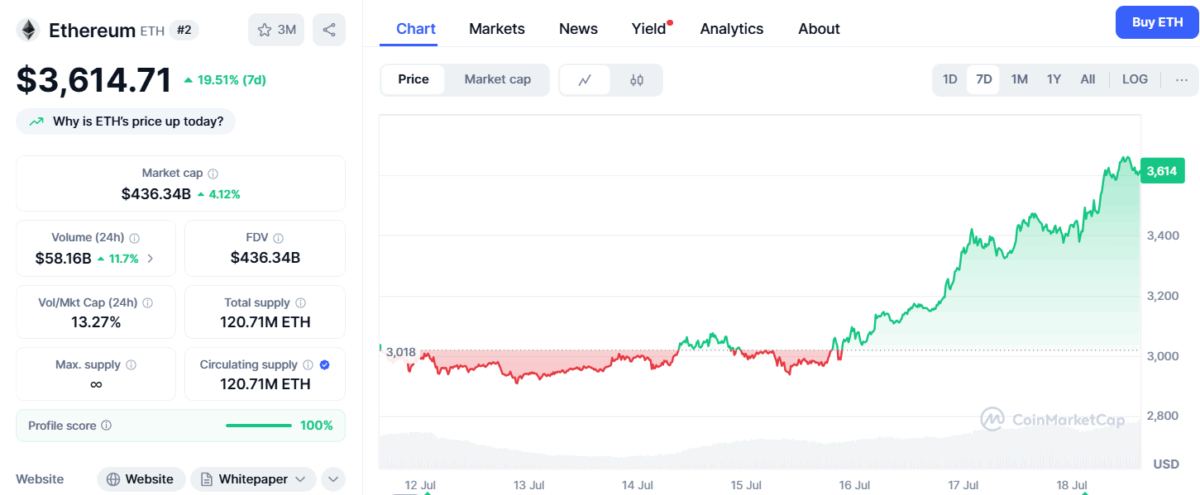

Ethereum (ETH) Smashes Through $3,600—Is $6,000 the Next Stop?

Ethereum isn't just climbing—it's moonwalking past resistance levels like they're going out of style. After breaching $3,600, the question isn't 'if' but 'how soon' before it eyes the $6K milestone.

Why the surge? Institutional FOMO meets DeFi's relentless innovation. TradFi banks are still figuring out blockchain while ETH's ecosystem keeps printing use cases—and value.

Risks? Always. Macro shudders, regulatory side-eyes, and the occasional 'wen merge 2.0?' troll. But ETH's got something your boomer stocks don't: a cult following with coding skills.

Prediction time: If ETH flips $3,600 into a support level, $6,000 isn't a target—it's a pitstop. Just don't expect Wall Street analysts to admit it until after the fact (as usual).

Source: CoinMarketCap

Source: CoinMarketCap

On June 16, the U.S. Ethereum Spot ETFs recorded their highest daily inflow since launch—$726.74 million. The next day saw another $602 million come in, as per SoSoValue.

Further, big players like SharpLink, BitMine and BlackRock have started allocating treasury funds into ETH, pushing adoption further. President Trump’s World Liberty Financial has also been seen buying Ethereum with a recent transaction showing a $5 million purchase.

OTC Platforms See ETH Shortage

With its surging demand, OTCs appear to be running out of ETH as investors are massively absorbing the available supply. A recent post from Ryan Adams of Bankless quotes Wintermute, a prominent crypto market maker, noting that its OTC platform has no ETH left for sale.

OTCs running out of ETH

don't worry, there'll be more at higher prices pic.twitter.com/uttoAW27mw

This shift suggests that most of the institutions and high-profile market players have purchased most of the ETH over OTC deals. Now anymore ETH purchases WOULD be executed via the secondary market.

The Historical Short Squeeze on ETH

Noting the trajectory, Kobeissi Letter, states that ETH is currently witnessing the largest short squeeze in history.

Citing a recent post from Zerohedge—which revealed the record high Leveraged shorts on ETH—the analysts noted that while the amount of short traders is at new high, the buying pressure from various institutions, whales and retail investors has only increased its price.

Ethereum is making HISTORY:

We are currently witnessing one of the LARGEST short squeezes in crypto history.

Ethereum has added +$150 BILLION in market cap since July 1st, days after net SHORT exposure hit record highs.

What's happening? Let us explain.

(a thread) pic.twitter.com/ZJ315XEIEV

“As we look ahead, we believe the themes driving crypto higher will result in major macroeconomic shifts,” the analyst added. “This is redefining the way markets are operating.”

Is $6,000 New Target?

As institutional interest is also clearly picking up, it is giving investors more confidence. In addition, the new U.S. crypto bills have also adds to the positive sentiment.

ETH is holding strong above $3,600 and still shows a strong buying momentum. Analysts suggest that if the uptrend continues, the coin could break the weekly resistance around the $4,000 psychological level and make a push toward $6,000 in next few months.

Also Read: Breaking: Canary Capital Files First Staked INJ ETF with SEC