Ethereum Whales Trigger Panic-Selling Frenzy as $ETH Plummets — Here’s Why It’s Actually a Buying Opportunity

Whale wallets are dumping—and retail's scrambling. But the smart money's already positioning for the next pump.

Behind the Panic

Massive sell orders hit exchanges as ETH dipped below key support levels. Whale activity spiked 300% in 24 hours—classic fear-driven liquidation. They're locking in losses while they still can.

Market Mechanics Exposed

Leveraged positions got torched. Stop-loss cascades amplified the drop. Yet on-chain data shows accumulation at lower levels—institutions aren't blinking. They've seen this script before.

The Real Play

This isn't 2018. Ethereum's fundamentals haven't changed. The merge still happened. Scaling solutions are still launching. Whales panic-selling during a dip? How… traditional of them. Maybe they should try reading a balance sheet instead of chasing green candles.

Bottom line: Weak hands fold. Strong hands stack. The cycle continues.

ETH Builds News key Support Level

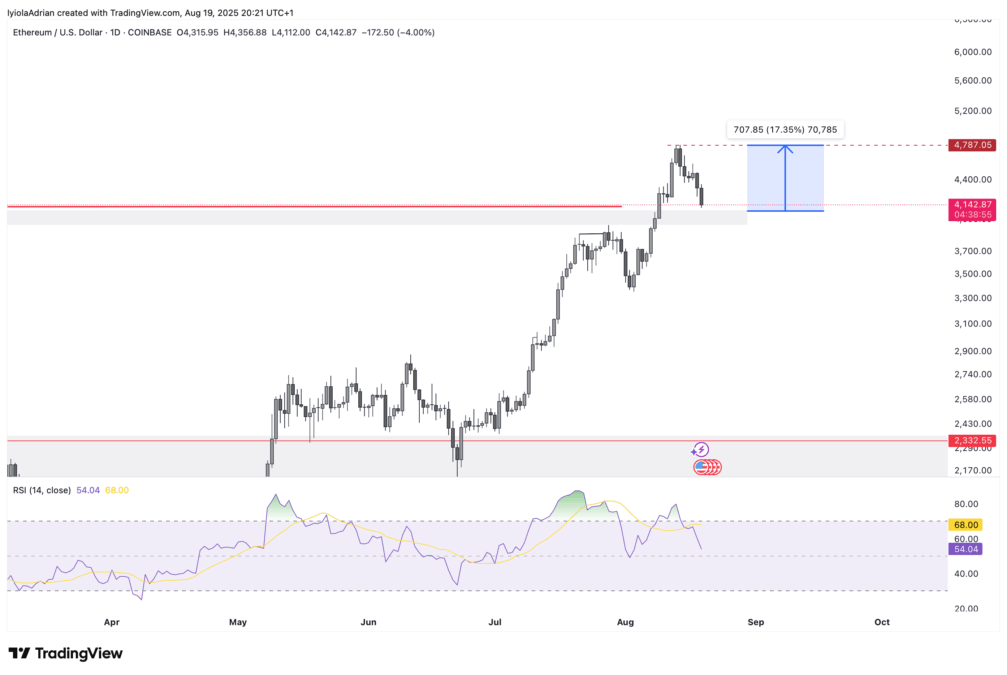

Right now, Ethereum is trading in a descending channel and heading toward an important support zone at $4,150. With most of the daily candles red in the last week, ETH is testing supports.

With dropping over 17% in this small time frame, market participants are filled with fear, however even in this bearish sentiment, firms like SharpLink and Bitmine counties to buy more on more ETH.

The Relative Strength Index (RSI) is now NEAR 35, and this suggests that sellers are running out of stream. At the same time, the MACD indicator shows weak selling pressure after a recent “death cross.”

The $4,150 level is now a delicate zone. If the market respects it, price could bounce back to $4,787, which is a possible 17% gain from current level. But for now, there’s no reason for recovery.

Also Read: Ethereum Community Buzzed with Trustless Agents (ERC-8004) Discussion