Standard Chartered Bets Big: BNB Could Rocket to $2,775—Here’s Their Play

Another day, another bullish crypto prediction from a bank that once scoffed at digital assets. Standard Chartered—yes, the same institution that still charges £25 for international wire transfers—just slapped a $2,775 price target on Binance Coin (BNB).

Why the sudden faith? Three words: exchange token supremacy. With Binance dominating trading volumes despite regulatory scrapes, BNB’s utility burns brighter than a meme coin hype cycle. The bank cites staking yields, fee discounts, and that sweet, sweet scarcity from quarterly burns.

But let’s be real—this target assumes crypto winter stays canceled. If the SEC lands another punch or Tether coughs up bad news, even ’conservative’ projections go up in smoke. Still, for traders riding the altcoin wave, Standard Chartered just handed you a shiny new moon ticket. Just don’t spend those unrealized gains on a Lambo... yet.

BNB Price Prediction

BNB Price Prediction

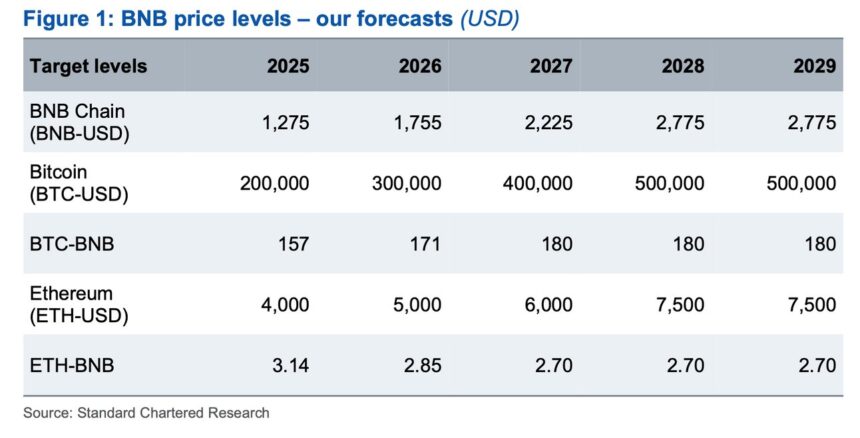

Geoffrey Kendrick, Standard Chartered’s chief of digital asset analysis, claims that since May 2021, the price movement of BNB has been strikingly similar to that of a combination of Bitcoin and Ethereum. This kind of behavior makes it a great benchmark to observe the overall crypto market. The bank believes that the future evolution of BNB is stable and connected to the ongoing dominance of Binance.

In a major development for investors, VanEck has filed with the SEC to list the first US-domiciled spot BNB ETF. If approved, this ETF would own actual BNB tokens and give US investors regulated access to BNB price action. The ETF could also include staking, which would generate income for the fund.

This step follows the leading wave of emerging cryptocurrency ETFs. So far, there is most publicity on Bitcoin, although experts suppose triumph might get transposed across broader top-performing altcoins, including BNB.

With institutional need increasing and potentially an ETF being in the pipeline, BNB could see intense demand in the coming years. This could support Standard Chartered’s optimistic forecast of reaching a price of $2,775 by the year 2028.

Also Read: Fact Check: Is CZ Secretly Behind VanEck’s BNB ETF?