Trump’s New Tax Bill Threatens Solar-Powered Bitcoin Miners With Financial Squeeze

Solar-powered Bitcoin miners face a rude awakening as Trump’s latest tax reforms take aim at renewable energy incentives.

The Green Mining Paradox

Miners who bet big on solar to cut costs now stare down a double-edged sword—clean energy credits slashed just as hash rates (and power bills) skyrocket.

Wall Street’s Oldest Trick

Washington giveth tax breaks, Washington taketh away. Another ‘stable policy environment’ from the folks who brought you quantitative easing and subprime mortgages.

The Mining Exodus Accelerates

With profit margins evaporating faster than a shitcoin’s liquidity, operators face a brutal choice: relocate, capitulate, or pray for a BTC price moonshot.

Source: CCAF

Source: CCAF

Can Bitcoin Thrive Without Subsidies?

But that may not always be the case. According to Mason Jappa, CEO of U.S.-based Bitcoin miner Blockware, the assumption that miners depend on solar is misguided.

“Miners don’t necessarily rely on solar,” he said, in response to questions from Cryptonews. “In fact, it’s really the other way around. Solar energy producers are very reliant on Bitcoin miners.”

That’s because large-scale solar farms are often located in remote areas where retail energy demand is low and transmission to cities, to larger consumers, is costly.

But BTC miners “are able to provide solar power producers with a ‘backstop’ of demand” because they can operate anywhere there’s a cheap power source, said Jappa.

In this light, he says, Trump’s clean energy tax credit cuts do not spell disaster for miners who depend on electricity generated from the sun. On the contrary, the economic incentive for collaboration could actually increase. Jappa explains:

“Investors looking to build new solar farms have less uncertainty because they know that Bitcoin miners are almost always willing and able to purchase their energy. Ultimately this will lead to increased solar energy production even in the absence of government subsidies.”

Environmental analyst Daniel Batten concurred with Jappa, saying Bitcoin doesn’t need subsidies to make renewables like solar economically viable.

“Bitcoin mining is politically agnostic,” Batten said. “It can operate in an environment with or without subsidies just as well.”

Speaking to Cryptonews, Batten cited academic research by Hakimi et al, which shows that utility-scale solar projects achieve faster ROI, or return on investment, in less than half the time when using Bitcoin mining.

Rooftop solar installations, too, achieve 57% better ROI, outperforming batteries by a factor of four when combined with mining. Batten sees any tax cuts from Trump’s bill as encouraging more market-driven innovation.

“So if solar operators (as some already have), start looking at a coordinated solar/Bitcoin mining rollout solution, that’s a more economically sustainable alternative than depending on subsidies, which may or may not exist depending on factors outside of your direct control.”

Bonus Depreciation: A Lifeline for Bitcoin Miners

On the campaign trail, Donald TRUMP promised to eliminate the clean energy tax credits passed by former President Joe Biden under the Inflation Reduction Act of 2022. The tax credits were a key pillar of the Biden administration.

Trump argued that energy subsidies are expensive and harmful to business. In a post on his Truth Social network over the weekend, Trump continued his attacks on green tax credits, calling them a “giant scam”.

“I would prefer that this money be used somewhere else, including reductions,” he said. “Windmills and the rest of this junk are the most expensive and inefficient energy in the world, is destroying the beauty of the environment (sic).”

However, Trump’s “big, beautiful bill” revives an old provision that could help Bitcoin miners “wipe out” their tax bills — 100% bonus depreciation.

As Cryptonews previously reported, the clause allows companies to promptly deduct the full cost of capital expenditures like new mining equipment from taxable income. Under the bill, Bitcoin miners can write off 100% of hardware costs in the year of purchase. It can apply when a firm buys new mining equipment, such as application-specific integrated circuit (ASIC) miners.

For example, a miner spends $30,000 to buy three ASIC miners for $10,000 each. Under 100% bonus depreciation, the miner’s $30,000 mining hardware purchase becomes a $30,000 tax deduction upfront.

If a miner earns as little as $5,000 in revenue that year, they can report a $25,000 paper loss. Mining firms or individuals can use the faux loss “to offset income from your job, business, or investments.”

“Depending on your tax bracket, that could save you $7,000 to $10,000 in taxes,” tax expert Arniel Sia posted on X in late May.

