Hyperliquid Soars: Bulls Charge Toward $25 as Open Interest Hits Record High

Hyperliquid’s price surge isn’t just hype—open interest just blasted past its all-time peak, signaling traders are doubling down on the rally. Here’s why the $25 target looks increasingly plausible.

The leverage frenzy: Open interest (the total value of unsettled derivatives contracts) hitting ATH means one thing—speculators are piling in with borrowed cash. Classic crypto.

Liquidity vs. volatility: While surging open interest fuels momentum, it’s a double-edged sword. Any sudden downturn could trigger cascading liquidations. But for now? The bulls have the floor.

Wall Street’s watching: Institutional desks are quietly building positions, treating Hyperliquid as a ’high-beta crypto play’ (translation: they want moon shots without admitting it).

Bottom line: This isn’t just retail FOMO. The smart money’s riding the Hyperliquid wave—until the next ’black swan’ event, of course. Always one exit away from a 40% flash crash in crypto-land.

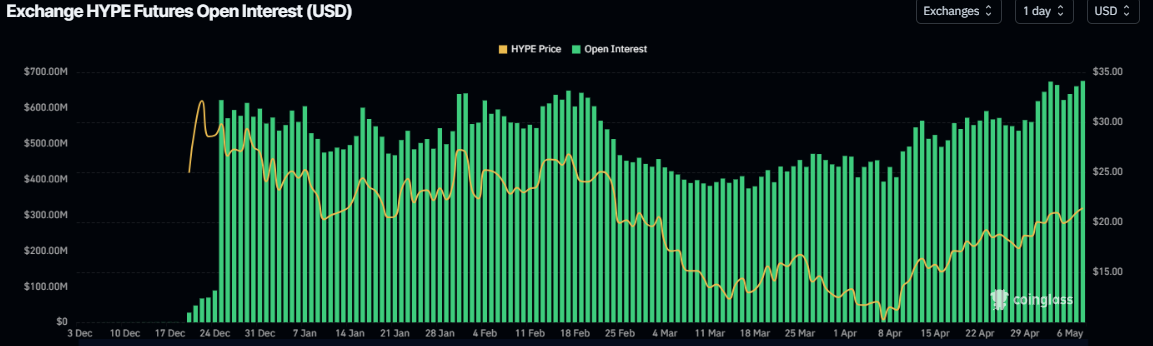

Hyperliquid Open Interest reaches new all-time high

Coinglass’ data shows that the futures’ OI in HYPE at exchanges rose from $622 million on Monday to $676.03 million on Wednesday, a new all-time high. An increasing OI represents new or additional money entering the market and new buying, which could fuel the current rally in the Hyperliquid’s price.

HYPE Open Interest chart. Source: Coinglass

Ethena Labs announced on Monday that it has launched USDe stablecoin on Hyperliquid’s exchange and HyperEVM blockchain. This will enable users to hold a Dollar-pegged asset in a high-speed DeFi ecosystem known for derivatives trading.

The integration of USDe into Hyperliquid’s ecosystem will benefit its native token HYPE as it increases ecosystem utility and adoption, boosts trading volume, attracts stablecoin liquidity, and signals growth through DeFi integrations and partnerships.

USDe is now live on both @HyperliquidX exchange & HyperEVM 🫳🏻

HyperCore users will earn daily rewards auto airdropped on top of their USDe spot exchange balances

USDe fills the opportunity for a scalable rewarding dollar asset within the Hyperliquid exchange & ecosystem

HYENA… pic.twitter.com/rbffoZh9ZJ

Hyperliquid’s technical outlook suggests 17% gains ahead

Hyperliquid’s price found a cushion around its daily support level at $19.24 on Tuesday and recovered slightly. This level roughly coincides with the 50% Fibonacci retracement (drawn from the February 14 high of $28.53 to the April 7 low of $9.28) at $18.90. At the time of writing on Wednesday, HYPE trades slightly above at around $21.23.

If HYPE continues its upward momentum, it could extend the rally by 17% from its current level to its psychological importance level of $25.

The Relative Strength Index (RSI) on the daily chart reads 66, above its neutral level of 50, indicating strong bullish momentum. The Moving Average Convergence Divergence (MACD) indicator also showed a bullish crossover, indicating a continuation of the upward trend.

HYPE/USDT daily chart

However, if HYPE fails to find support around the daily level of $19.24 and closes below it, it could extend the decline to retest its April 28 low of $16.90