XRP Price Prediction 2025: Can the Bull Run Push It to $4 and Beyond?

- XRP Technical Analysis: The Bullish Case vs. Warning Signs

- Market Sentiment: Why Everyone's Talking About XRP

- The $4 Question: Realistic Target or Overextension?

- Institutional Adoption vs. Banking Resistance

- Historical Patterns Suggest Bigger Moves Ahead

- What Should Traders Do Now?

- XRP Price Prediction: Frequently Asked Questions

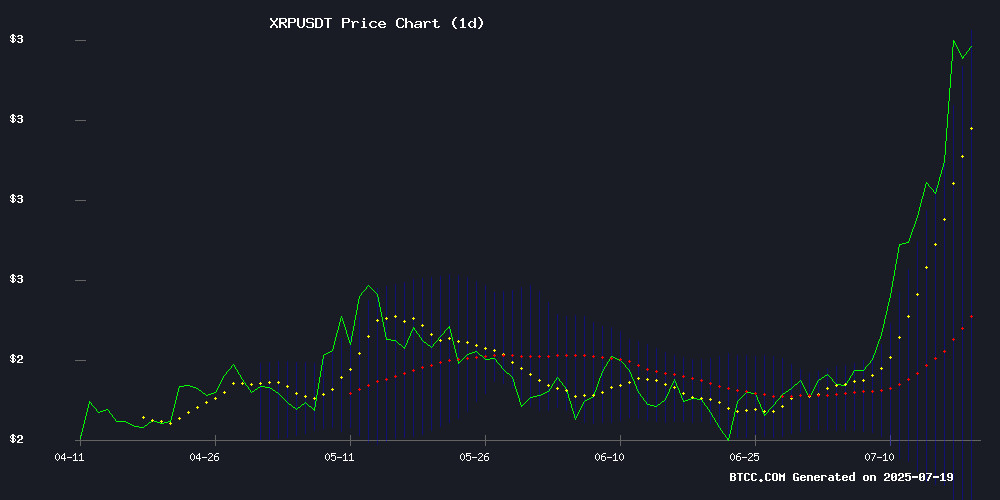

XRP is currently riding a massive bullish wave, breaking past $3.50 with eyes set on $4 as institutional interest and ETF speculation fuel its ascent. The cryptocurrency has shown remarkable resilience, trading above its 20-day moving average while technical indicators paint a mixed picture. This analysis dives deep into XRP's price action, market sentiment, and the key factors that could determine whether it hits the coveted $4 mark or faces a short-term pullback.

XRP Technical Analysis: The Bullish Case vs. Warning Signs

As of July 20, 2025, XRP sits at $3.3964 - comfortably above its 20-day MA of $2.6327, which typically signals strong bullish momentum. The Bollinger Bands show volatility with the upper band at $3.5005, suggesting room for growth before hitting resistance. However, the MACD indicator tells a different story with its bearish crossover (MACD line at -0.4793, signal line at -0.3078), hinting at potential consolidation ahead.

What's fascinating is how XRP has defied typical overbought signals. The RSI recently hit 89.8 - way into overbought territory - yet the price keeps climbing. In my experience, when crypto assets get this kind of momentum, they can stay overbought much longer than traditional assets. The symmetrical triangle breakout we're seeing now actually started forming back in 2018, making this a potentially massive technical development.

Market Sentiment: Why Everyone's Talking About XRP

The current bullish sentiment around XRP is nothing short of electric. News headlines are filled with predictions ranging from conservative $4 targets to wildly optimistic $10-$30 projections. Even Dave Portnoy, the Barstool Sports founder who famously sold his XRP too early, publicly regretted his decision as prices surged past $3.60.

Several factors are driving this enthusiasm:

- The upcoming July 25 SEC decision on spot XRP ETFs

- ProShares launching the first XRP futures ETF on July 18

- Ripple's application for a U.S. national banking charter

- California Governor's endorsement at Ripple's headquarters

Whale activity tells an interesting story too - 2,743 wallets now hold over 1 million XRP each, controlling nearly 50 billion tokens collectively. When the big players accumulate like this, it's usually a sign they expect higher prices ahead.

The $4 Question: Realistic Target or Overextension?

At current levels, $4 represents about a 17% gain from $3.3964. Given the recent 24% weekly surge, this seems achievable but potentially volatile. The upper Bollinger Band at $3.5005 might offer short-term resistance, but if institutional flows continue, we could see a breakout.

However, the falling star candlestick pattern that appeared recently can't be ignored. These often signal exhaustion after strong rallies. If we see confirmation with increased selling volume, a pullback to $3.20 or lower might precede the next leg up.

Institutional Adoption vs. Banking Resistance

While institutional adoption grows, traditional banks are pushing back. Five major U.S. banking associations recently opposed granting national charters to crypto custody firms like Ripple. This creates an interesting tension - just as crypto gains mainstream traction, the old guard is digging in their heels.

Personally, I see this as growing pains rather than a long-term threat. Remember when banks resisted online banking? Now it's standard. The same transition seems inevitable for crypto services.

Historical Patterns Suggest Bigger Moves Ahead

Looking at XRP's historical cycles, the current symmetrical triangle breakout could signal much larger moves. Fibonacci extensions point to targets between $4.70-$6.48, with some analysts like Egrag Crypto suggesting $20-$30 isn't out of the question long-term.

That said, the $1,000 per XRP talk seems mathematically implausible - that WOULD require a market cap exceeding global GDP. While crypto has defied expectations before, investors should maintain realistic expectations.

What Should Traders Do Now?

With such strong momentum, the temptation to FOMO in is real. But smart trading means balancing opportunity with risk management:

- Watch the $3.50 level - a clean break could signal $4 is coming

- Monitor trading volume - decreasing volume on up moves suggests weakening momentum

- Set stop losses - perhaps around $3.20 if going long

- Dollar-cost average if concerned about volatility

This article does not constitute investment advice. Always do your own research before trading.

XRP Price Prediction: Frequently Asked Questions

What is the current XRP price and key technical levels?

As of July 20, 2025, XRP trades at $3.3964. Key levels include support at the 20-day MA ($2.6327) and resistance at the upper Bollinger Band ($3.5005). The all-time high sits at $3.84 from 2018.

Can XRP realistically reach $4 soon?

Given current momentum and institutional interest, $4 appears achievable in the NEAR term. However, the MACD bearish crossover suggests we might see consolidation first before another push upward.

What are the biggest factors driving XRP's price?

ETF speculation (particularly the July 25 SEC decision), institutional accumulation, technical breakouts, and growing adoption by traditional financial institutions are the primary drivers currently.

Is XRP overbought right now?

Technically yes, with RSI at 89.8, but crypto assets can remain overbought during strong trends. The falling star candlestick pattern does suggest potential short-term exhaustion.

What's the long-term outlook for XRP?

Long-term prospects appear strong due to Ripple's banking partnerships and growing institutional adoption. However, regulatory hurdles and banking resistance remain challenges to monitor.