Crypto Rebound Alert: Bitcoin, Ethereum, XRP Defy Volatility With Lightning Recovery

Crypto markets pull off a Houdini act—again. After a weekend that shook out weak hands, Bitcoin, Ethereum, and XRP staged a textbook dead-cat bounce. Traders who blinked missed the rally.

The Rebound Playbook

No fancy fundamentals here—just pure algorithmic whiplash. Liquidity flooded back faster than a Wall Streeter ordering a martini after margin call. BTC reclaimed $60K, ETH snapped back above $3.4K, and even XRP shrugged off SEC drama to gain 12% in 24 hours.

The Cynic’s Corner

Another day, another ‘institutional adoption’ narrative. Funny how those press releases always drop right after a 20% drawdown. Meanwhile, leverage traders keep treating crypto like a roulette wheel—with similar results.

Market overview: US strikes on Iran keep investors on the edge

US President Donald Trump ordered strikes on three main Iranian nuclear sites on Saturday, unleashing mayhem in global markets, which saw Bitcoin price drop below the $100,000 mark, its lowest point since May 8.

The strikes dimmed hopes for a potential ceasefire, as reported by Reuters. "It's irrelevant to ask Iran to return to diplomacy," Iran's foreign minister Abbas Araqchi told reporters in Istanbul on Sunday.

Following the attacks, President TRUMP urged Iran to return to the negotiating table but warned against retaliatory attacks on US assets and personnel in the Middle East region.

Volatility in the market is likely to remain elevated, with traders treading cautiously. Liquidations exploded above the $1 billion mark on Sunday, offering a glimpse of the damage that could happen if the conflict between Iran and Israel keeps escalating.

