Aave Eyes $300 Milestone After Aptos Integration and Surging Open Interest

Aave’s bold move onto Aptos blockchain sparks market frenzy as open interest skyrockets—defi’s sleeping giant awakens.

Protocol’s cross-chain ambitions meet trader euphoria, but can it sustain the momentum? (Spoiler: Wall Street’s still skeptical about ’magic internet money’ hitting price targets.)

Aave v3 launches on Aptos to revolutionise cross-chain lending

Aave v3 protocol’s deployment on Aptos is part of a larger plan to re-architect the core lending mechanisms for the Move programming language. According to the announcement on X, the Aptos execution environment, collateral flows, liquidation logic, and incentives infrastructure are up for review under new guidelines. The development could present a unique chance to enhance the security of Aave and Apto’s Decentralized Finance (DeFi) ecosystems.

Researchers, clear your calendars: The @Aave competition is live at the Cantina.

Aave’s v3 deployment on Aptos introduces a new era of cross-chain lending logic, rewritten in MOVE and ready for review.

💰 $150,000 GHO

📅 Live now – June 9

🔗 Below pic.twitter.com/sFn8EPQFMd

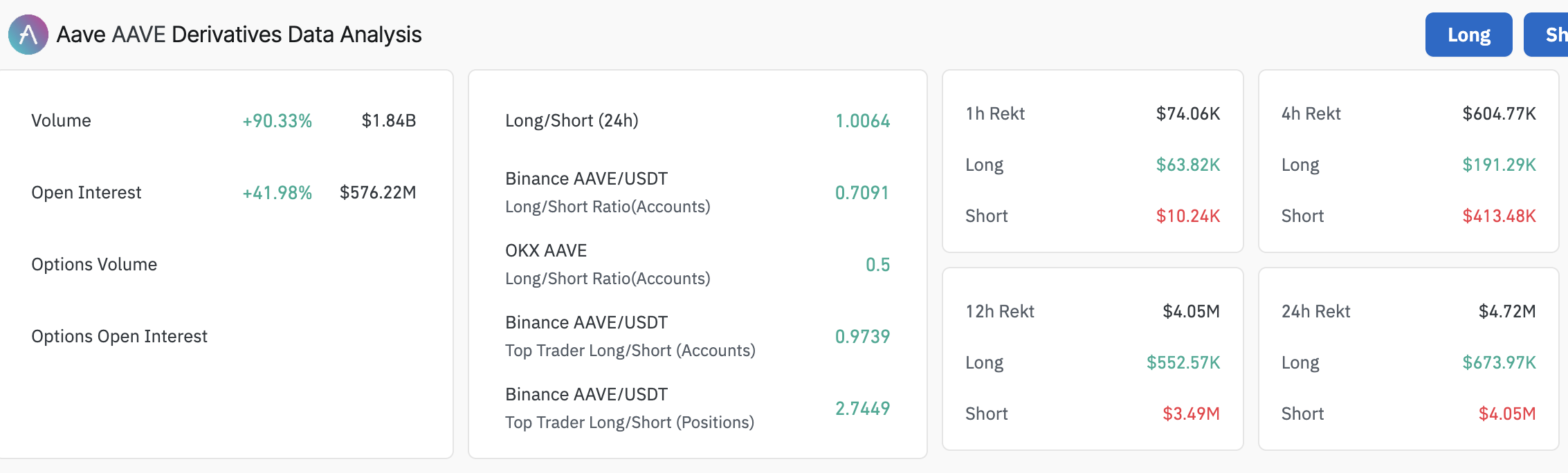

The debut on Aptos has ignited interest in the AAVE token, with traders opening new positions. CoinGlass data shows an approximately 42% increase in Open Interest (OI) to $576 million, highlighting a significant influx of capital and heightened trader interest.

Aave derivatives data | Source: CoinGlass

A 90% increase in trading volume to $1.84 billion reflects robust trading activity, often a precursor to substantial price movements. High volume alongside rising OI typically points to a strong trend forming.

Similarly, the 24-hour long-short ratio of 1.0064 points to a near-even split between buyers and sellers, with a minor tilt toward longs. The slight long bias aligns with the top traders’ positioning, hinting at the possibility of the bullish momentum lasting longer.

Short liquidations reached roughly $4.05 million over the past 24 hours, significantly outpacing long liquidations at approximately $673,970, suggesting that more bearish positions were forced to close, likely due to the price increase, which tested the $270 resistance before correcting to $264.

Aave’s rally stalls below $270 as bulls maintain control

Aave’s price holds the uptrend steady around $264 despite the slight correction from the supply area at $270. The path with the least resistance is strongly upward, supported by key moving averages, including the up-trending 50-day Exponential Moving Average (EMA) at $194, the 100-day EMA at $197 and the 200-day EMA at $200.

Should the 50-day EMA cross above the 200-day EMA, forming a golden cross on the daily chart, bullish momentum could accelerate, potentially driving Aave past the $300 mark.

The Moving Average Convergence Divergence (MACD) indicator further supports this outlook, showing buyers in control with expanding green histogram bars above the center line.

AAVE/USDT daily chart

The resistance at $270 must be broken to ensure interest in AAVE does not dwindle. However, the extremely overbought Relative Strength Index (RSI) at 75.44 suggests caution among traders as trend reversals often follow overbought conditions.

Key support areas to monitor over the coming days include moving averages ranging between $194 and $200, the area tested at $162 in March and the lowest point in April at $114.

Cryptocurrency prices FAQs

How do new token launches or listings affect cryptocurrency prices?

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

How do hacks affect cryptocurrency prices?

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

How do macroeconomic releases and events affect cryptocurrency prices?

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

How do major crypto upgrades like halvings, hard forks affect cryptocurrency prices?

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.