Bears Rekt: Bitcoin’s Explosive Rally Liquidates $1B in Shorts – Who’s Laughing Now?

Bitcoin just delivered a brutal uppercut to skeptics—liquidating over $1 billion in bearish bets as its price surged. The crypto market’s latest pump left short sellers scrambling, proving once again that betting against BTC is a high-stakes gamble.

### The Carnage in Charts

Leveraged traders who doubted Bitcoin’s momentum got steamrolled. The rally wasn’t just a nudge—it was a full-blown margin call massacre.

### Wall Street’s ‘Told You So’ Moment

Traditional finance pundits—still nursing their 2017 PTSD—watched in horror as crypto’s ‘irrational exuberance’ paid off… again. Maybe those ‘tulip’ comparisons need a revision.

### What’s Next? More Pain for Bears

With momentum like this, anyone shorting Bitcoin might as well be fighting gravity. The only thing dropping faster than their positions? Their excuses.

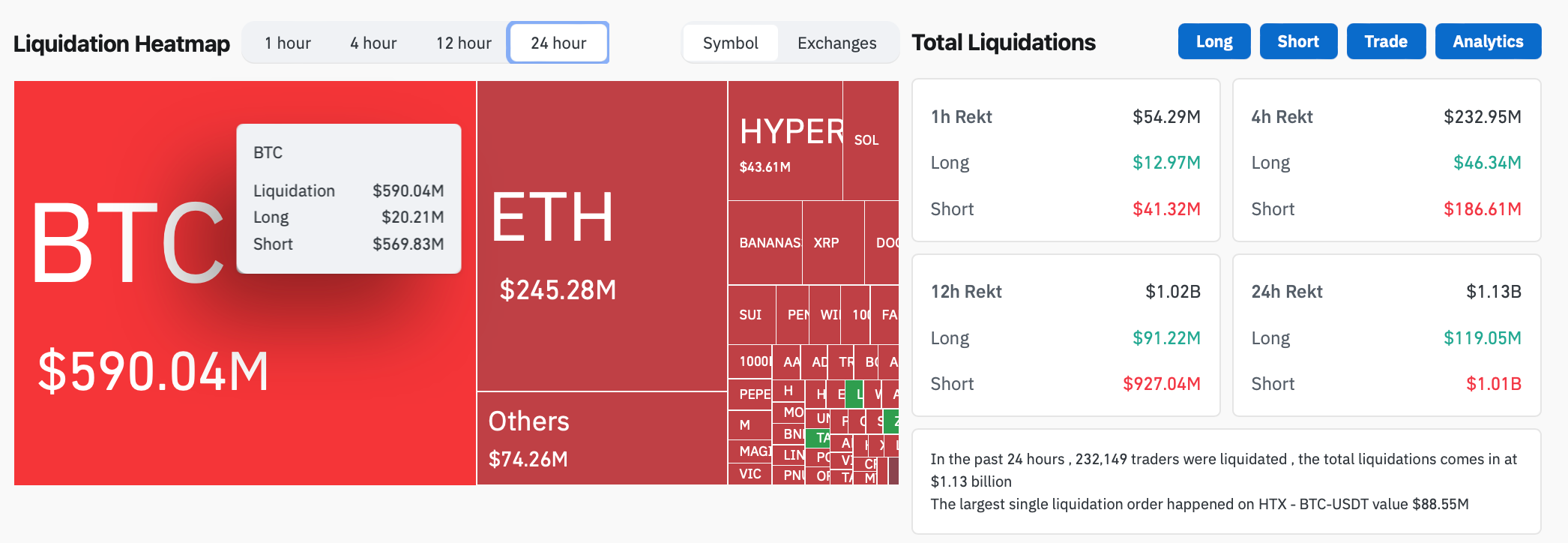

Bitcoin liquidations totaled $590.04 million over the past 24 hours with only $20.21 million being long positions. Source: CoinGlass

The liquidations came as Bitcoin clocked a new record high for the second day in a row — $112,000 on Wednesday and $116,500 on Thursday, while Ether surged to $2,990 on Thursday.

Shakeout triggers response from crypto industry

Crypto market capitalization has spiked 4.4% over the past 24 hours to $3.63 trillion, according to CoinMarketCap data.

“Bears in disbelief,” crypto analyst Miles Deutscher said in an X post on Thursday.

Crypto trader Daan Crypto Trades on X called it a “MASSIVE Short squeeze on BTC & ETH.”

Echoing a similar sentiment, Velo noted the significant liquidation event and said, “Lots of emails are being sent.”

