offset the imbalance, bulls pay positive funding rates and vice versa.

At the time of writing, OI-weighted funding rate stands at 0.0219% suggesting increased buying activity among traders.

ADA Derivatives data. Source: Coinglass

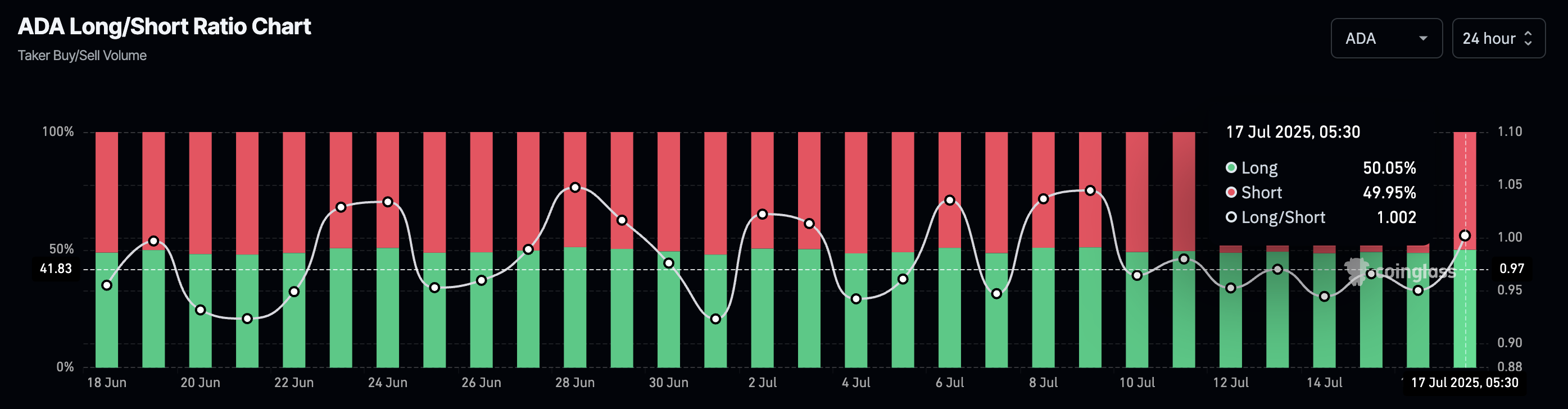

The Taker buy/sell volume indicates that the long position holds 50.02% of the taker volume, up from 48.72% on Wednesday, resulting in a long/short ratio of slightly over 1. An increase in bullish bets is evident, as evidenced by the rising long positions over the last 24 hours.

Taker buy/sell volume. Source: Coinglass

Cardano targets $1 as bullish momentum increases

Cardano appreciates over 7% on the day, surpassing the $0.80 mark. At the time of writing, ADA hits the 50% Fibonacci retracement level at $0.8233, drawn from the December 3 peak of $1.3264 to the April 7 low of $0.5110.

A decisive daily push above this level could stretch the bullish run in cardano to the 61.8% Fibonacci level at $0.9214. If the uptrend sustains momentum, ADA could reclaim the $1 milestone.

The 200-day, 100-day, and 50-day Exponential Moving Averages (EMAs) witness an uptick, increasing the chances of bullish crossovers and a Golden Cross. The dynamic average lines, at $0.6894, $0.6760, and $0.6581, respectively, WOULD act as support levels in the event of a bearish reversal.

The Relative Strength Index (RSI) reads 79 on the daily chart, indicating increased buying momentum and skewing into the overbought zone. Investors must remain cautious as overbought conditions could result in a reversal.

Still, the Moving Average Convergence/Divergence (MACD) indicator displays a positive trend in the MACD and signal lines, which are above the zero line. From the same line, green histogram bars regain strength, suggesting increased bullish momentum.

ADA/USDT daily price chart.

On the downside, a reversal in Cardano from the 50% Fibonacci retracement level at $0.8233 could extend the declining trend toward the 200-day EMA at $0.6894.