Bitcoin Teases $109K: Bulls Charge After Historic Weekly Close

Bitcoin's price action just gave Wall Street a masterclass in volatility—again. The king of crypto is flexing at $109,000 resistance after smashing its previous all-time high. Traders are either liquidating shorts or praying for a pullback.

Why this matters: That weekly close wasn't just a number—it was a middle finger to the 'overbought' crowd. The market's pricing in what institutions still won't admit: fiat is bleeding out.

Watch the leverage ratios. When BTC plays chicken with six figures, things get messy fast. And for the traditional finance guys still waiting for 'regulation clarity'? Enjoy your 2% bond yields.

Bitcoin institutional and corporate demand remains robust

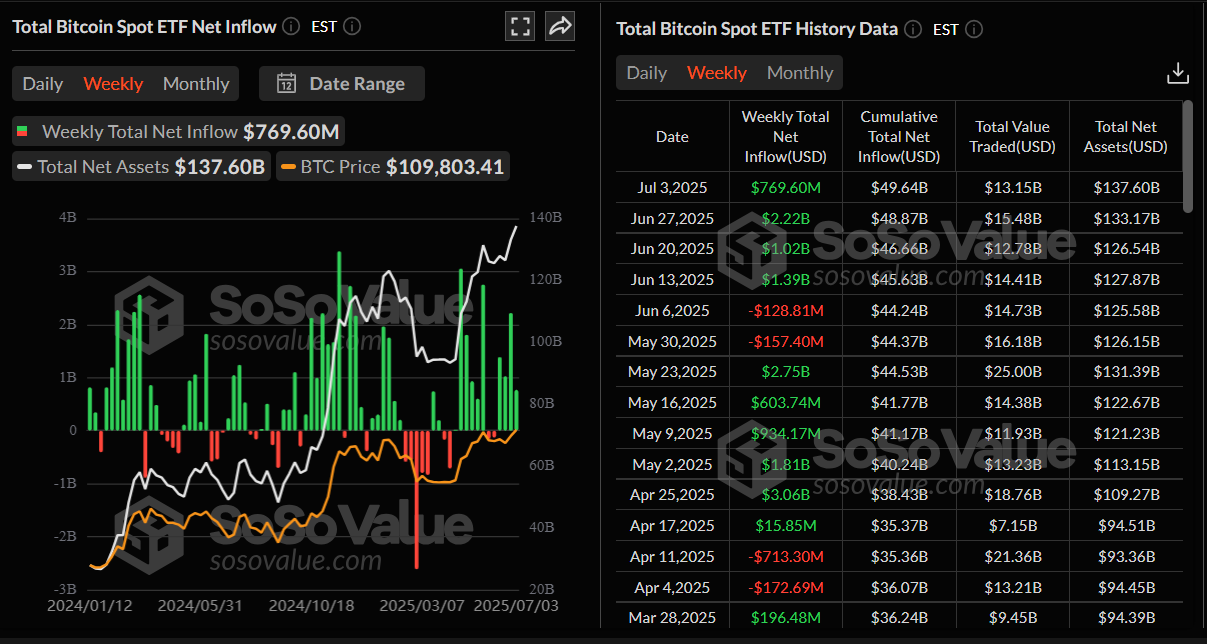

Bitcoin recorded its highest weekly close in the first week of July, closing at 109,203 on Sunday. The rising institutional demand for BTC fueled this historical level. SoSoValue data show that spot Bitcoin ETFs recorded a total of $769.60 million in inflows last week, marking the fourth consecutive weekly increase since mid-June. If the inflow continues and intensifies this week, BTC could reach or even surpass its all-time highs.

Total bitcoin spot ETF net inflow weekly chart. Source: SoSoValue

Apart from continuous demand from institutional investors, the corporate company demand for BTC also remains robust. Japanese investment firm Metaplanet announced on Monday that it has purchased an additional 2,205 BTC, bringing the total holding to 15,555 BTC. On the same day, the Blockchain Group confirmed the acquisition of 116 BTC, bringing its total holdings to 1,904 BTC.

The Trump administration could extend the tariff pause to August 1

Markets turn risk-averse at the beginning of the week as investors assess the latest headlines surrounding the US tariff regime.

The Kobeissi Letter reported on Sunday that US Treasury Secretary Scott Bessent stated that President Trump will impose April 2 level tariffs on countries that do not reach trade deals with the US, beginning August 1. Simply put, Trump could extend the tariff pause from July 9 to August 1.

