Bitcoin Plunges Below $115,000 Amidst $6 Billion Volume Surge – Is a Major Rebound Imminent?

Bitcoin's brutal selloff just crossed a critical threshold—dipping under $115,000 as traders scrambled for exits. Yet something unusual happened: spot trading volumes exploded past $6 billion.

Behind the Panic

Whale movements and leveraged liquidations triggered the slide, but retail investors piled into the dip—pushing volume to levels not seen since the last major correction. Exchanges reported order book imbalances favoring buys near key support zones.

Institutional Players Hold Steady

While futures markets flashed red, custody data shows institutions didn’t flinch. Cold wallet balances held firm—suggesting this might be a speculator-driven shakeout, not a structural breakdown.

Recovery Signals or Dead Cat Bounce?

Technical analysts point to historical rebounds after volume spikes, but skeptics warn of cascading margin calls. One thing’s clear: Wall Street’s still trying to time crypto cycles like a tourist guessing monsoon season.

If history’s any guide—and in crypto, it rarely is—this could be the flushout before the next leg up. Or just another reminder that $6 billion in volume doesn’t guarantee smarter money.

Is Bitcoin In The Accumulation Phase?

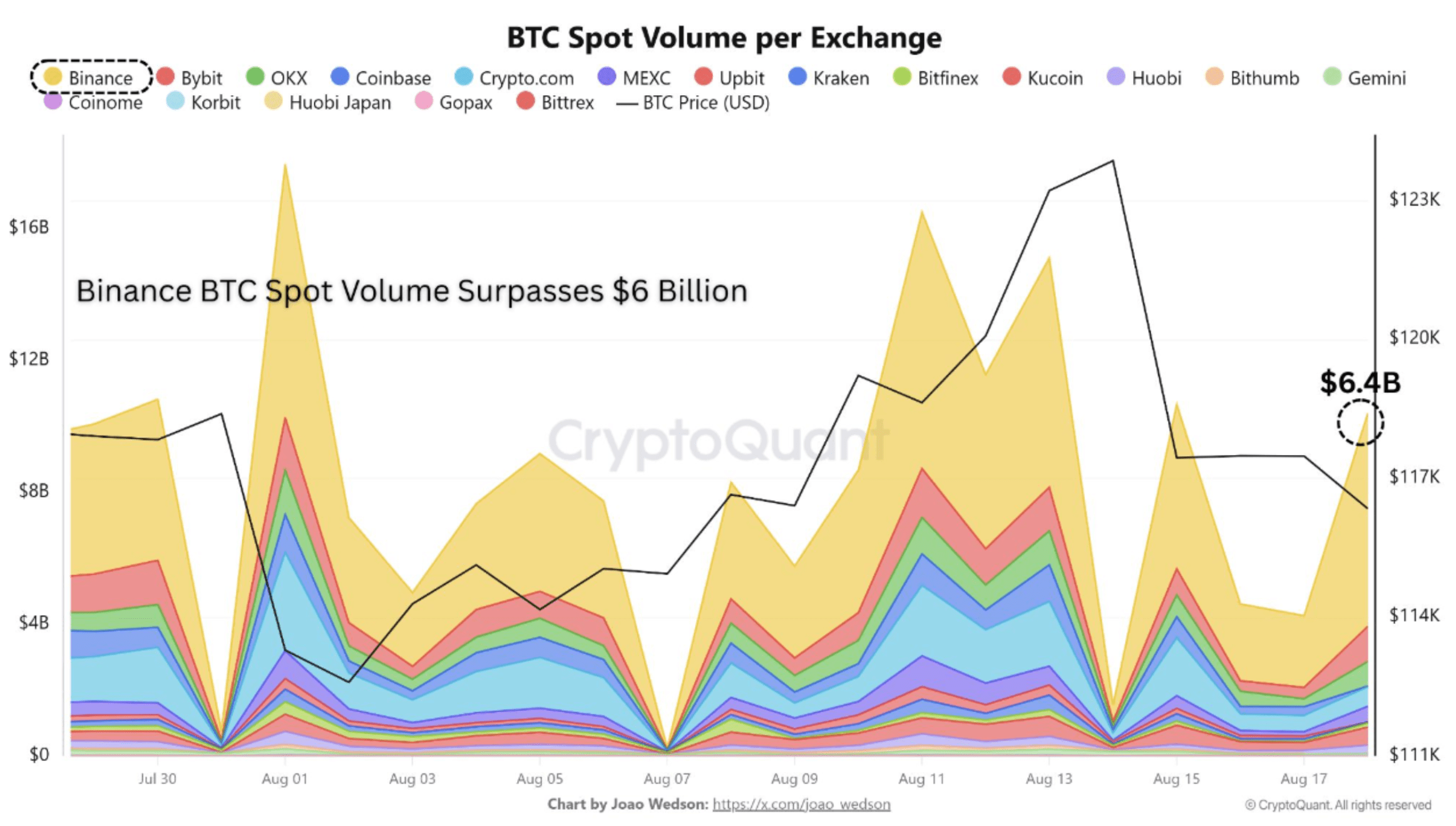

According to a CryptoQuant Quicktake post by contributor Amr Taha, Binance’s BTC spot trading volume surpassed $6 billion on August 18 – one of the most significant spikes this month.

Taha noted that such sudden spikes typically signal increased participation from institutional investors and large traders, along with some retail activity looking to capitalize on heightened volatility.

