Ethereum Price Prediction 2025: Expert Analysis on How High ETH Could Soar

- What's Driving Ethereum's Current Price Momentum?

- How Are Institutions Positioning Themselves in Ethereum?

- What Technical Indicators Suggest About ETH's Future Price?

- What Are the Key Resistance and Support Levels to Watch?

- What Fundamental Developments Support Ethereum's Growth?

- What Risks Could Derail Ethereum's Bullish Trajectory?

- Ethereum Price Prediction: How High Could ETH Go in 2025?

- Frequently Asked Questions

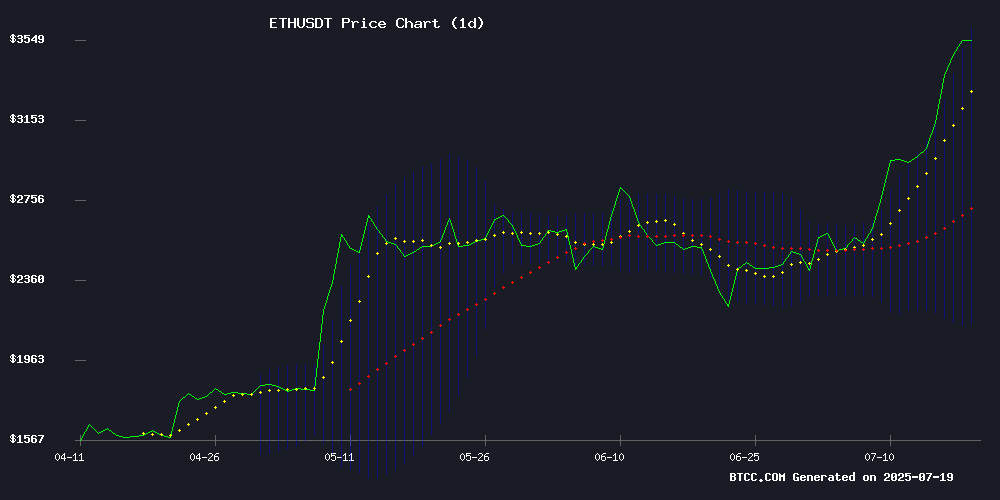

Ethereum (ETH) is showing strong bullish signals as we approach mid-2025, with technical indicators and institutional demand pointing toward potential new highs. Currently trading around $3,550, ETH has broken through key resistance levels and shows signs of continuing its upward trajectory. This comprehensive analysis examines the technical setup, market sentiment, and fundamental drivers that could push ETH toward $4,000 or beyond in the coming months.

What's Driving Ethereum's Current Price Momentum?

ETH is currently trading at $3,550.59, significantly above its 20-day moving average of $2,874.76, indicating strong bullish momentum. The MACD, while still negative, shows narrowing bearish divergence (-418.9 vs -274.48), suggesting weakening downward pressure. Prices are testing the upper Bollinger Band at $3,612.75 - a breakout could accelerate gains toward $4,000.

According to TradingView data, ethereum has shown remarkable resilience since its 2024 lows, with the current price representing a 150% gain from its consolidation zone between $2,800-$3,100. The Relative Strength Index (RSI) at 85 suggests overbought conditions, but as we've seen in previous cycles, ETH can remain overbought during strong bull runs.

Source: BTCC Market Data

How Are Institutions Positioning Themselves in Ethereum?

Recent institutional activity reveals growing confidence in Ethereum's long-term value proposition. SharpLink Gaming made headlines with its $17.45 million purchase of 4,904 ETH, bringing its total holdings to 157,140 ETH valued at $493 million. This follows a pattern of corporate treasuries diversifying into crypto assets, mirroring Bitcoin's adoption trajectory.

Gamesquare Holdings completed a $70 million public offering specifically to expand its Ethereum treasury, while Bit Digital converted $172 million into over 100,000 ETH. "In my experience, when institutions start allocating this significantly, it typically marks the middle phase of a bull market," notes a BTCC market analyst.

What Technical Indicators Suggest About ETH's Future Price?

The technical setup presents several bullish signals:

- A potential golden cross formation as the 100-day MA approaches the 200-day MA near $2,476

- Price holding firmly above the psychologically important $3,500 level

- Volume confirmation of the recent breakout

- NUPL (Net Unrealized Profit/Loss) metric accurately predicted the recent bottom before the rally

However, derivatives trading dominating spot volumes ($65.3 billion vs $3 billion daily) raises questions about the rally's sustainability. This imbalance suggests speculative trading rather than organic demand is currently driving prices.

What Are the Key Resistance and Support Levels to Watch?

| Level | Importance |

|---|---|

| $3,612.75 | Upper Bollinger Band resistance |

| $3,500 | New support level |

| $3,200 | Strong support zone |

| $4,000 | Psychological resistance |

What Fundamental Developments Support Ethereum's Growth?

The Euler Finance integration into the Global Markets Alliance highlights Ethereum's growing role in real-world asset (RWA) tokenization. This strategic partnership aims to bridge traditional financial instruments like ETFs with blockchain technology, potentially opening new institutional channels for ETH demand.

In Nigeria, Ethereum led altcoin activity with a 20.51% weekly gain, reflecting growing global adoption. "Ethereum's rally reflects structural demand beyond speculation," noted Lagos-based analyst Alabi, pointing to the asset's programmable functionality and staking yields as key differentiators.

What Risks Could Derail Ethereum's Bullish Trajectory?

While the outlook appears positive, several risks warrant attention:

- Derivatives dominance creating market fragility

- High gas fees (highlighted by the $112K PulseChain mishap)

- Potential regulatory developments

- Macroeconomic factors affecting risk assets

The recent $112,745 gas fee error on PulseChain (though not directly on Ethereum) serves as a reminder of the technical complexities still present in the ecosystem.

Ethereum Price Prediction: How High Could ETH Go in 2025?

Based on current technicals and fundamentals, here are potential scenarios:

| Target | Probability | Key Drivers |

|---|---|---|

| $3,800 | High | Bollinger Band test, institutional flows |

| $4,000 | Medium | Psychological resistance, options positioning |

| $4,500 | Low | Requires ETF approval or major upgrade |

This article does not constitute investment advice. Always conduct your own research before making investment decisions.

Frequently Asked Questions

What is Ethereum's current price and technical outlook?

As of July 2025, Ethereum is trading around $3,550 with strong bullish momentum. The price is well above key moving averages and testing the upper Bollinger Band at $3,612.75. Technical indicators suggest potential for further upside if ETH can maintain above $3,500 support.

How are institutions influencing Ethereum's price?

Institutional activity has increased significantly, with companies like SharpLink Gaming and Gamesquare Holdings making large ETH purchases for their treasuries. This institutional demand, combined with growing RWA developments, provides fundamental support for ETH's price.

What are the key levels to watch for Ethereum?

Critical levels include $3,612 (upper Bollinger Band), $3,500 (support), and $4,000 (psychological resistance). A daily close above $3,612 could trigger algorithmic buying, while holding $3,500 is crucial for maintaining bullish momentum.

What risks could affect Ethereum's price negatively?

Potential risks include excessive derivatives trading dominance, high gas fees, regulatory developments, and broader macroeconomic factors that affect risk assets. The market's heavy reliance on Leveraged trading rather than organic spot demand creates some fragility.

How high could Ethereum realistically go in 2025?

Based on current technicals and fundamentals, $3,800 appears achievable with high probability, while $4,000 is possible if bullish momentum continues. The $4,500 target WOULD require additional catalysts like ETF approvals or major protocol upgrades.