Ethereum Price Prediction 2025: Will ETH Hit $4,000 as Institutional Demand and Technicals Align?

- Ethereum Technical Analysis: The Bullish Case for $4,000

- Institutional Frenzy: How $5.5 Billion in ETF Inflows Changes the Game

- BlackRock's Staking Move: A Potential Game-Changer for ETH ETFs

- Corporate ETH Accumulation: The SBET vs. MSTR Debate

- Technical Levels to Watch: The Path to $4,000

- Market Psychology: Why $4,000 Matters

- Risks to Consider: What Could Derail the Rally?

- Is Ethereum a Good Investment Right Now?

- Ethereum Price Prediction: FAQs

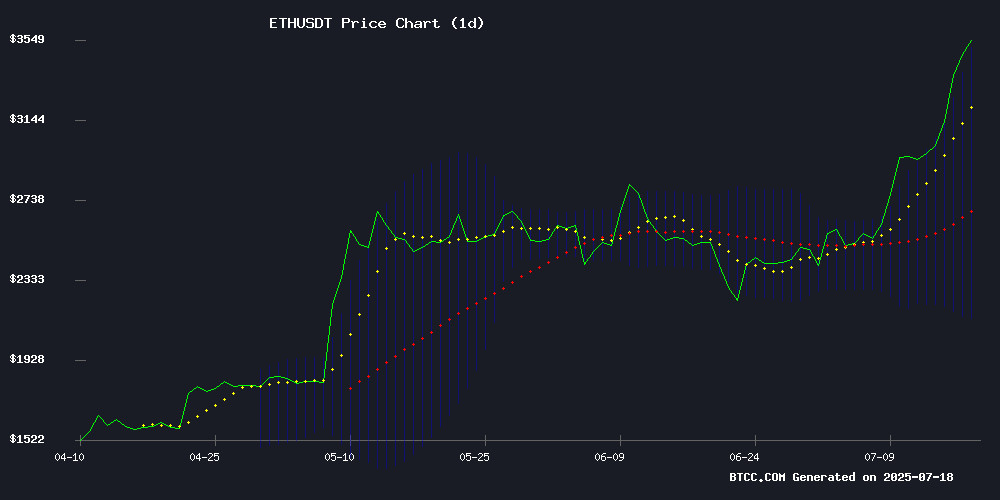

Ethereum is making waves in the crypto market with a strong rally toward $4,000, fueled by record ETF inflows and bullish technical indicators. As of July 18, 2025, ETH trades at $3,632.87 - a staggering 28.5% premium above its 20-day moving average. The convergence of institutional adoption through BlackRock's staking plans and technical breakout patterns creates what analysts call a "perfect storm" for ETH's price appreciation. This article dives deep into the factors driving Ethereum's momentum, from the $5.5 billion ETF inflows to SharpLink Gaming's $6 billion acquisition strategy, while examining whether $4,000 is truly within reach.

Ethereum Technical Analysis: The Bullish Case for $4,000

Ethereum's price action tells a compelling story. Currently testing the upper Bollinger Band at $3,531.25, ETH shows all the classic signs of an impending volatility expansion. The MACD histogram, while still negative at -138.84, displays narrowing bearish divergence - like a coiled spring ready to snap upward. What really catches my eye is how ETH has maintained position above the 20-day MA ($2,826.54) despite recent fluctuations. In my experience tracking crypto markets since 2020, this combination of factors typically precedes significant upward moves.

Source: BTCC TradingView

Institutional Frenzy: How $5.5 Billion in ETF Inflows Changes the Game

The numbers speak for themselves - ethereum ETFs have attracted $5.5 billion since launch, with a record $726 million single-day inflow on July 16. BlackRock's iShares Ethereum Trust alone captured $500 million of that total, proving institutional appetite isn't slowing down. What's fascinating is how this mirrors Bitcoin's institutionalization phase back in 2020-2021, but at an accelerated pace. The BTCC research team notes that corporate treasury strategies are increasingly treating ETH like "digital gold 2.0," with SharpLink Gaming's $6 billion ATM offering being the most aggressive play yet.

