DDC Enterprise Bets Big on Bitcoin: 5,000 BTC Target in Corporate Treasury Shakeup

Corporate balance sheets just got more orange. DDC Enterprise Ltd is diving headfirst into Bitcoin—announcing plans to accumulate 5,000 BTC as a strategic reserve asset within three years.

Why it matters: The move signals growing institutional conviction in Bitcoin’s store-of-value thesis—or perhaps just another case of FOMO-driven corporate treasury management (we’ve seen this movie before).

Between the lines: While MicroStrategy’s 214,000 BTC hoard still dominates headlines, DDC’s aggressive accumulation strategy could make them the new poster child for corporate Bitcoin adoption—assuming they don’t paper-hand during the next 30% drawdown.

Public companies’ interest in BTC grows

On Thursday, DDC Enterprise Ltd, a cross-border consumer brand and e-commerce company between China and the United States, announced that it will adopt Bitcoin as a strategic reserve asset.

The announcement accompanied DDC Enterprise Ltd’s 2024 full-year results and was detailed in a Shareholder Letter from Founder, Chairwoman, and CEO Norma Chu. It highlighted the company’s strong financial performance and introduced a pioneering Bitcoin accumulation strategy to redefine long-term value creation.

The strategy begins with an immediate purchase of 100 BTC, with short-term goals to acquire 500 BTC within six months and an overall target to hit 5,000 BTC in 36 months.

The news is positive for Bitcoin and its prices as it indicates a growing acceptance of BTC as a strategic asset, boosting its legitimacy and potentially driving long-term adoption.

DDC Enterprise Ltd, a cross-border consumer brand and e-commerce company between China and the United States, announced that it will adopt Bitcoin as a strategic reserve asset and plans to accumulate 5,000 Bitcoins within the next 36 months.https://t.co/WVAMRjnpqA

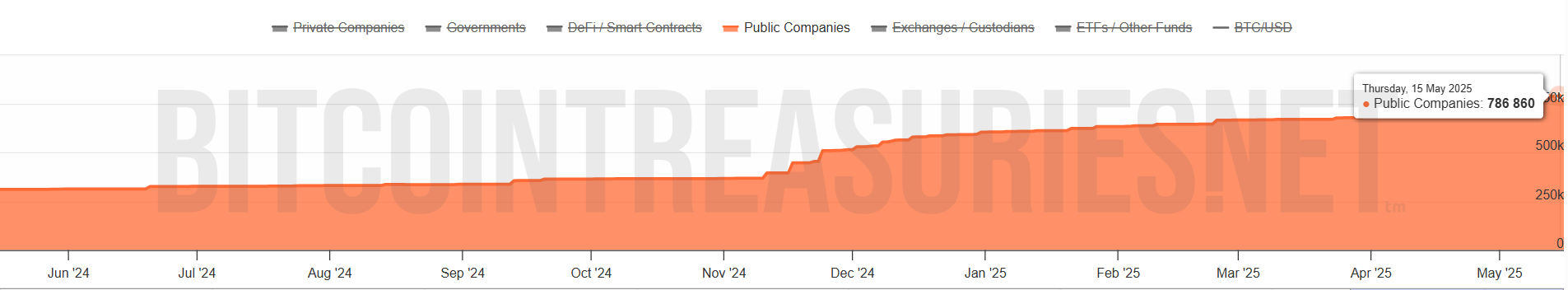

— Wu Blockchain (@WuBlockchain) May 16, 2025The chart below shows a growing trend of public companies adding Bitcoin to their treasuries, with total corporate holdings of 786,860 BTC.

Public companies’ BTC holding chart. Source: BitcoinTreasuries.net

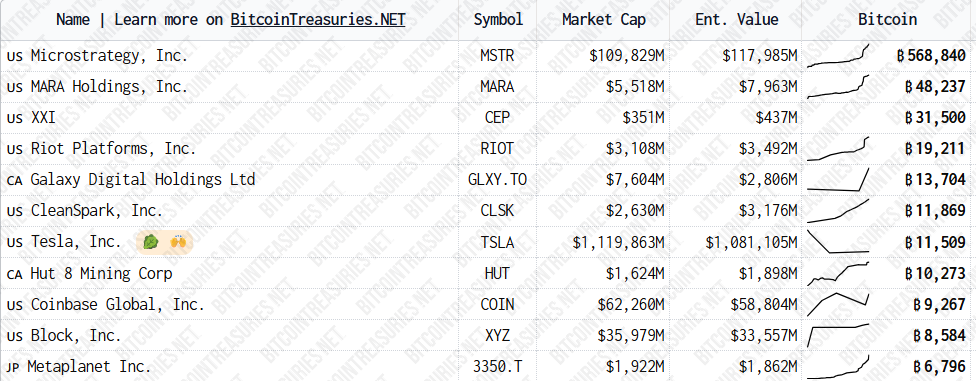

MicroStrategy (MSTR) is taking the lead with 568,840 BTC, followed by MARA Holding (MARA) with 48,237 BTC.

Top 10 companies BTC holding chart. Source: BitcoinTreasuries.net