Litecoin Smashes Into 6.83 Million LTC Wall—Can Bulls Break Through?

Litecoin’s rally hits a brick wall of resistance at 6.83 million LTC—just as open interest spikes. Traders are either loading up for a breakout or setting traps for the over-leveraged.

Open interest swelling? Check. Liquidity clusters forming? Check. The only thing missing is a catalyst—or another ’institutional adoption’ press release to juice the pumps.

Watch those liquidation levels. The market’s memory is short, but the whales’ algos never forget.

Litecoin’s surge above $90 supports the bullish case

Litecoin’s price recovery from the tariff-triggered crash to $63 on April 7 signals the likelihood of a long-term uptrend. This bullish outlook comes after LTC broke above key levels like the resistance-turned support at $80, the 50-day Exponential Moving Average (EMA) at approximately $86, and the 100-day EMA at $92.

LTC/USDT daily chart

A bullish engulfing candle propelled Litecoin’s uptrend past $92 on Tuesday, a level not seen in 42 days. Now, LTC encounters resistance at $93, reinforced by the 200-day EMA.

The Relative Strength Index (RSI) indicator’s climb above the midline toward overbought territory highlights strong bullish momentum, boosting the odds of LTC hitting $100, a resistance last tested in early March.

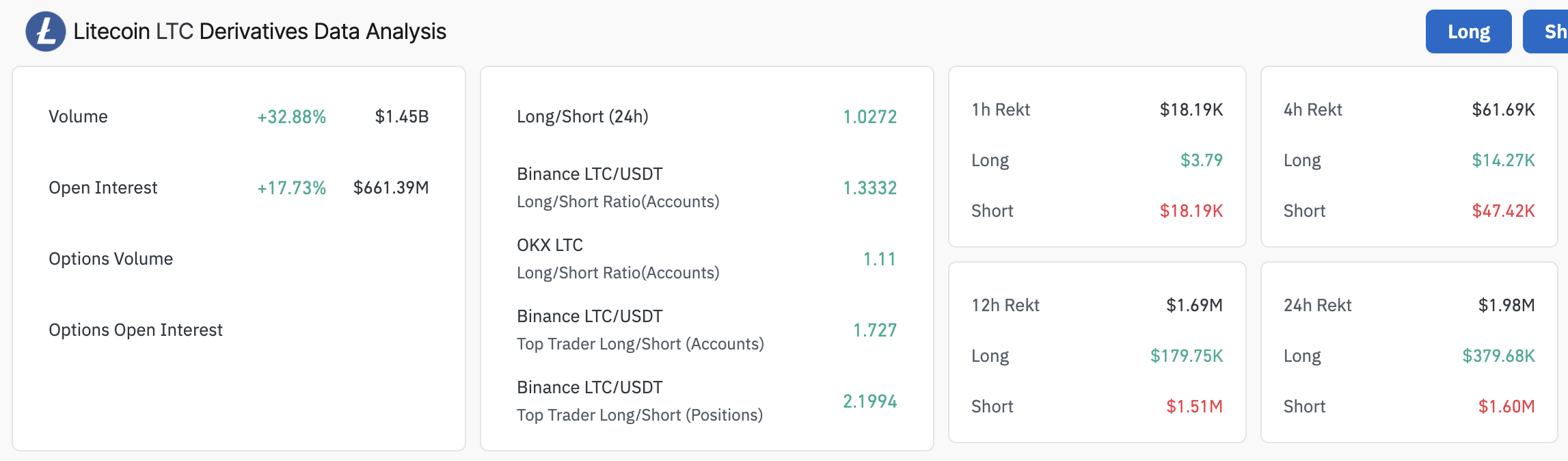

A 17.73% surge in Open Interest (OI) reveals a significant influx of new positions in the Litecoin derivatives market. The uptick reflects growing trader interest, as OI measures the total number of outstanding contracts. It is plausible that traders are positioning for a run-up above $100 as Litecoin’s price gains bullish momentum.

Litecoin derivatives data | Source CoinGlass

The chart above shows that the 32.88% increase in trading volume to $1.45 billion amplifies the OI surge. It suggests strong conviction among traders; moreover, liquidation data indicates a strong bias toward long positions.

Short liquidations ($1.60 million) have significantly outpaced long liquidations ($370,000) over the last 24 hours, mirroring a short squeeze, where price increases force short sellers to close positions. This adds upward pressure, as LTC approaches the resistance cluster between $92 and $95.

