Toncoin Weekend Rally Crashes After UAE Denies Golden Visa Rumors for TON Stakers

Toncoin's brief weekend surge evaporated faster than a Dubai mirage after UAE officials shot down claims about staking rewards including residency perks.

No Lambos, no visas – just reality

The Middle Eastern crypto rumor mill went into overdrive last week with whispers that staking TON could fast-track golden visa applications. Market reaction proved how desperately crypto traders cling to any regulatory hope – even unconfirmed ones.

When UAE authorities called BS on Monday, Toncoin gave up all weekend gains. Another reminder that in crypto, the house always wins – especially when that house is a sovereign nation's immigration policy.

Pro tip for degens: Maybe read the actual visa requirements before FOMO-ing into a coin. Just a thought.

UAE shakes off golden visa offer marketed by Toncoin Foundation

Max Crown, CEO of the Toncoin Foundation, announced a partnership with the United Arab Emirates (UAE) government, offering TON holders the chance to win a golden visa. Marketing the move as a step forward in real-world crypto use cases, Max shared the process, which includes a stake of $100,000 worth of TON for three years and a one-time payment of $35,000.

However, the UAE Federal Authority for Identity, Citizenship, Customs and Port Security (ICP), the Securities and Commodities Authority (SCA), and the VIRTUAL Assets Regulatory Authority (VARA) deny such offers in a joint statement released on Sunday.

The sentiments surrounding Toncoin decline as the UAE's official authorities urge investors to exercise caution.

Toncoin sellers turn aggressive in the derivatives market

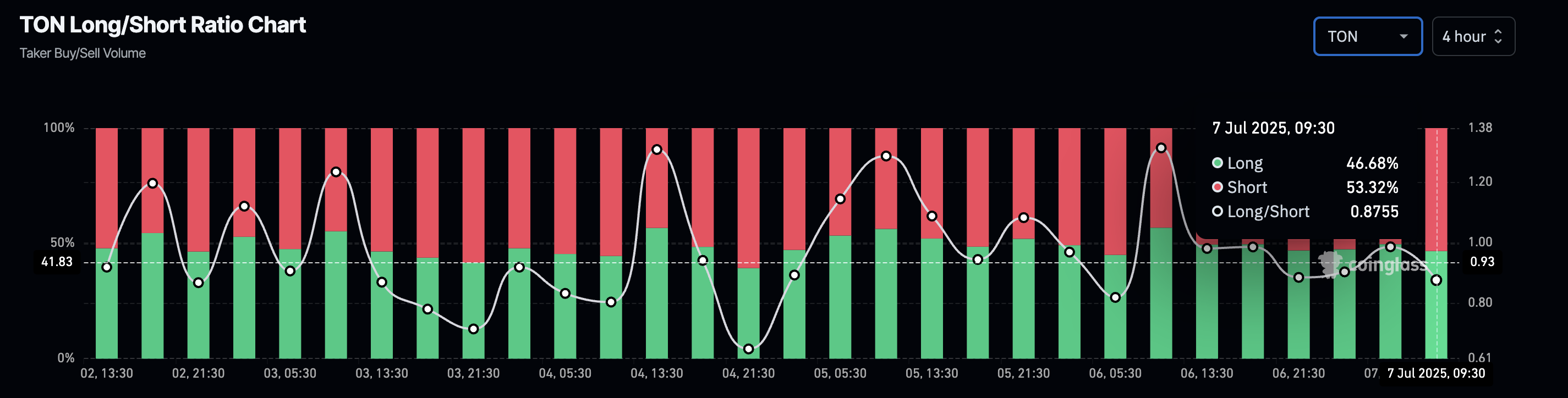

The Taker Buy/Sell Volume indicator tracks the volume of market orders tilting toward the ask or bid side. An increase in taker buy volume pumps the long/short ratio above 1, indicating bullish sentiment as volume from orders that buy at the ask price increases, and vice versa.

CoinGlass’ data indicates a bearish tilt as the taker sell volume accounts for 53.32% of all executed orders in the last four hours, resulting in a long/short ratio of 0.8755.

Toncoin long/short ratio chart. Source: Coinglass

Toncoin fails to cross the 7-month resistance trendline

Toncoin ticks lower by nearly 1% at press time on Monday as short-term buying pressure subsides following the golden visa controversy. TON’s bullish spike on Sunday failed to surpass a long-standing resistance trendline formed by connecting the highs of December 4 and June 10 on a logarithmic scale.

The intraday pullback aims to retest the local support at $2.73, marked by the June 22 bearish close. A decisive push below this floor could extend the declining trend towards $2.52, the lowest closing price in 2025.

The Moving Average Convergence/Divergence (MACD) indicator displays mixed signals as the MACD and signal lines remain merged, indicating a neutral trend. However, the average lines are moving in the negative territory, which suggests a bearish bias for the Toncoin price.

The Relative Strength Index at 44 hovers below the halfway line, while room for further correction grows before reaching the oversold condition.

TON/USDT daily price chart.

To reinforce an uptrend, Toncoin must surpass the resistance trendline with a daily close above Sunday’s high at $3.06. In such a scenario, Toncoin could target a close at $3.34 on June 11.