Data spotlight: Digital asset inflows hit 10-week streak

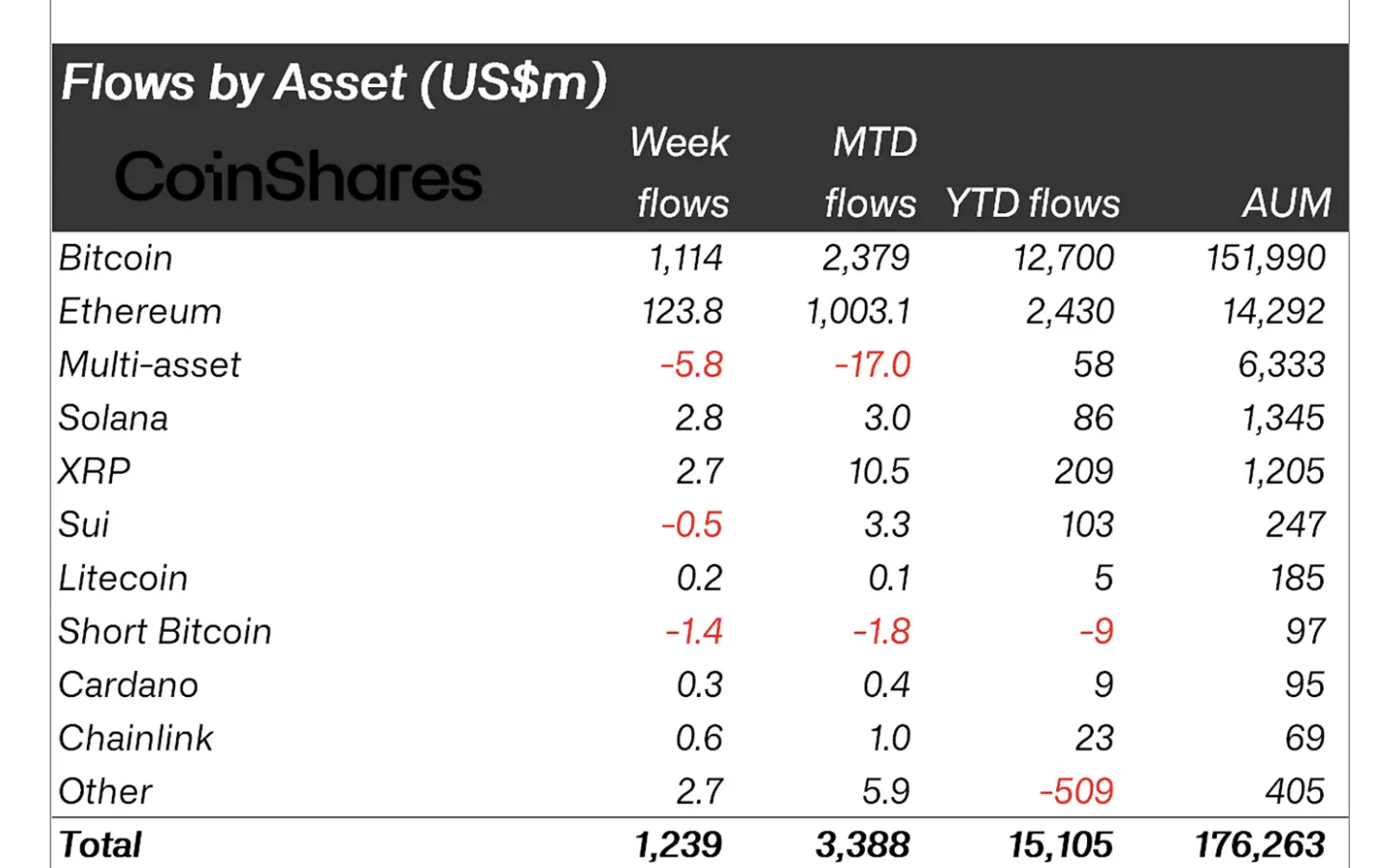

Inflows into digital asset financial products, including spot Exchange Traded Funds (ETFs), extended the bullish streak, reaching $1.24 billion last week. CoinShares reported that year-to-date inflows have hit a record $15.1 billion.

Bitcoin and ethereum dominated the inflows with $1.1 billion and $124 million, signaling strong sentiment despite escalating geopolitical tensions. Ethereum posted its ninth consecutive week of inflows, bringing the total inflow for this period to slightly above $2.2 billion.

"This marks the longest run of inflows since mid-2021, reflecting continued robust investor sentiment toward the asset," the CoinShares weekly report states.

Digital asset inflows | Source: CoinShares

Chart of the day: Bitcoin's rebound offers bullish signals

Bitcoin's price hovers at around $101,457 at the time of writing as traders focus on the possibility of the uptrend extending further. According to QCP Capital's Monday market update, "BTC's reclaim of $100k this morning suggests that the weekend drawdown was macro-driven, with investors turning to crypto as a hedge while awaiting equity futures to open."

Technically, the Relative Strength Index (RSI) indicates that momentum is gradually shifting bullish as it reverses the trend, pointing toward the 50 midline. Recovery beyond this neutral level could boost the uptrend, paving the way for further gains this week.

BTC/USDT daily chart

Key monitoring levels, especially for intraday traders, include the 100-day Exponential Moving Average (EMA), currently at $99,212, which is set to serve as support, and the 50-day EMA at $102,954, a former support level that has been flipped into resistance. A break above the 50-EMA hurdle WOULD expand the bullish scope above $105,000, a psychological round-number resistance.

Altcoins update: Ethereum resumes uptrend as XRP wobbles

Ethereum's price shows subtle signs of a minor recovery on Monday, steadying during the European session, buoyed by support at $2,111 and buy-the-dip initiatives. Although the RSI is NEAR the oversold region, a reversal is underway at 35. The 100-day EMA at $2,366, the 50-day EMA at $2,417 and the 200-day EMA at $2,469 mark key resistance levels. Closing above these levels will likely boost ETH's bullish structure.

ETH/USDT daily chart

On the contrary, the Money FLOW Index (MFI) indicator, which tracks the amount of money entering Ethereum, suggests a strong bearish grip as it slides toward the oversold area. In other words, traders may lack the conviction to keep the recovery steady in upcoming sessions.

Meanwhile, the leading cross-border money transfer token, XRP, shows signs of weakness despite reclaiming ground slightly above support at $2.00. If downside risks intensify, traders may want to prepare for the possibility of losses extending to lows last seen in April, such as $1.80 and $1.61.

XRP/USDT daily chart

The path of least resistance appears firmly downward, accentuated by the RSI pointing downwards and approaching oversold territory. On the upside, the 200-day EMA at $2.09, which served as support last week, could cap gains, favoring consolidation above the support level of $2.00.

Cryptocurrency prices FAQs

How do new token launches or listings affect cryptocurrency prices?

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

How do hacks affect cryptocurrency prices?

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

How do macroeconomic releases and events affect cryptocurrency prices?

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

How do major crypto upgrades like halvings, hard forks affect cryptocurrency prices?

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.