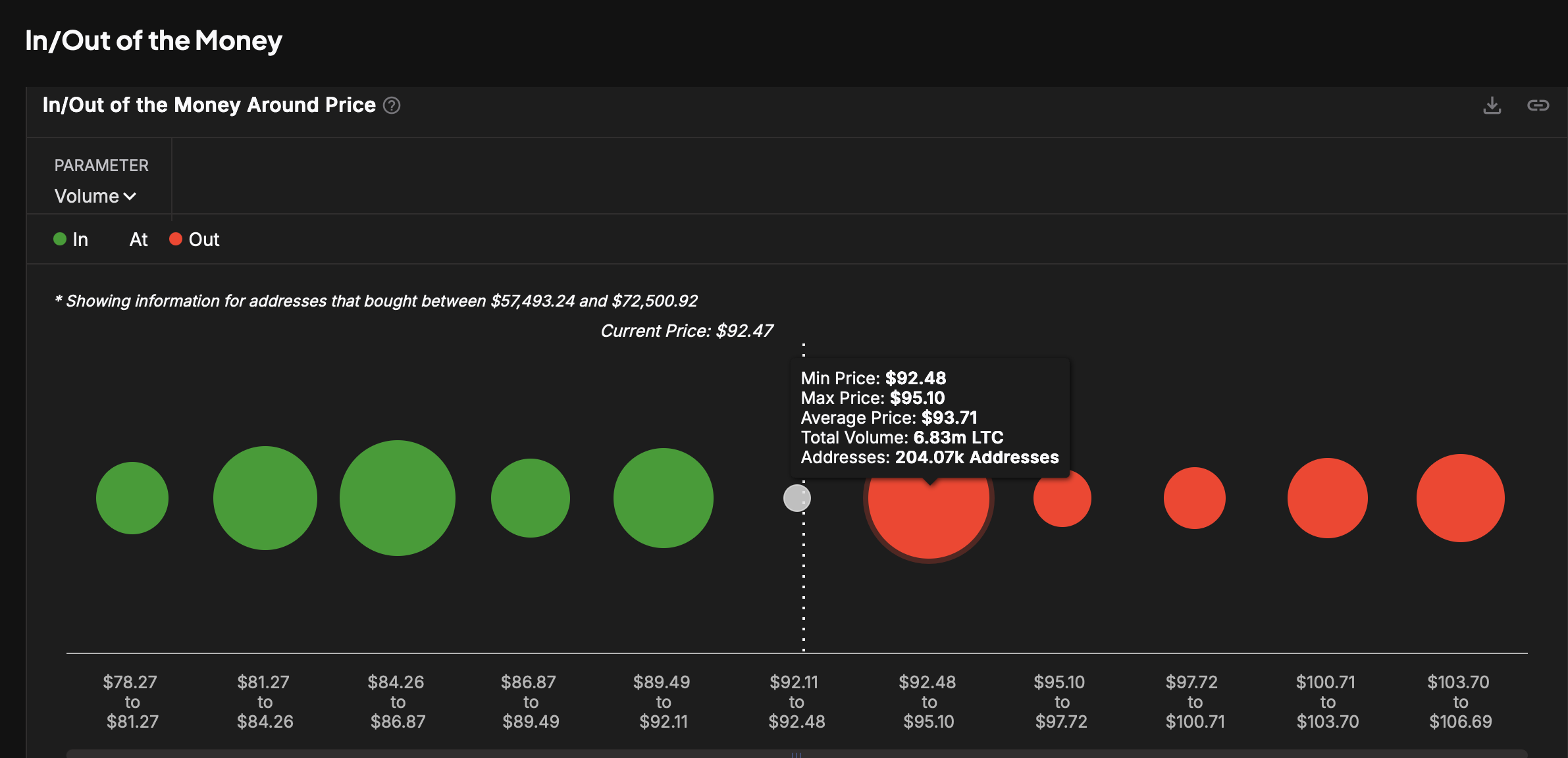

Litecoin’s uptrend encounters massive supply

Litecoin’s price is facing robust resistance in the region between $92 and $95, according to IntoTheBlock’s In/Out of the Money Around Price (IOMAP) on-chain metric. About 204,000 addresses that previously bought 6.83 million LTC in this range pose a challenge to the uptrend if investors decide to sell to break even.

Litecoin IOMAP model | Source: IntoTheBlock

On the bright side, a break above the seller congested area at $92-$95 could accelerate Litecoin above the $100 hurdle. Besides, Litecoin sits on multiple demand clusters, as illustrated by the green circles in the chart above. In the event of a pullback below $90, traders would look for tentative liquidity-rich regions around $85 and $82, respectively.

Cryptocurrency metrics FAQs

What is circulating supply?

The developer or creator of each cryptocurrency decides on the total number of tokens that can be minted or issued. Only a certain number of these assets can be minted by mining, staking or other mechanisms. This is defined by the algorithm of the underlying blockchain technology. On the other hand, circulating supply can also be decreased via actions such as burning tokens, or mistakenly sending assets to addresses of other incompatible blockchains.

What is market capitalization?

Market capitalization is the result of multiplying the circulating supply of a certain asset by the asset’s current market value.

What is trading volume?

Trading volume refers to the total number of tokens for a specific asset that has been transacted or exchanged between buyers and sellers within set trading hours, for example, 24 hours. It is used to gauge market sentiment, this metric combines all volumes on centralized exchanges and decentralized exchanges. Increasing trading volume often denotes the demand for a certain asset as more people are buying and selling the cryptocurrency.

What is the funding rate?

Funding rates are a concept designed to encourage traders to take positions and ensure perpetual contract prices match spot markets. It defines a mechanism by exchanges to ensure that future prices and index prices periodic payments regularly converge. When the funding rate is positive, the price of the perpetual contract is higher than the mark price. This means traders who are bullish and have opened long positions pay traders who are in short positions. On the other hand, a negative funding rate means perpetual prices are below the mark price, and hence traders with short positions pay traders who have opened long positions.