Bitcoin’s Floor Just Got Higher: Standard Chartered Predicts $100K as Permanent Support Level

Bitcoin's days of trading below six figures could be over for good according to banking giant Standard Chartered.

The New Normal in Crypto Valuation

Standard Chartered's analysis suggests Bitcoin has fundamentally reset its price floor—transforming what was once considered astronomical into the new baseline. The bank's research points to institutional adoption and scarcity dynamics creating an irreversible upward shift in Bitcoin's valuation framework.

Institutional Money Changes Everything

When pension funds and asset managers start allocating just 1% to Bitcoin, the math gets brutal for shorts. The bank's models show current institutional inflows could sustain prices even during typical market corrections—making sub-$100K dips increasingly unlikely.

The Scarcity Engine

With daily minting cut to 450 BTC and accelerating ETF demand, the supply-demand equation has permanently tilted. Standard Chartered calculates that even moderate continued adoption would absorb available supply at current prices—let alone during accumulation phases.

Of course, when banks start making bold crypto predictions, it's either brilliant analysis or they've got positions to unload—but the numbers don't lie. Bitcoin's next 'dip' might just be from $150K to $120K.

Easing Trade Tensions Spark Market Optimism

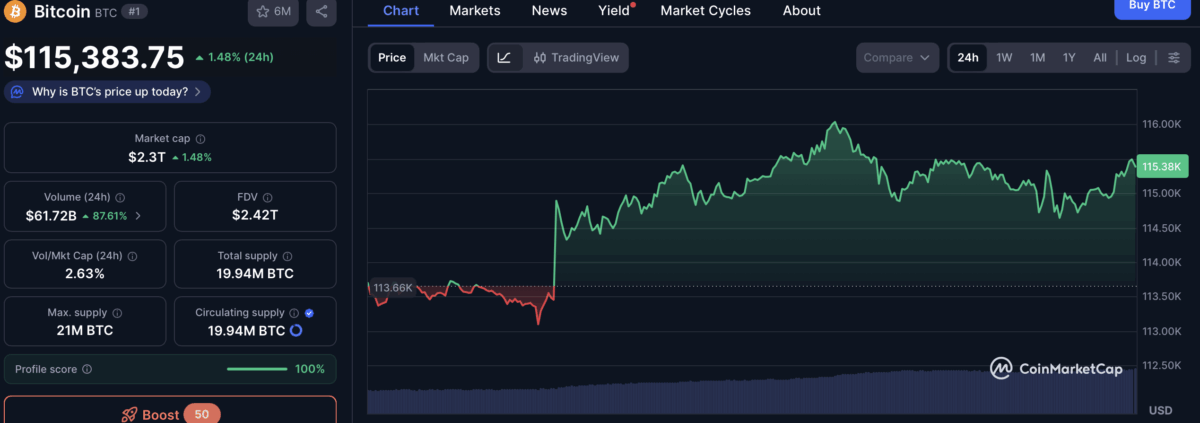

The market has reacted to this news and lifted the overall sentiment. At the time of writing this report, Bitcoin is trading for $115k, this is a 1.63% surge from an intraday low of $113k. In addition to that, the bitcoin-to-gold ratio, which compares Bitcoin’s market value to gold, has risen back to levels which were seen before October 10, when tariff headlines caused panic selling.

“I will watch for this ratio to break back above 30 to signal an end to such fear,” Kendrick said in his note.

ETF Inflows Could Confirm Bitcoin’s Strength

He also pointed out that inflows into spot bitcoin exchange-traded funds (ETFs) would be another sign of growing confidence. Last week, over $2 billion was withdrawn from U.S. gold ETFs between Wednesday and Friday.

Kendrick said it WOULD show stronger belief in Bitcoin if even half of that money moved into Bitcoin ETFs this week. He added that Bitcoin ETF inflows have been weaker compared to gold, and “some catch-up is due.”

According to Kendrick, if Bitcoin reaches a new all-time high, it would confirm this positive trend. He believes such a MOVE would end the idea that Bitcoin’s price depends on halving cycles. “To clarify, I think the halving cycle is dead (ETF flows matter more), but it will take confirmation to convince everyone of this,” he explained.

He also noted that the Federal Open Market Committee meeting which is scheduled for this Wednesday as confirmed from the federal reserve, is expected to bring another 25-basis-point rate cut, which could be good for Bitcoin.

“If this week goes well, bitcoin may NEVER go below $100,000 again,” Kendrick concluded.

Also Read: Strategy Adds 390 BTC, Holding Now 640,808