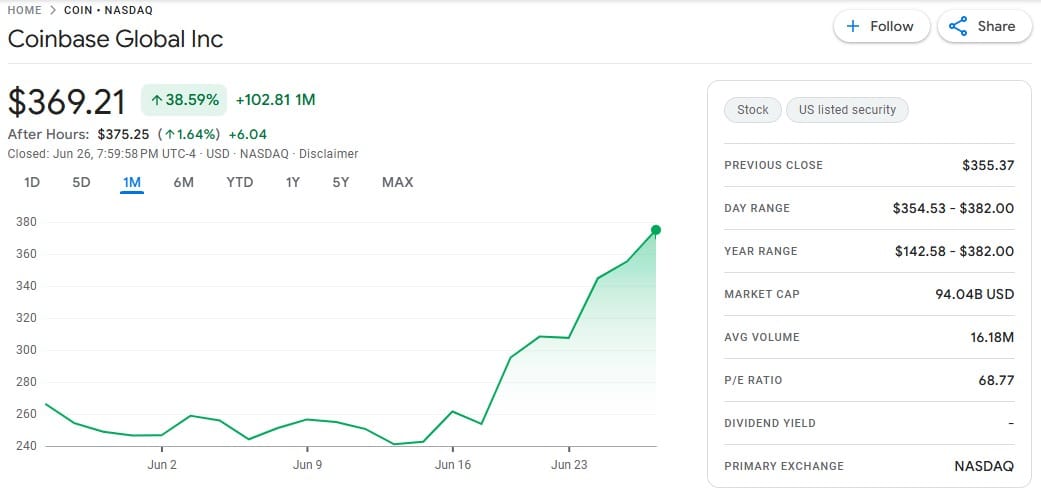

Coinbase Stock Rockets to Record High with Stunning 40% Monthly Rally

Wall Street scrambles as crypto's favorite blue-chip defies gravity—again.

Coinbase shares just ripped past all previous resistance levels, marking a watershed moment for institutional crypto adoption. The 40% monthly surge leaves traditional finance veterans clutching their Bloomberg terminals—and their pearls.

While shorts get vaporized, the rally raises uncomfortable questions: Is this sustainable growth or another case of crypto markets moving faster than SEC subpoenas?

Source: Google Finance

Source: Google Finance

One major factor behind the recent rally is the explosive debut of Circle (CRCL), the firm behind USDC, the second-largest stablecoin. Since launching on June 5 at $83.23per share, Circle stock has skyrocketed over 156%, closing at $213.63 on Thursday.

According to filings, Coinbase earned more than 60% of Circle’s USDC income last year as part of a revenue-sharing deal. Coinbase also receives 50% of the interest income from USDC reserves.

Circle’s USDC currently holds $61.45 billion in market share, trailing only Tether (USDT). This deep partnership with Circle is paying off in a big way for Coinbase.

Adding more fuel, Coinbase recently became the first pure crypto company to join the S&P 500 index, which went live on May 19. Analysts are bullish, with Bernstein raising its target to $510 and calling Coinbase the “Amazon of crypto financial services.”

With strong momentum and growing investor confidence, Coinbase continues to shine as crypto adoption rises.

Also Read: Bernstein: Coinbase is ‘Most Misunderstood’ Stock, Can Rally 50%