It’s worth noting that the surge in Binance spot volume coincided with BTC’s drop below $115,000 – a movement that can serve as a leading indicator of a potential reversal in price momentum.

Historical data suggests that strong spot buying during price dips often reflects traders stepping in to accumulate BTC at discounted prices. This dynamic can ease selling pressure and lay the foundation for a rebound if demand persists.

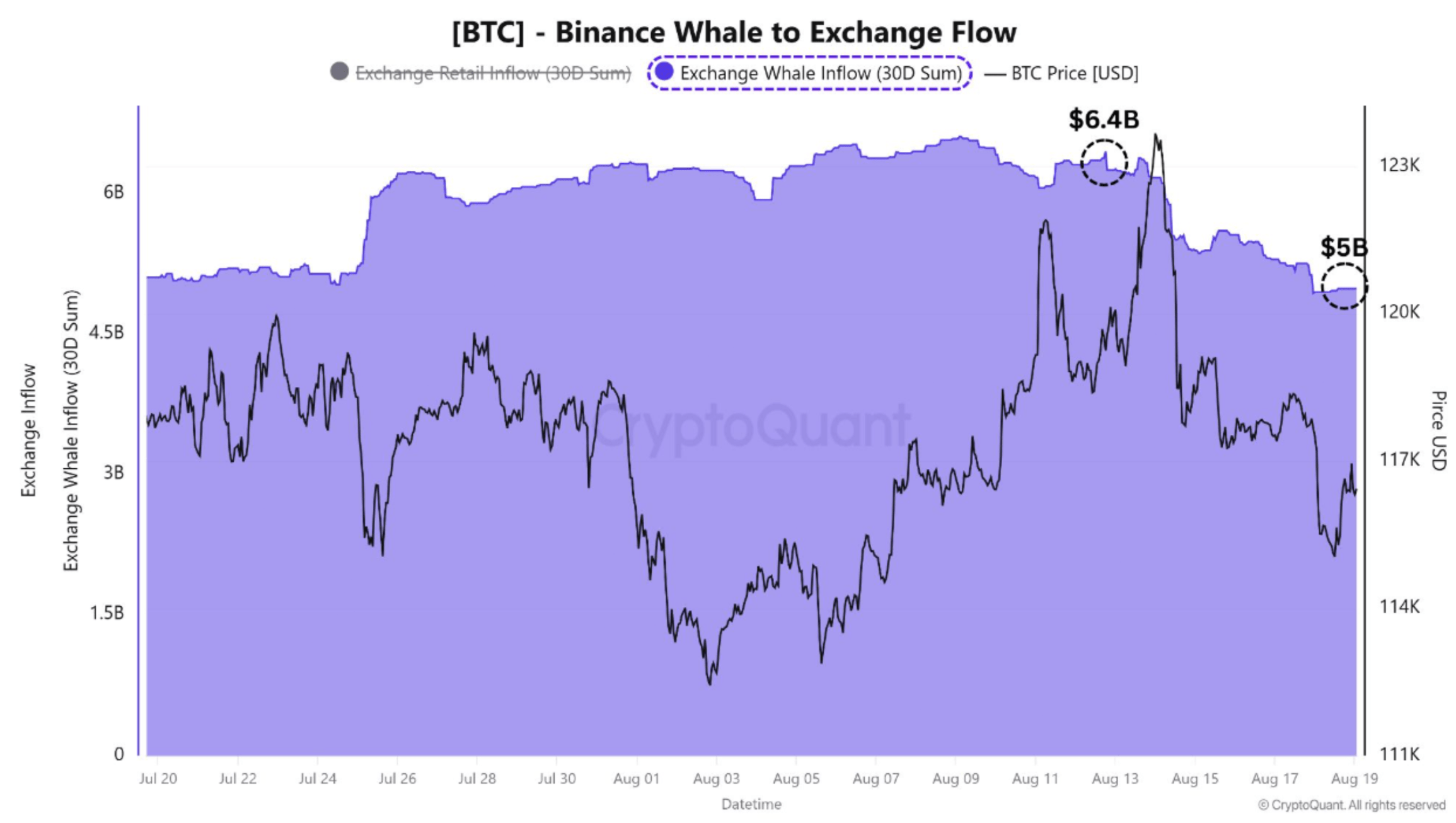

Taha also highlighted that the increase in Binance spot volume occurred alongside a decline in the Binance Whale-to-Exchange Flow, which fell from $6.4 billion to $5 billion – a $1.4 billion drop in whale transfers to Binance over the past week.

This reduction in whale deposits suggests fewer large holders are sending BTC to exchanges for potential selling, a trend generally considered bullish. Taha concluded:

Bringing these elements together – a surge in Binance spot volume, rising demand during a price dip, and a decline in whale deposits – the market is showing early signs of stabilization. If accumulation continues at current levels, Bitcoin has a solid chance to recover and retest higher resistance levels in the near term.

From a technical perspective, crypto analyst Titan of Crypto noted that BTC is still following its weekly trendline. If the trend holds, BTC could target $130,000 in the coming weeks.

Warning Signs For September

While Taha suggests BTC may currently be in an accumulation phase with the possibility of a trend reversal in the coming months, other analysts remain cautious. Crypto analyst Josh Olszewics warned that BTC must survive a “brutal September” before any meaningful rebound can occur in Q4 2025.

Similarly, CryptoQuant contributor BorisVest cautioned that the next 1–2 weeks may bring heightened selling pressure for the top cryptocurrency by market capitalization. At press time, BTC trades at $115,489, down 0.1% over the past 24 hours.