This news could offer a mixed bag for riskier assets such as Bitcoin. The extension of the tariff deadline is likely to postpone the immediate downside risk, but it will also prolong uncertainty.

Moreover, last week’s US macroeconomic data showed that the Nonfarm Payrolls ROSE by 147,000 in June, against expectations of a 110,000 increase and the 144,000 seen in May. The Unemployment Rate also unexpectedly dropped to 4.1% last month, compared to the expected 4.3% and May’s 4.2%. This data, as of now, has squashed hopes for aggressive Federal Reserve (Fed) easing and a cautious stance for an interest rate cut.

Meanwhile, traders remain expectant of the Minutes of the Fed’s June meeting, set to be released on Wednesday, for more clarity on the timing of the next interest rate cut.

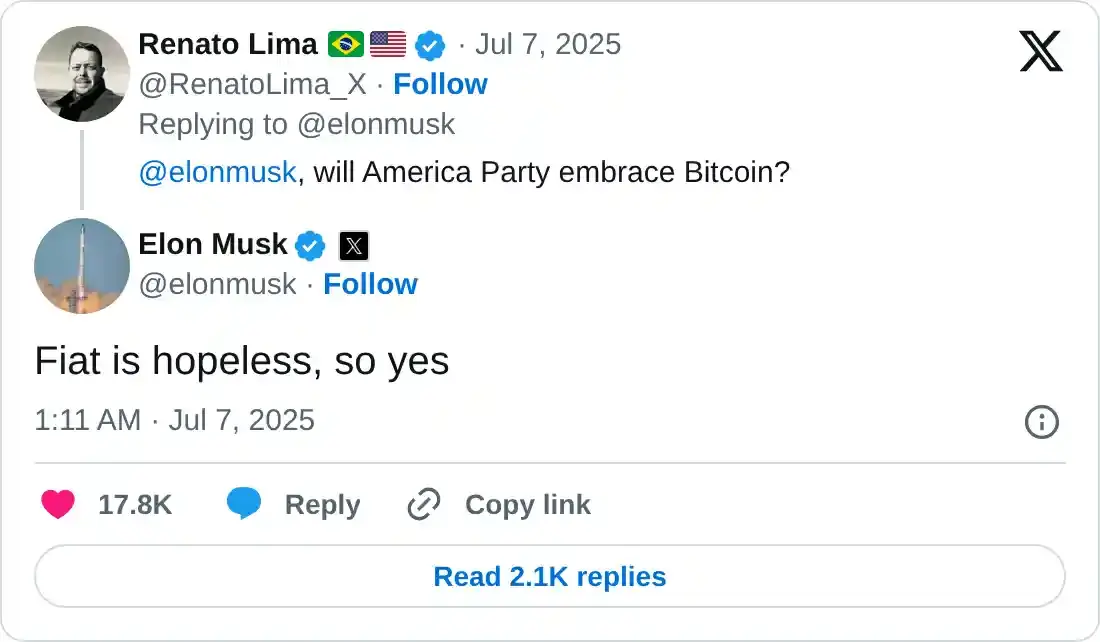

Elon Musk’s America Party embraces Bitcoin

Elon Musk has announced that his new political group, called the America Party, will support Bitcoin. When asked on the social media platform X if the American Party will embrace Bitcoin, Musk replied, “Fiat is hopeless, so yes.”

Bitcoin Price Forecast: Will BTC refresh its record highs?

Bitcoin price rebounded on Sunday after retesting the upper boundary of a previously broken consolidation zone at $108,355. At the time of writing on Monday, BTC hovers at around $109,000.

If BTC continues its upward momentum, it could extend the rally toward the May 22 all-time high at $111,980.

The Relative Strength Index (RSI) on the daily chart reads 57, above its neutral level of 50, indicating bullish momentum. The Moving Average Convergence Divergence (MACD) on the daily chart displayed a bullish crossover. It also shows rising green histogram bars above its neutral level, suggesting bullish momentum and indicating an upward trend.

BTC/USDT daily chart

However, if BTC faces a correction and closes below its support at $108,355, it could extend the decline to retest the lower boundary of the consolidation zone at $105,333, which roughly coincides with with the 50-day Exponential Moving Average (EMA) at $105,158, making this a key support zone for BTC.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.