Binance’s 30th Proof-of-Reserves Audit: $58B Bitcoin Treasury On Display

Binance flexes its institutional-grade custody muscles yet again with its latest proof-of-reserves report. The exchange now safeguards $58 billion worth of Bitcoin—enough to make even BlackRock’s ETF team blush.

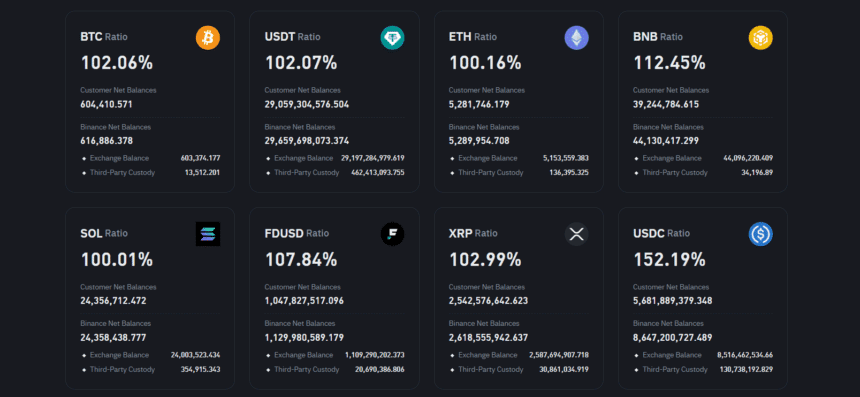

By the numbers: The 30th consecutive audit shows reserves exceeding customer liabilities by 104%. No funny business—just cold, verifiable on-chain data.

Why it matters: In an era where ’not your keys’ remains crypto’s mantra, Binance keeps setting the gold standard for exchange transparency. Take notes, Wall Street.

The cynical take: Meanwhile, traditional banks still can’t decide whether to classify Bitcoin as a commodity or a security—while quietly accumulating it through backdoor ETFs.

Binance’s 30th Proof-of-Reserve – Source: binance.com/en/proof-of-reserves

Binance’s 30th Proof-of-Reserve – Source: binance.com/en/proof-of-reserves

At the current price level, the total Bitcoin holding of the exchange is valued at $58 billion—as per latest Bitcoin price of $96,500—which marks a decrease of 1.35% from the previous month’s 612,675 BTC, signaling potential user withdrawals or sales amid market uncertainty.

The firm’s Ethereum (ETH) holding has also dropped by 3.36%, totaling 5,281,746 ETH, worth around $9.5 billion at an estimated $1,800 per ETH. Its native token, BNB, also saw a slight 0.74% decline, with 39,244,785 BNB held, valued at roughly $23 billion at $600 per BNB.

In contrast, user holdings of Tether (USDT) surged by 2.61%, reaching 29.05 billion USDT—equivalent to $29 billion, given its 1:1 USD peg. This increase highlights a growing preference for stablecoins, likely as a hedge against crypto price volatility or macroeconomic pressures.

The combined value of ETH, BNB, and USDT amounts to approximately $67 billion, with an additional $15 billion in other crypto assets. This brings the non-BTC crypto holdings to around $82 billion.

According to CoinMarketCap data, Binance’s total user assets are estimated at $140 billion. The exchange uses zero-knowledge cryptography and Merkle Tree audits to ensure all user balances are accounted for. Although it excludes the firm’s corporate holdings from PoR calculations.

Also read: Binance Delays Second MOVE Airdrop, What’s the Reason?