Crypto Bulls Charge: BNB, Bitcoin & Ethereum Price Forecasts - Asia Market Watch September 26

Digital assets roar into Asian trading hours with triple-threat momentum.

BNB EYES BREAKOUT LEVEL

Binance's native token tests resistance as exchange volumes spike—traders watching for decisive move above critical threshold.

BITCOIN DEFIES GRAVITY

King crypto holds firm despite macro pressures. Institutional inflows continue steady drip—whale accumulation patterns suggest confidence in near-term upside.

ETHEREUM NETWORK ACTIVITY SURGES

Smart contract platform sees developer migration accelerate. Gas fees stabilize as layer-2 adoption hits new records—defi protocols reporting highest TVL since merge.

Meanwhile traditional finance executives still trying to explain why their blockchain projects need 300 consultants and 18-month timelines.

BNB Price Forecast: BNB risks a 10% drop as sell-off wave amplifies

BNB (BNB), previously known as Binance coin, trades below $1,000 after the 7% drop on the previous day. At the time of writing, BNB extends the loss by nearly 1% on Friday, approaching the support trendline of a rising channel. Both the derivatives and technical outlook suggest a sudden decline in buying pressure, flashing risks of further correction.

Top 3 Price Prediction: Bitcoin, Ethereum, Ripple – BTC, ETH, and XRP stabilize after massive correction

Bitcoin price failed to find support around the daily level of $116,000 on September 19 and declined 3.19% over the next four days, closing below the 50-day Exponential Moving Average at $113,490 on Monday. BTC recovered slightly on Wednesday, but failed to close above the 50-day EMA and declined 3.81% the next day, closing below the ascending trendline. At the time of writing on Friday, it trades at around $109,600. If BTC continues to correct, it could extend the decline toward the daily support at $107,245.

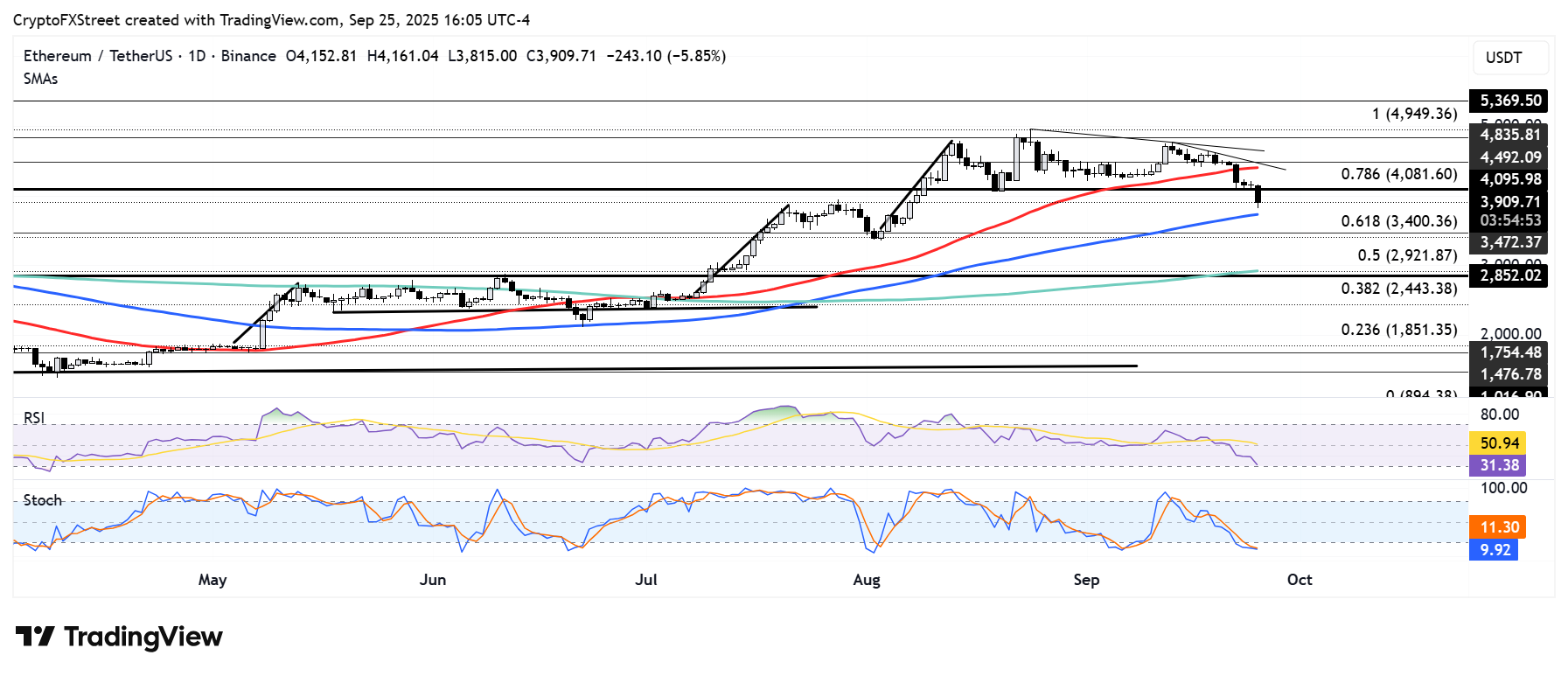

Ethereum Price Forecast: ETH dips below $4,000, sparks heavy liquidations as REX-Osprey debuts staking Ether ETF

Ethereum (ETH) is declining below $4,000 on Thursday, accelerating liquidations among holders of long positions on ETH futures. Long liquidations surged above $400 million for the second time in four days as prevailing bearish sentiment in the crypto market continues to weigh on Ethereum. The decline comes after FXStreet noticed ETH funding rates flashed negative on Wednesday. Despite the prevailing bearish sentiment, REX Shares debuted the first Ethereum staking ETF in the United States.