Cardano (ADA) Defies SEC Roadblock: Resilient Recovery Continues as Grayscale GDLC Approval Hits Snag

Cardano's ADA shrugs off regulatory headwinds—again. While the SEC throws cold water on Grayscale's GDLC fund approval, ADA's price action keeps climbing like a caffeinated altcoin. Here's why the 'Ethereum killer' won't stay down.

SEC plays spoiler, market plays along

Another day, another regulatory curveball. The SEC's pause on Grayscale's diversified crypto fund—which would've included ADA—did exactly zero to dent Cardano's momentum. Traders barely flinched, proving once more that crypto markets digest bureaucracy like a blockchain digests transactions: with impatient efficiency.

Technical resilience meets cynical reality

ADA's recovery isn't just surviving—it's thriving. The token's proving its independence from Wall Street's permissioned playgrounds. Meanwhile, traditional finance scrambles to keep up, still trying to fit decentralized assets into centralized boxes. Good luck with that.

Cardano's latest act? A masterclass in ignoring the noise. While regulators debate paperwork, builders keep shipping—and ADA holders keep winning. The takeaway? In crypto, real utility bypasses bureaucratic theater every time. (But sure, keep waiting for that 'official' stamp of approval.)

SEC halts Grayscale GDLC for review a day after approval

The US SEC announced on Wednesday that the Grayscale GDLC is being reviewed after its recent approval on Tuesday.

“This letter is to notify you that, pursuant to Rule 431 of the Commission’s Rules of Practice,17 CFR 201.431, the Commission will review the delegated action. In accordance with Rule 431(e), the July 1, 2025 order is stayed until the Commission orders otherwise,” said the letter from the US SEC.

The SEC continued that it WOULD let the NYSE know “of any pertinent action taken by the Commission.”

Grayscale’s proposal to convert its GDLC into a spot ETF that holds a mix of five major cryptocurrencies, including Bitcoin (79.90%), ethereum (11.32%), Ripple (4.99%), Solana (3.01%), and Cardano (0.78%), nearly $774 million in assets under management.

Despite renewed regulatory uncertainty, major cryptocurrencies held firm on Wednesday, buoyed by positive sentiment following Donald Trump’s announcement of a new US-Vietnam trade deal. Cardano rose nearly 8% that day and steadied near $0.58 during the early Asian trading session on Thursday.

Cardano’s derivatives data bullish bias

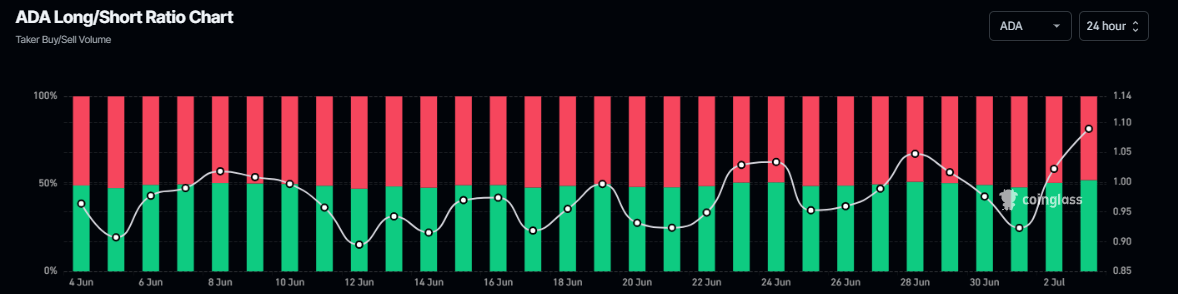

Cardano’s derivatives data shows traders remain optimistic. The Coinglass long-to-short ratio for ADA reads 1.10 on Thursday, the highest level in over a month. The ratio above one indicates that traders are betting on the asset price to rise.

Cardano’s long-to-short ratio chart. Source: Coinglass

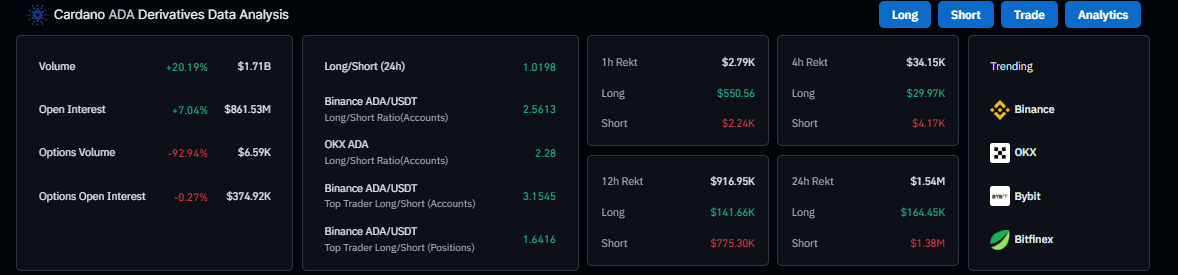

Additionally, the ADA Open Interest (OI) surged by 7.04% in the last 24 hours, reaching $861.53 million. An increased buying activity fuels the OI spike, suggesting heightened Optimism surrounding Cardano.

Cardano derivatives data chart. Source: Coinglass

Cardano Price Forecast: ADA on the verge of a breakout

Cardano price is trading within a falling wedge pattern, which is formed by connecting multiple highs and lows with two trendlines. ADA recovered nearly 8% on Wednesday and is approaching its daily resistance level at $0.58 as of Thursday.

If ADA breaks above the daily resistance at $0.58, it could extend the rally toward its upper trendline boundary of the falling wedge pattern. A breakout above this pattern would extend the gains toward its June 11 high of $0.73.

The Relative Strength Index (RSI) on the daily chart reads 45, pointing upward toward its neutral level of 50, which indicates a fading of bearish momentum. For the bullish momentum to be sustained, the RSI must MOVE above its neutral level.

The Moving Average Convergence Divergence (MACD) indicator on the daily chart also displayed a bullish crossover on Sunday. It also showed a rising histogram bar above its neutral value, indicating bullish momentum and an upward trend.

ADA/USDT daily chart

However, if ADA faces a correction, it could extend the decline toward its next daily support at $0.49.