Hyperliquid’s HYPE Token Soars 25% in 7 Days, Dominates Protocol Revenue Charts

HYPE Token Defies Market Gravity With Explosive Weekly Surge

The numbers don't lie—Hyperliquid's native token just put up performance metrics that would make traditional finance blush. While Wall Street analysts debate basis points, HYPE casually notched a 25% gain in a single week, outpacing virtually every major digital asset in the space.

Revenue Generation That Actually Generates

Here's the kicker: HYPE isn't just riding speculative momentum. The token now leads all competitors in protocol revenue generation—the kind of fundamental strength that separates flash-in-the-pan projects from legitimate ecosystem players. No empty promises, just verifiable on-chain performance.

Meanwhile, traditional finance continues paying hedge fund managers 2-and-20 fees for single-digit returns. The irony's thicker than a blockchain ledger.

Interface projects boost ecosystem growth

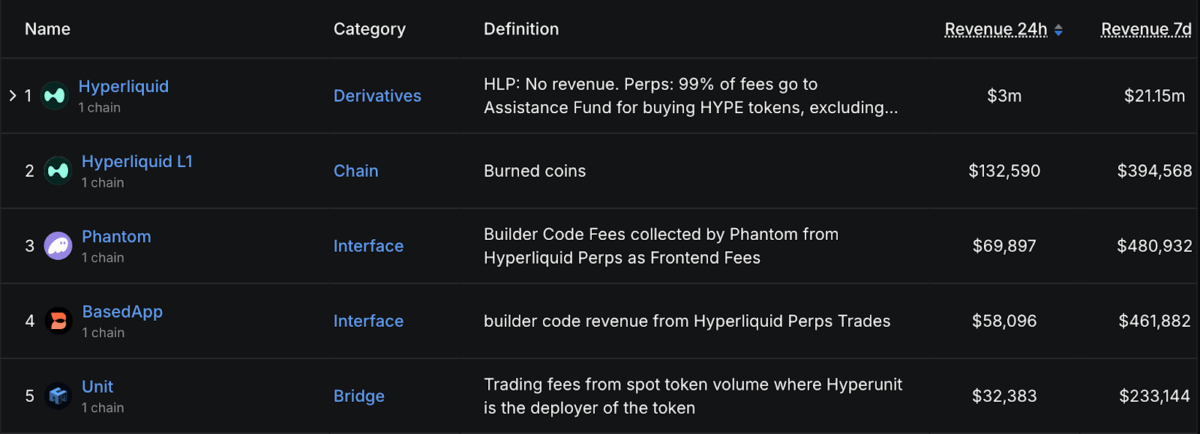

Beyond the main platform, Hyperliquid’s own blockchain, Hyperliquid L1, earned about $132,590 in a single day in revenue and $394,568 over the week. Unit, a bridge platform in the Hyperunit network, also earned $32,383 in a day and $233,144 over the week. With these gains, Hyperliquid’s ecosystem now ranks among the most profitable projects in the entire DeFi.

Other projects, such as Phantom made $69,897 in a day and $480,932 for the week from trading fees, while BasedApp earned $58,096 daily and $461,882 weekly, boosted by revenue from builder code tied to Hyperliquid trades.

Market sentiment shows mixed whale positions

According to CoinGlass data, the Hyperliquid Whale Tracker shows that major traders are almost evenly divided between betting that prices will rise or fall. The total value of their open trades has reached $7.2 billion, with 47.02% in long positions and 52.98% in short ones, showing a slight lean toward bearish sentiment.

![]()

However, the market recently moved against bears, pushing long positions into $182.6 million profit while shorts lost $222.7 million. Funding fees totaled $104.9 million, with shorts paying more than longs, suggesting a mild shift toward bullish momentum.

One of the other price boosters of the token is the listing on Robinhood. The trading app even created a landing page for HYPE before officially confirming the listing on X.

$HYPE is now available to trade on Robinhood. pic.twitter.com/sRLLJavwze

— Robinhood (@RobinhoodApp) October 23, 2025Also, Hyperliquid Strategies filed paperwork with the U.S. Securities and Exchange Commission last week to raise $1 billion to buy more HYPE tokens. The new crypto treasury firm, backed by Sonnet BioTherapeutics and Rorschach I LLC, plans to increase its investment in the Hyperliquid ecosystem.

Hyperliquid’s fast-growing revenue, active big traders, and the upcoming Robinhood listing have made HYPE one of the hottest and most talked-about tokens this week.

Also Read: Bitcoin Reclaims $115K as Bulls Test Key Resistance