![]() BIG TAX HACK COMING FOR BITCOINERS

BIG TAX HACK COMING FOR BITCOINERS![]()

Trump’s proposed “𝗧𝗛𝗘 𝗢𝗡𝗘, 𝗕𝗜𝗚, 𝗕𝗘𝗔𝗨𝗧𝗜𝗙𝗨𝗟 𝗕𝗜𝗟𝗟” brings back the much-anticipated 100% bonus depreciation…

And that means one thing:

You could mine Bitcoin AND wipe out your tax bill.![]()

![]() pic.twitter.com/AObQPUZP0P

pic.twitter.com/AObQPUZP0P

![]()

![]()

Existing Internal Revenue Service (IRS) rules require firms to depreciate large equipment buys over many years. Tax deductions are spread out across an asset’s useful life, typically five years for ASIC miners.

Blockware’s Jappa believes the 100% bonus depreciation is a game-changer.

“This will allow miners to write off the full cost of their mining hardware (ASICs) in a single tax year – leading to major tax savings and higher net returns for Bitcoin miners,” he told Cryptonews.

Jerlis, the EMCD Bitcoin mining pool CEO, said hardware makes up the majority of mining capital expenditures, estimated at somewhere between 60%-70%. The tax break from bonus depreciation could offset solar-related price hikes, especially for miners using mixed energy sources, he said.

Energy Independence

Apart from solar, Trump’s push for “domestic energy independence,” with plans to scale back environmental regulations while promoting things like natural gas and nuclear expansion, could lower costs across the industry.

As the Blockware CEO Jappa notes, Bitcoin miners are “adaptable and non-discriminatory,” prioritizing the cheapest source, whether subsidized solar or deregulated gas. They could benefit from Trump’s pivot, he says.

“Policies that encourage natural gas production, reduce regulatory barriers for new energy projects, etc., would all result in lower energy prices for Americans and higher profitability for Bitcoin mining.”

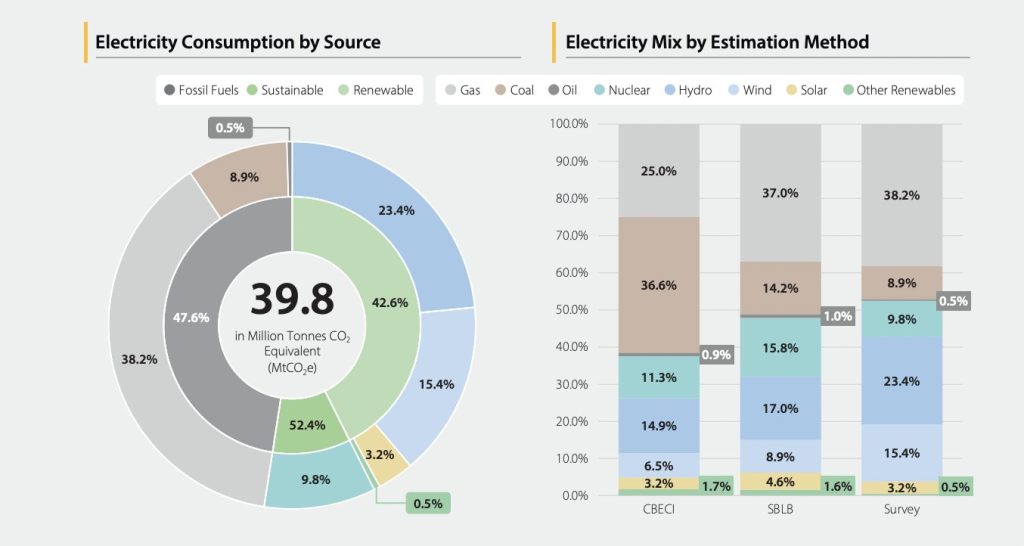

According to the latest Cambridge Centre for Alternative Finance study, more miners are switching to cheaper, off-grid power. It says the 52.4% sustainable power used in BTC mining includes 9.8% nuclear and 42.6% renewables like hydro, solar, and wind.

For the first time, natural gas has replaced coal as the single largest energy source in Bitcoin mining — a process that involves solving complex mathematical puzzles to verify transactions and add them to the blockchain.

The report, published in April, says natural gas, a cleaner burning fuel, now accounts for 38.2% of the electricity used to mine BTC, up from 25% three years ago. Coal usage has dropped to 8.9% from 36.6% during the same period.

Meanwhile, Bitcoin-related emissions have remained steady over the last three years, stabilizing at 39.8MtCO2e (megatons of carbon dioxide equivalent), thanks to improved machine efficiency and a switch to renewable power.