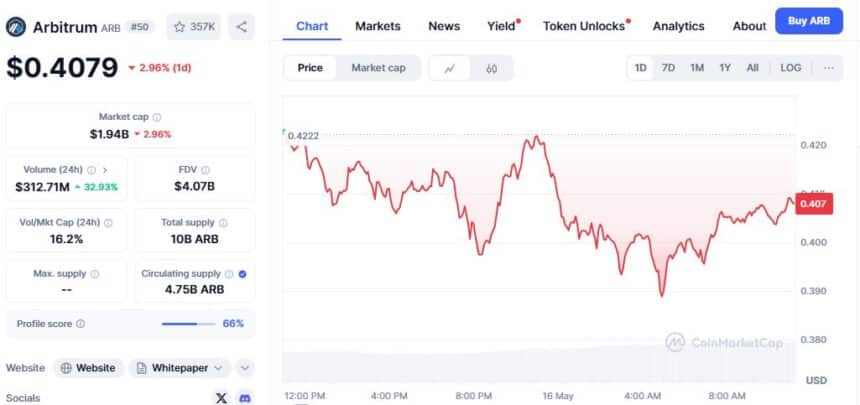

Arbitrum Takes a 3% Hit as $37M Token Unlock Looms—Traders Brace for Impact

Arbitrum’s native token dips ahead of a major unlock event—because nothing says ’bullish’ like a flood of new supply hitting the market.

Key details: The Layer 2 scaling solution faces selling pressure as 37 million dollars worth of tokens prepare to enter circulation. Classic crypto economics at play—team and investor unlocks rarely spark rallies.

The cynical take: Another ’decentralized’ project proving that tokenomics often just means ’early backers cashing out’. Will Arbitrum’s tech stack outweigh the dilution? The market’s voting with its sell orders—for now.

Source: CoinMarketCap

Source: CoinMarketCap

Even with the price dipping, ARB is seeing a lot of action. Trading activity has picked up noticeably, with volume surging over 32% in the past day to reach $312.7 million. While some traders appear to be preparing for a potential sell-off, others seem to be eyeing a quick bounce.

At the moment, roughly 4.13 billion ARB tokens are already in circulation, which makes up around 41% of the total supply.

At current prices, that chunk alone is worth roughly $1.69 billion. Another 2.47 billion tokens are locked (about 24.6%), while 3.4 billion more (34%) are listed under “TBD locked”—essentially tokens still waiting for their release schedule.

ARB sits at the 50th spot on the crypto rankings, with more than 357,000 holders. This unlock is part of its planned token release schedule, but it’s clearly shaking things up in the short term. Whether the market absorbs the new supply smoothly or reacts with more downside will become clearer once the tokens actually hit wallets.

Also Read: Uniswap price Crashes 15%, Will UNI Crypto Drop to $5?