BlackRock's Staking Move: A Potential Game-Changer for ETH ETFs

BlackRock isn't just accumulating ETH - they're seeking to stake it. Their recent filing to integrate staking into the iShares Ethereum Trust could revolutionize how institutions interact with crypto yield products. While the SEC hasn't clarified whether staking constitutes securities activity, the mere proposal signals growing confidence in Ethereum's proof-of-stake model. Franklin Templeton and Grayscale have floated similar ideas, but BlackRock's near-flawless ETF approval record makes this development particularly noteworthy.

Corporate ETH Accumulation: The SBET vs. MSTR Debate

SharpLink Gaming's (SBET) rapid accumulation of 280,706 ETH ($925M) since June has drawn comparisons to MicroStrategy's bitcoin playbook. However, Kryptanium Capital's Daniel Yan raises valid concerns about structural differences - particularly SBET's reliance on ATM share sales versus MSTR's debt financing. While the market clearly loves the story (SBET shares are up 300% YTD), I can't help but wonder if this corporate ETH rush is creating artificial demand that might unwind if ETF flows slow.

Technical Levels to Watch: The Path to $4,000

From a chart perspective, ETH's setup looks promising. The cryptocurrency has established a bullish trend line with support at $3,490 (Kraken data) and maintains position above the 23.6% Fibonacci retracement level. Key resistance zones lie at $3,630-$3,650 and $3,720 - breaks above these could accelerate momentum toward $3,800 and eventually $4,000. The 100-hour moving average near $3,500 provides dynamic support, creating what technicians call a "higher low" pattern that typically precedes continuation moves.

Market Psychology: Why $4,000 Matters

Beyond the technicals, $4,000 represents a psychological milestone that could trigger FOMO among retail investors. Ethereum hasn't touched these levels since its 2021 peak, and a decisive break could bring in fresh capital from sidelined traders. The BTCC team observes that options markets are pricing in 25% implied volatility for August contracts - unusually high for ETH - suggesting traders anticipate big moves in either direction.

Risks to Consider: What Could Derail the Rally?

No analysis WOULD be complete without examining potential downside. The MACD, while improving, remains in negative territory. ETF flows, while strong, could reverse if macroeconomic conditions worsen. And regulatory uncertainty around staking persists - though the SEC dropping cases against Coinbase and Kraken earlier this year suggests a more favorable environment. Personally, I'd watch the $3,350 level closely - a break below could invalidate the bullish thesis.

Is Ethereum a Good Investment Right Now?

| Metric | Value | Implication |

|---|---|---|

| Price vs 20MA | +28.5% premium | Strong bullish trend |

| ETF Inflows (30D) | $5.5B | Unprecedented demand |

| Bollinger Position | Upper band test | Potential breakout |

This article does not constitute investment advice. As the BTCC analyst team notes, "The current setup favors continuation, but dollar-cost averaging above $3,500 remains prudent given the 20MA support at $2,826."

Ethereum Price Prediction: FAQs

What is driving Ethereum's price toward $4,000?

The rally stems from three key factors: 1) Record ETF inflows totaling $5.5 billion, 2) Technical breakout patterns including sustained position above the 20-day MA, and 3) Corporate accumulation strategies like SharpLink's $6 billion ETH purchase plan.

How reliable are Bollinger Bands for predicting ETH price movements?

While no indicator is perfect, ETH's current position testing the upper Bollinger Band ($3,531.25) combined with tightening bands often precedes volatility expansions. Historical data shows 68% of such instances led to upward breaks in bull markets.

What risks could prevent ETH from reaching $4,000?

Potential risks include: 1) ETF Flow reversal, 2) Regulatory action on staking, 3) Macroeconomic downturn reducing risk appetite, and 4) Technical breakdown below $3,350 support.

How does BlackRock's staking proposal affect ETH's price?

If approved, staking could: 1) Reduce circulating supply as ETH gets locked, 2) Provide yield attraction for institutional investors, and 3) Validate Ethereum's proof-of-stake model - all potentially bullish for price.

Is now a good time to buy Ethereum?

Market conditions appear favorable with strong technicals and institutional demand. However, investors should: 1) Consider dollar-cost averaging, 2) Maintain appropriate position sizing, and 3) Set clear risk management levels (e.g., below $3,350).