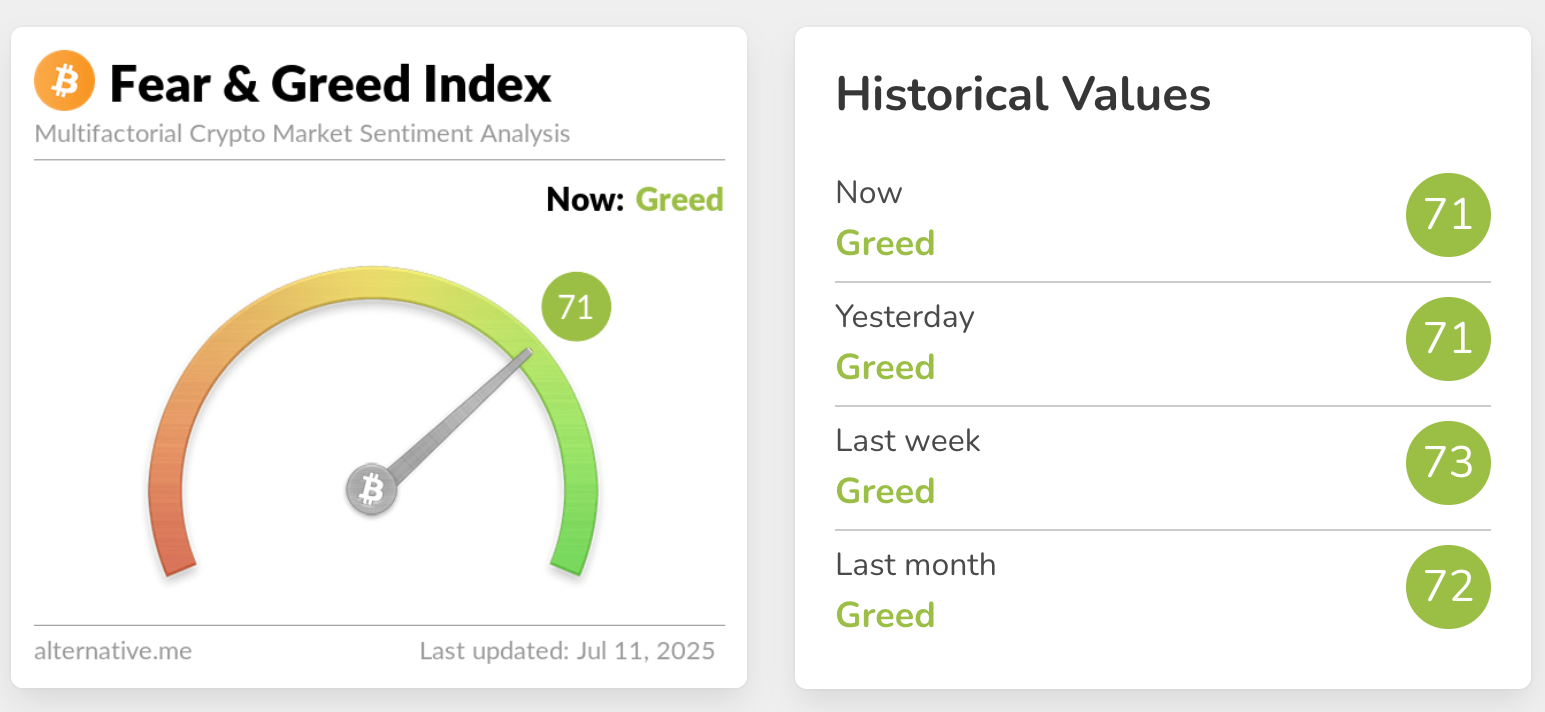

The Crypto Fear & Greed Index held steady on Thursday at a “Greed” score of 71 out of 100, down two points from last week’s score of 73. Source: Alternative.me

One of the larger crypto liquidation events came on Feb. 3 , however, with over $2.24 billion liquidated amid growing concerns of a global trade war after US President Donald TRUMP signed an executive order to impose import tariffs.

Earlier this week, some analysts were skeptical of bitcoin reaching new highs.

Traders were divided over whether Bitcoin would tap new highs

Bitfinex analysts said on Tuesday that Bitcoin traders were showing a “lack of follow-through strength” as BTC struggles to break its current all-time high level.

“Bulls are hesitant or unable to push prices significantly higher without fresh catalysts or clearer macro signals,” Bitfinex analysts said on Tuesday as Bitcoin traded around $108,500.

However, others were more bullish. MN Trading Capital founder Michael van de Poppe said on June 30, “The inevitable breakout to an ATH on Bitcoin might even happen during the upcoming week.”

For now, traders are betting on the price remaining stable or rising further.

Approximately $2.11 billion in long positions are at risk of liquidation if Bitcoin retraces to Wednesday’s price of $112,000.